Unlock The Power Of Email In Online Banking: Enhance Security, Efficiency, And Customer Engagement

Email plays a crucial role in online banking by providing instant transaction notifications, eliminating paper clutter with digital statements, simplifying bill payments and money transfers, offering easy access to account information, enhancing security with features like two-factor authentication, and enabling 24/7 customer support via email. Additionally, it serves as a channel for promoting new offers, delivering financial insights, and providing budgeting tools.

Real-Time Transaction Notifications: Empowering You with Instant Financial Awareness

In today’s fast-paced world, keeping track of your financial transactions is essential for maintaining peace of mind and financial control. Real-time transaction notifications empower you with the ability to stay informed and vigilant about every transaction that occurs in your account.

Through the convenience of mobile banking and push notifications, you can receive instant alerts for each transaction. This feature acts as an early warning system, keeping you aware of any unauthorized activity. By receiving these timely notifications, you can quickly respond and take appropriate actions to protect your account and funds.

Moreover, real-time transaction notifications foster a sense of financial transparency. Every transaction, regardless of its size or nature, is brought to your immediate attention. This enhanced visibility allows you to review your spending habits, detect any discrepancies, and make informed financial decisions.

By leveraging the power of real-time transaction notifications, you can minimize the risk of fraud and unauthorized access. The instant alerts serve as a safeguard, enabling you to monitor your account activity closely and identify any suspicious transactions that may require investigation. This proactive approach empowers you to take immediate measures to protect your financial well-being.

The Convenience of Paperless Statements and Receipts

In the digital age, paperless statements and receipts have become indispensable tools for efficient bill management and eco-friendly living. Digital banking has revolutionized the way we handle our finances, transforming the cumbersome paper trail into a streamlined and environmentally conscious process.

With paperless statements, you can effortlessly access your account information online anytime, anywhere. No more waiting for physical statements or digging through stacks of paper to find that one important document. Simply log into your online banking portal and you’ll have instant access to your clear and up-to-date statements.

Gone are the days of filing cabinets overflowing with receipts. Digital receipts are stored securely in your online banking account, eliminating clutter and making it easier to track your expenses. No more scrambling to find a receipt for a warranty claim or lost item. Simply access your account and retrieve the digital receipt in a matter of seconds.

The environmental benefits of paperless statements and receipts are undeniable. By reducing paper consumption, we minimize our carbon footprint and conserve precious natural resources. And with digital storage, you’ll never lose an important document again, ensuring peace of mind and effortless organization.

Effortless Bill Payment and Money Transfer: The Convenience of Digital Banking

In the era of digital transformation, banking has undergone a remarkable evolution, offering unparalleled convenience and ease to its customers. One such transformation is the advent of electronic bill payment and mobile payment solutions. These innovative features have revolutionized the way we manage our finances, eliminating the hassles of traditional bill payment methods and introducing a new level of flexibility in money transfers.

Electronic Bill Pay: Say Goodbye to Postage and Paper Clutter

With electronic bill pay, the days of writing checks, stuffing envelopes, and mailing payments are long gone. This digital service allows users to schedule and pay their bills online, saving them valuable time and postage expenses. By setting up automatic payments, you can rest assured that your bills are taken care of on time, avoiding late fees and potential damage to your credit score.

Mobile Payments: Transfer Money Securely, Anytime, Anywhere

Mobile payments offer an even more convenient way to transfer money instantly and securely. Whether you’re splitting the dinner bill with friends or sending funds to family members, mobile payment apps like Interac e-Transfer have made it a breeze. With just a few taps on your smartphone, you can transfer money to anyone with an email address or mobile number, without the need for cash or bank visits.

The convenience of electronic bill payment and mobile money transfer has not only made our lives easier but has also brought about significant environmental benefits. By eliminating paper bills and envelopes, we are reducing our collective carbon footprint and contributing to a greener future.

