Understanding Relevant Range For Cost-Volume-Profit (Cvp) Analysis

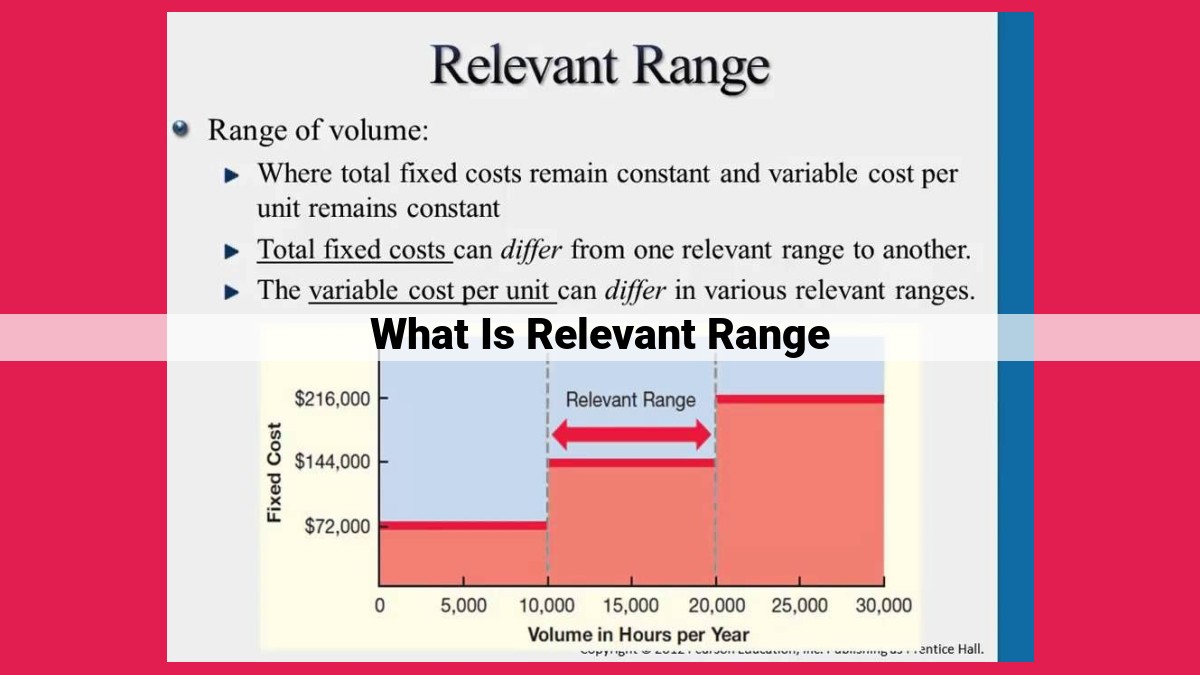

Relevant range refers to the range of activity levels within which a company’s cost behavior is relatively linear, making it useful for cost-volume-profit (CVP) analysis. It is bounded by the break-even point and target profit level, and within this range, fixed costs remain constant while variable costs fluctuate with activity. Understanding relevant fixed and variable costs is crucial for accurate CVP analysis, as fixed costs are considered relevant within the relevant range while variable costs are relevant to activity levels.

Understanding the Relevant Range: A Key Concept in Cost-Volume-Profit Analysis

In the realm of business finance, understanding the relevant range is paramount for making informed decisions about production, pricing, and profitability. The relevant range refers to the specific level of activity within which assumptions about costs and revenues remain valid. It plays a critical role in cost-volume-profit (CVP) analysis, helping businesses determine their break-even point and target profit.

Why is the Relevant Range Important?

Consider a clothing manufacturer that produces shirts. As the company increases production, it incurs more costs for raw materials, labor, and other expenses. However, some costs, such as rent and insurance, remain fixed regardless of production levels. The relevant range helps the manufacturer understand the cost behavior within different levels of production, enabling it to make informed decisions about whether to increase or decrease production based on cost and profit considerations.

Relevant Range: A Compass for Profitability Analysis

In the realm of business decision-making, understanding relevant range is crucial. It’s the window of activity where your cost structure remains relatively stable. Within this range, you can predict how changes in activity levels affect your profitability.

Cost-Volume-Profit (CVP) Analysis relies heavily on the concept of relevant range. It enables you to estimate costs, revenue, and profits at various activity levels. This information is invaluable for planning, budgeting, and setting targets.

