Unlocking Margin Of Safety (Mos): A Guide To Enhanced Investment Decision-Making

Margin of Safety (MOS) provides a buffer against market fluctuations, protecting investors. To calculate MOS, determine the intrinsic value using valuation techniques, then compare it to the current market price. The formula for MOS is (Intrinsic Value – Current Price) / Intrinsic Value, expressed as a percentage. A MOS of 25% or more indicates a potential for undervaluation and a potential investment opportunity. Interpreting MOS values helps investors make informed decisions, and its practical applications include identifying undervalued stocks and balancing risk-reward profiles. Incorporating MOS into investment strategies enhances decision-making and potentially improves investment outcomes.

Understanding Margin of Safety: A Shield Against Market Volatility

In the treacherous waters of investing, investors seek solace in strategies that minimize risk while maximizing returns. One such strategy is the Margin of Safety (MOS). MOS acts as a protective barrier, safeguarding investors from the unpredictable whims of the market. It’s like wearing a lifejacket while navigating stormy seas; it provides reassurance and peace of mind.

By incorporating MOS into your investment approach, you’re essentially putting a buffer between yourself and potential losses. It represents the difference between the intrinsic value of a stock and its current market price. Intrinsic value is like a company’s true worth, while market price is often subject to market frenzy and emotions. When you buy a stock at a price significantly below its intrinsic value, you create a Margin of Safety.

This safety margin protects you in three critical ways:

- Price fluctuations: MOS provides a cushion against market fluctuations. Even if the stock price dips temporarily, your MOS will help you weather the storm and avoid panic selling.

- Overvaluation: MOS protects you from overpaying for a stock. When a stock is overpriced, its intrinsic value is lower than its market price. By insisting on a Margin of Safety, you ensure that you’re not buying into a bubble that could burst.

- Unknown risks: Investing always involves some degree of uncertainty. MOS provides a buffer against unforeseen risks or company challenges that could impact the stock’s value.

Calculating Intrinsic Value: The Bedrock of Margin of Safety

In the realm of investing, the concept of intrinsic value holds immense significance. It represents the true, underlying worth of an asset, independent of its current market price. Understanding intrinsic value is crucial for calculating margin of safety (MOS), a metric that helps investors identify potential bargains.

Various valuation techniques can be employed to estimate intrinsic value. One widely used method is the discounted cash flow (DCF) analysis, which projects an asset’s future cash flows and then discounts them back to the present to determine its fair value. Another technique is the comparable company analysis, which compares a company’s financial metrics to similar companies in the same industry and uses those comparisons to derive a reasonable valuation.

For example, if the intrinsic value of a stock is determined to be $40 per share using DCF analysis, but it is currently trading at $30 per share, it would indicate a potential margin of safety of 25%. This margin of safety provides a cushion against potential market fluctuations, reducing the risk of overpaying for an investment.

It’s important to note that calculating intrinsic value is not an exact science. It involves estimations and assumptions, and different valuation techniques can yield varying results. However, the process of valuing an asset helps investors develop a better understanding of its underlying fundamentals, ultimately informing their investment decisions.

By incorporating intrinsic value into their analysis, investors can identify stocks that are potentially undervalued and offer a favorable margin of safety. This approach can enhance portfolio returns and mitigate the impact of market volatility over the long term.

Determining Current Market Price: A Crucial Factor in Margin of Safety Calculation

When assessing the Margin of Safety (MOS) of an investment, the current market price plays a pivotal role. It acts as the benchmark against which intrinsic value is compared to determine the potential margin of error. This price reflects the collective perceptions of the market participants and incorporates a host of factors that influence the demand and supply dynamics of a stock.

Understanding the Factors Influencing Stock Prices

Stock prices are driven by a multitude of factors, both fundamental and market-related. Fundamental factors include a company’s financial performance, earnings potential, and competitive landscape. Market-related factors encompass economic conditions, interest rates, and speculation. By understanding these drivers, investors can gain insights into the potential future trajectory of stock prices.

Conducting Market Research: A Cornerstone of Investment Success

Market research is an indispensable tool for determining current market prices accurately. It involves analyzing historical price trends, understanding the company’s industry dynamics, and keeping abreast of market news and events. This research helps investors identify factors that may have influenced past price movements and anticipate future trends.

By incorporating current market price into MOS calculation, investors mitigate risk and enhance their decision-making process. A thorough understanding of the factors that shape stock prices and the importance of market research empowers investors to make informed investment choices and maximize their chances of success.