So, if you’re still relying on traditional bill payment methods, it’s time to embrace the convenience and security of digital banking solutions. Set up electronic bill pay and start using mobile payments today to enjoy a hassle-free financial experience.

Easy Access to Account Balances and History: Banking at Your Fingertips

Gone are the days of waiting in long lines at bank branches or endlessly hunting for misplaced statements. Today, with online and mobile banking, you can gain instant access 24/7 to your account balances and transaction history. This real-time information puts you in complete control of your finances, empowering you to make informed decisions and manage your money wisely.

Imagine checking your account balance while you’re on the go, without the hassle of visiting a branch during business hours. Or easily tracking your recent transactions to identify any unauthorized activity or errors. Online and mobile banking have revolutionized the way we manage our finances, providing us with real-time insights and the convenience we crave in today’s fast-paced world.

Moreover, these digital platforms offer a secure and user-friendly interface, ensuring that your financial data remains protected and accessible only to you. With just a few taps or clicks, you can view your account activity, download statements, and even set up alerts to stay informed about any changes to your balance or transactions.

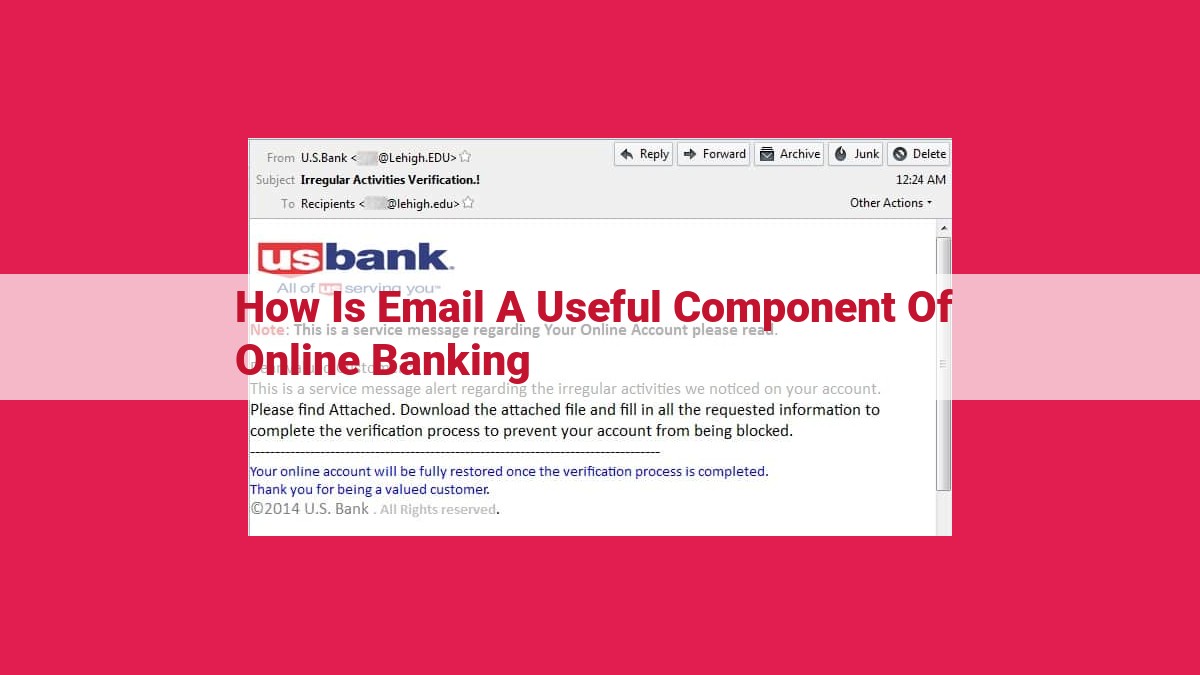

Enhance Your Banking Security with Two-Factor Authentication and Fraud Prevention

In the ever-evolving digital landscape, safeguarding your financial information has become paramount. The introduction of advanced security measures in online banking platforms offers a much-needed shield against cyber threats, providing peace of mind and protecting your hard-earned money.