The relevant range is directly linked to the break-even point and target profit. The break-even point is the level of activity at which total revenue equals total costs. By understanding the relevant range, you can determine how far you can increase sales without exceeding your production capacity.

Similarly, target profit analysis helps you identify the activity level required to achieve a desired profit goal. The relevant range provides the boundaries within which you can adjust your operations to meet your target.

Understanding the Role of Relevant Range in CVP Analysis

Imagine a manufacturing company that produces and sells widgets. The company’s fixed costs include rent, insurance, and depreciation. Variable costs include materials, labor, and shipping.

By identifying the relevant range, the company can determine that within a certain range of widget production, its fixed costs remain constant. This allows them to accurately predict how changes in sales volume will affect their profits.

If the company plans to increase production outside the relevant range, it may incur additional fixed costs, such as hiring more workers or renting a larger facility. This would change the cost structure and impact the company’s profitability calculations.

Therefore, understanding the relevant range is essential for making informed decisions about production levels, pricing, and cost optimization. By carefully considering the boundaries of this range, businesses can optimize their operations and maximize profitability.

Relevant Range and Its Significance in Cost-Volume-Profit Analysis

Understanding the Relevant Range

The relevant range is the crucial activity level within which a company’s cost behavior remains relatively constant. It plays a vital role in cost-volume-profit (CVP) analysis, helping managers make informed decisions about pricing, production, and marketing strategies.

Relevance to Break-Even Point and Target Profit

The relevant range is closely linked to the break-even point, where total revenue equals total costs. At this point, the company neither makes a profit nor incurs a loss. Identifying the relevant range allows managers to determine the sales volume needed to reach the break-even point and calculate the target profit.

Target Profit

The target profit is the desired profit level that a company aims to achieve. By analyzing the relevant range, managers can estimate the sales volume required to generate the target profit and develop strategies to achieve it. For example, if the target profit is $100,000 and the unit profit contribution is $10, the company needs to sell 10,000 units within the relevant range to reach its target.

Understanding Relevant Fixed Costs

In the financial world, understanding relevant fixed costs is crucial for accurate cost-volume-profit (CVP) analysis. But what exactly are these mysterious costs?

Fixed costs are expenses that remain constant regardless of your business’s activity level. These unwavering expenses include overhead costs, those unavoidable expenses that keep your business running, such as rent, insurance, and utilities. Indirect costs are similar to overhead costs but are specifically tied to production, like depreciation on equipment or factory maintenance.

Finally, there are period costs. Unlike overhead and indirect costs, period costs are those that don’t directly relate to production, such as advertising, marketing, and administrative salaries. While not involved in production, period costs remain fixed within the relevant range.

Identifying relevant fixed costs within the relevant range is essential to accurately predict your business’s financial performance. By understanding these unwavering expenses, you can make informed decisions, mitigate risks, and optimize your path to profitability.

Identifying Relevant Fixed Costs within the Relevant Range: A Guiding Light

In the realm of business, understanding the nuances of costs is paramount to navigating the path towards profitability. One crucial aspect of this is identifying relevant fixed costs within the relevant range. Let’s embark on a journey to demystify this concept and illuminate its significance.

Fixed costs, as the name suggests, remain constant regardless of fluctuations in production or sales volume. However, it’s important to note that only certain fixed costs are relevant within the relevant range—the range of activity levels where assumptions about cost behavior hold true. To identify these relevant fixed costs, we must delve into the world of overhead, indirect, and period costs.

Overhead costs, often referred to as expenses, encompass all costs not directly related to production. Examples include rent, utilities, insurance, and administrative salaries. While some overhead costs may vary with activity, such as overtime pay, others remain fixed within the relevant range.

Indirect costs, on the other hand, are incurred in support of production but cannot be directly traced to specific units. For instance, a factory supervisor’s salary would be considered an indirect cost, as their contribution affects production as a whole rather than individual units.

Finally, period costs are expenses that occur over a specific time period, regardless of activity level. Examples include depreciation, amortization, and interest expenses.

Once we have an understanding of these cost categories, we can pinpoint which fixed costs are relevant within the relevant range. The key lies in determining which costs remain constant despite changes in activity. For example, the monthly rent for a factory building is typically a relevant fixed cost because it does not fluctuate based on production levels.