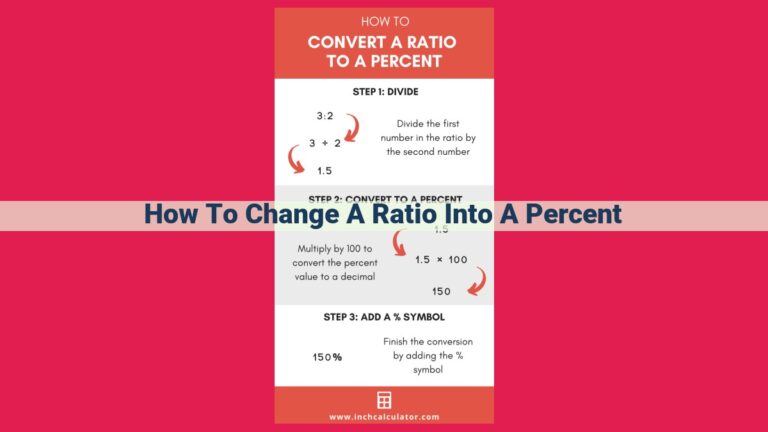

Applying the Margin of Safety Formula

To calculate the margin of safety (MOS), we use the following formula:

MOS = (Intrinsic Value - Current Market Price) / Current Market Price

Where:

- Intrinsic value is an estimate of the true or fundamental value of the company.

- Current market price is the current price of the stock in the market.

To illustrate, let’s say a company has an intrinsic value of $50 per share. If the stock is currently trading at $40 per share, the MOS would be:

MOS = (50 - 40) / 40 = 25%

This means that the current market price is 25% below the intrinsic value, indicating a potential margin of safety.

The percentage difference in MOS is crucial in making investment decisions. A higher percentage difference implies a larger margin of safety, providing a buffer against potential market downturns. Conversely, a lower percentage difference suggests a smaller margin of safety, indicating a higher risk of loss.

By incorporating MOS into your investment analysis, you can make informed decisions that align with your risk tolerance and investment goals. It helps you identify undervalued companies with a buffer against market fluctuations, increasing your chances of profitable investments.

Interpreting Margin of Safety Results

Understanding the Implications of Margin of Safety

The margin of safety is an indispensable tool that equips investors with valuable insights into the potential risks and rewards associated with an investment. Interpreting MOS values appropriately is crucial for making informed investment decisions.

A High Margin of Safety: A Sign of Opportunity

A high MOS, typically above 50%, indicates that the current market price of a stock is significantly below its intrinsic value. This suggests that the stock is potentially undervalued, offering investors an opportunity to purchase it at a discount. However, it’s important to remember that even with a high MOS, it’s not guaranteed that the stock will appreciate in value.

A Low Margin of Safety: Proceed with Caution

Conversely, a low MOS, closer to 0%, indicates that the current market price is closer to the intrinsic value. While this may not necessarily mean that the stock is overvalued, it suggests that there is less room for significant upside potential. Investors should approach such stocks with more caution, considering other factors before making a decision.

The Sweet Spot: Finding the Optimal MOS

The optimal MOS value depends on individual investor risk tolerance and investment goals. Generally, a MOS of 30-50% is considered a reasonable target, providing both a buffer against market fluctuations and the potential for healthy returns. Ultimately, investors should determine an appropriate MOS range that aligns with their comfort level with risk.

By interpreting MOS values wisely, investors can make more educated decisions about potential investments. A high MOS signals an opportunity, while a low MOS warrants a more cautious approach. By incorporating MOS into investment analysis, investors can navigate volatile markets and increase the likelihood of achieving their financial goals.

Practical Applications of Margin of Safety

In the realm of investing, the margin of safety (MOS) serves as a crucial safeguard, protecting investors against the unpredictable swings of the market. By utilizing MOS, investors can minimize risk and increase their chances of achieving long-term success.

One real-world example of MOS in action is the legendary investor Warren Buffett. Buffett’s conservative approach to investing involves purchasing stocks that trade at a significant discount to their intrinsic value. This built-in margin of safety allows Buffett to withstand market fluctuations and ride out temporary setbacks.

MOS can also aid investors in identifying undervalued securities. By comparing the intrinsic value of a stock to its current market price, investors can determine the potential upside. A high MOS indicates a significant gap between the two values, suggesting a lucrative investment opportunity.

However, MOS is not a foolproof tool. It has its limitations. The estimation of intrinsic value is an art, not a science, and can be subjective. Additionally, MOS does not account for unexpected events, such as global pandemics or economic crises.

Despite these limitations, MOS remains an invaluable tool for prudent investors. By incorporating it into their investment strategy, investors can mitigate risks and increase their chances of financial success.