Two-factor authentication serves as a robust defense mechanism against unauthorized account access. This multi-layered approach requires users to provide two forms of identification, typically a password and a unique code sent to their mobile device or email. This additional layer of security makes it significantly harder for malicious actors to breach your account, even if they obtain your password.

Alongside two-factor authentication, intelligent fraud prevention systems monitor account activity in real-time to detect any suspicious patterns. These algorithms are trained to identify anomalies such as unusual spending habits or attempted access from unfamiliar locations. When suspicious activity is detected, the system instantly alerts you, allowing you to take immediate action to protect your account.

By implementing these enhanced security measures, banks are empowering customers to take control of their financial safety. Choosing a banking platform that prioritizes security with two-factor authentication and fraud prevention not only safeguards your personal data but also gives you peace of mind knowing your money is protected.

24/7 Customer Support via Email: Your Lifeline to Banking Convenience

In the fast-paced world of today, banking needs can arise anytime, anywhere. That’s where 24/7 email support comes to the rescue, providing convenient and responsive customer service at your fingertips. Whether you have account inquiries, technical issues, or need product guidance, our email support team is ready to assist you around the clock.

Imagine this: it’s 2 AM, and you’re checking your account balance when you notice an unfamiliar transaction. Panic sets in, but you remember our 24/7 email support. You quickly send an email, and within minutes, a friendly and knowledgeable representative is responding, helping you resolve the issue and assuring you that your account is safe.

Our email support goes beyond just troubleshooting. Our team can provide in-depth guidance on our products and services. Whether you’re interested in opening a new account, applying for a loan, or exploring investment options, our experts are here to empower you with the information and advice you need.

Think of our 24/7 email support as your personal banking concierge, always available to answer your questions, resolve your concerns, and support your financial journey. We understand that banking can be complex, but we’re here to simplify it for you, one email at a time.

So, rest assured, with our 24/7 email support, you have a reliable and responsive lifeline to your banking needs, even in the middle of the night. Let us be your constant companion, guiding you through every financial step of the way.

Stay Informed with Promotion and Product Updates

In the ever-evolving banking landscape, staying abreast of the latest services and offerings is crucial. Digital banking empowers you to stay informed with timely email updates on new account offers and product enhancements.

Marketing and advertising via email serve as a convenient channel to keep you connected to the latest advancements in banking. These communications provide valuable insights into innovative features, exclusive promotions, and personalized recommendations tailored to your financial needs.

By subscribing to these email updates, you’ll be among the first to know about new features that can enhance your banking experience. Whether it’s the launch of a new mobile app or the introduction of personalized financial insights, these updates ensure you stay up-to-date with the latest banking solutions that can make your life easier.

Personalized Financial Insights and Recommendations for Smarter Decision-Making

In today’s fast-paced financial landscape, making informed decisions is crucial. Digital banking has emerged as a key player, empowering users with personalized financial insights and recommendations that can simplify their financial journey.

With digital banking platforms, you gain access to a suite of sophisticated tools that analyze your financial habits and provide tailored advice. These tools leverage advanced algorithms to identify patterns, predict potential outcomes, and recommend strategies that align with your unique financial goals.

For example, you can utilize budgeting tools to track expenses, identify areas for savings, and create realistic financial plans. By visualizing your financial data, you gain a clearer understanding of your spending patterns and can make adjustments to optimize your budget.

Moreover, these platforms offer personalized investment recommendations based on your risk tolerance, investment objectives, and time horizon. The tools analyze market trends and historical data to construct diversified portfolios that aim to maximize returns while managing risk.

By leveraging these personalized financial insights, you can make smarter financial decisions, whether it’s allocating assets, managing debt, or planning for retirement. Digital banking empowers you to take control of your financial future with confidence.