By accurately identifying relevant fixed costs, businesses gain invaluable insights into their cost structure and can make informed decisions regarding production, pricing, and profit targets. It’s the foundation upon which cost-volume-profit analysis and break-even analysis rest, providing a roadmap for financial success.

Relevant Range: Understanding Relevant Costs for Optimal Decision-Making

When it comes to making informed business decisions, understanding relevant costs is crucial. The relevant range is a key concept in cost-volume-profit (CVP) analysis, helping you determine the range of activity where total costs change in proportion to changes in output.

Within the relevant range, costs can be classified into fixed and variable categories. Relevant fixed costs are those that remain constant regardless of activity level, such as rent, insurance, and executive salaries. These costs are irrelevant for decision-making within the relevant range, as they do not impact short-term profit outcomes.

Conversely, relevant variable costs vary directly with activity level. They include expenses like raw materials, labor, and utilities. These costs are relevant for decision-making, as they significantly impact profitability within the relevant range.

Direct, Unit, and Prime Costs: Defining Variable Cost Components

Direct costs can be traced directly to a specific product or service, such as raw materials and labor. Unit costs are variable costs expressed per unit of production, making them essential for calculating per-unit costs.

Prime costs are a subset of variable costs that include direct labor and raw materials. These costs are particularly relevant for manufacturers, as they represent the primary production expenses.

By understanding these cost classifications and their relevance within the relevant range, businesses can make informed decisions about pricing, production, and resource allocation to maximize profitability and achieve optimal outcomes.

Identify Variable Costs: The Dynamic Side of Expenses

In the realm of business, understanding the behavior of costs is crucial for making sound financial decisions. Variable costs, unlike their fixed counterparts, fluctuate gracefully with changes in activity. Identifying these dynamic costs is essential for accurate cost-volume-profit (CVP) analysis.

Variable costs are like the heartbeat of an organization. They pump life into operations, responding to changes in production, sales, and service. They encompass a wide range of expenses, including raw materials, direct labor, and commissions. These costs have a direct and proportional relationship with activity.

To uncover variable costs, consider the following criteria:

- Direct Correlation with Activity: Does the cost increase or decrease in lockstep with changes in production, sales, or service?

- Unit-Based: Is the cost charged per unit produced, sold, or serviced?

- Responsive to Volume: Does the cost adjust without the need for significant changes in infrastructure or capacity?

By carefully evaluating these factors, you can pinpoint the variable costs that shape your business’s financial landscape. This knowledge empowers you to optimize production levels, set realistic sales targets, and forecast profitability with greater precision.

Characteristics of Semi-Variable and Semi-Fixed Costs

In the realm of cost accounting, semi-variable costs and semi-fixed costs blend the characteristics of both fixed and variable costs, creating a unique layer of complexity.

Semi-Variable Costs

Residing between the rigid stronghold of fixed costs and the flexible dance of variable costs, semi-variable costs are peculiar creatures. They exhibit both a fixed component that remains constant across a specific range of activity and a variable component that fluctuates in response to changes in activity.

Take, for instance, a manufacturing facility. Its rent expense might remain fixed for a set number of square feet. However, the cost of electricity, a semi-variable expense, increases as production ramps up, requiring more power for machinery and lighting.

Semi-Fixed Costs

Semi-fixed costs, on the other hand, showcase a contrasting behavior. They behave like fixed costs within a particular activity range, maintaining a steady presence. Yet, they can transform into variable costs once that range is exceeded.

Consider a company’s sales commissions: Within the normal sales volume, commissions are fixed. But when sales surge beyond a certain threshold, the company may hire additional sales staff, incurring variable commissions.

Unveiling the Nature of Mixed Costs

To identify semi-variable and semi-fixed costs, accountants employ various techniques. Scatter plots, which map costs against activity levels, can reveal linear patterns (variable costs) or non-linear trends (mixed costs). High-low method and regression analysis provide quantitative means to separate fixed and variable components within mixed costs.

Techniques for allocating mixed costs into fixed and variable components

Understanding Mixed Costs and Techniques for Allocation

Mixed Costs: The Puzzle of Partially Fixed and Variable

When it comes to cost behavior, not all costs fit neatly into fixed or variable categories. Mixed costs, also known as semi-variable or semi-fixed costs, exhibit a blend of both. They have a fixed component that remains constant within a specific range of activity, but also a variable component that fluctuates with changes in production or sales.

Identifying and Allocating Mixed Costs

Identifying mixed costs requires careful analysis of historical data. Accountants use various techniques to allocate these costs into fixed and variable components. One common method is the high-low method. This involves comparing costs at both high and low levels of activity to determine the fixed and variable portions.

Another technique is regression analysis. This statistical approach uses a line of best fit to estimate the relationship between costs and activity levels. The slope of the line represents the variable cost per unit of activity, while the intercept represents the fixed cost.

The Difficulty of Allocation

Allocating mixed costs can be challenging, especially when the fixed and variable components are not easily distinguishable. In such cases, accountants may need to rely on judgment and assumptions to make reasonable estimates. It’s important to note that these allocations are not exact science and may vary depending on the specific circumstances.

Understanding mixed costs and their appropriate allocation is crucial for accurate cost-volume-profit analysis. By carefully considering the techniques described above, accountants can improve the reliability of their forecasting and decision-making. Remember, mixed costs are a puzzle piece in the complex world of cost behavior, and their precise allocation ensures a clearer path to profitability.

Step Costs: Non-Linear Changes

Step costs, like sudden bumps in a smooth road, introduce non-linearity into the world of cost analysis. Imagine a business that rents office space. As the business grows, it may reach a point where it needs an extra room. This additional space triggers a jump in rent, a step-like increase in fixed costs.

Capacity Costs

These costs, like a gatekeeper, guard the limits of a business’s production or service capacity. They stay steady until a threshold is reached, then bam! They take a step up. Think of a factory that needs to hire more staff when production ramps up.

Discretionary Costs

These costs, like a flexible dance partner, can be adjusted as needed within a certain range. A business may choose to increase marketing spending during a sales push, then dial it back when the campaign ends.

Committed Costs

These costs, like a stubborn bull, resist change. They are fixed and remain intact regardless of changes in activity. An example is a long-term lease agreement that locks in rent payments for a specific period.

Identifying and allocating step costs into fixed and variable components is crucial. This allows businesses to accurately forecast costs and make informed decisions in the face of fluctuating demand.

So, as you navigate the financial landscape, keep an eye out for these sneaky step costs. They may not follow a linear path, but understanding their unique characteristics will help you keep your business on a smooth and profitable trajectory.

Understanding how step costs increase in discrete increments

Step Costs: The Non-Linear Increments

Imagine you’re a bakery owner, diligently churning out freshly baked treats. As your business expands, you decide to invest in a shiny new oven with double the capacity of your old one. This upgrade, while promising increased productivity, comes with a catch: step costs.

Step costs, unlike their linear counterparts, jump up in discrete increments. Think of it as a staircase with each step representing a specific cost. In your bakery, the new oven might require an additional employee to operate, resulting in a fixed step cost for each shift.

Now, suppose you reach a point where the new oven allows you to produce 50% more pastries. Those extra pastries require more ingredients and packaging, but at a variable step cost per unit produced. As you continue baking, the cost of these supplies plateaus, only increasing once you cross the next threshold of production.

This non-linear behavior of step costs can be tricky to manage. If you’re not careful, you could find yourself with unexpected expenses as your business grows. To avoid unpleasant surprises, it’s crucial to carefully evaluate potential step costs before making major investments.

Identifying Step Costs

Spotting step costs can be like finding hidden treasures. Look for costs that change abruptly at specific levels of activity. These might include:

- Capacity costs: Expenses that depend on your facility’s size or capacity, such as rent or utilities.

- Discretionary costs: Expenses that can be turned on or off at specific activity levels, such as overtime pay or marketing campaigns.

- Committed costs: Expenses that are fixed for a period of time, such as contracts or leases.

Managing Step Costs

Once you’ve identified your step costs, it’s time to tame them. Here are some strategies:

- Plan: Forecast future activity levels and anticipate when step costs might arise.

- Negotiate: If possible, negotiate flexible contracts or agreements that allow for step costs to be spread over a longer period.

- Optimize: Evaluate your operations and find ways to reduce the impact of step costs. For example, you could explore shared staffing arrangements or invest in automation.

Understanding step costs is like having a secret weapon in your business arsenal. By recognizing and managing them effectively, you can keep your financial path smooth and paved with fresh-baked delights.