Understanding Physical Capital Per Worker: A Key Metric For Economic Productivity

Physical capital per worker, a measure of economic productivity, is calculated by dividing the physical capital stock (tangible assets like machinery and infrastructure) by the labor force (individuals available for work). It represents the amount of physical capital available to each worker in the economy. This metric is crucial for policymakers and businesses as it reflects the ability of capital to enhance labor productivity, efficiency, and technological advancements, leading to improved economic performance, resource allocation, and growth forecasts.

Defining Physical Capital Stock

- Explain the concept of physical capital stock as tangible assets used in production.

- List examples of physical capital, such as machinery, buildings, vehicles, and infrastructure.

Defining Physical Capital Stock

In the realm of economics, understanding the concept of physical capital stock is crucial. It refers to the tangible, long-lasting assets used by businesses and industries in the process of production. These assets are essential for creating goods and services and contribute significantly to a nation’s economic growth.

Types of Physical Capital

Examples of physical capital stock include:

- Machinery: Tools, equipment, and machinery used to manufacture products.

- Buildings: Factories, offices, and warehouses that house production activities.

- Vehicles: Cars, trucks, and ships used for transportation and distribution.

- Infrastructure: Roads, bridges, and utilities that support economic activity.

Understanding the Labour Force

- Define the labour force as individuals available for work.

- Discuss the components of the labour force, including employed, unemployed, and actively seeking employment.

Understanding the Labour Force: The Foundation of Economic Productivity

In the realm of economics, the labour force holds a pivotal position, representing the individuals who are available for work and contribute to the production of goods and services. This dynamic group comprises three main components:

- The employed: Individuals who are currently engaged in paid work, earning wages or salaries for their labour.

- The unemployed: Individuals who are actively seeking employment but are currently without a job.

- Those actively seeking employment: Individuals who are not currently employed but are actively engaged in job hunting, attending interviews, or taking steps to improve their employability.

The labour force is a key indicator of the health and vitality of an economy. A large and skilled labour force can contribute to increased production, innovation, and economic growth. Conversely, a small or inadequately skilled labour force can hinder economic progress.

Measuring the labour force is essential for economists and policymakers to understand the dynamics of the job market and inform decisions related to labour market policies, education, and skills development. By tracking changes in the size and composition of the labour force, governments and businesses can respond to labour market trends and ensure that the economy has the human capital it needs to thrive.

Calculating Capital per Worker: A Key Metric for Economic Productivity

What is Capital per Worker?

Capital per worker, also known as capital intensity, measures the amount of physical capital stock available to each member of the labor force. Physical capital stock includes tangible assets used in production, such as machinery, buildings, vehicles, and infrastructure. The labor force, on the other hand, refers to individuals available for work, including those employed, unemployed, or actively seeking employment.

Formula for Calculating Capital per Worker

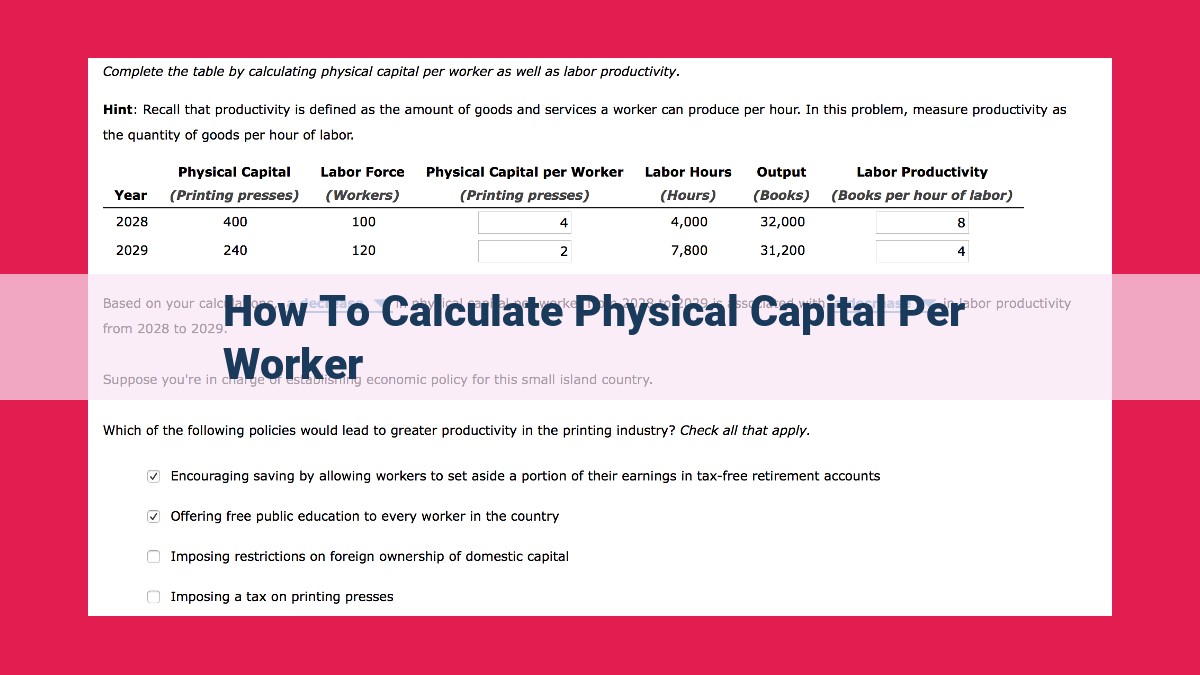

Calculating capital per worker is a simple process:

Capital per Worker = Physical Capital Stock / Labour Force

For instance, if a country has a physical capital stock valued at $100 billion and a labor force of 50 million, its capital per worker would be $100 billion / 50 million = $2,000.

What Does Capital per Worker Tell Us?

Capital per worker is a crucial indicator of economic productivity. It shows how well-equipped workers are with the physical capital necessary to produce goods and services. Generally, higher capital per worker leads to:

- Enhanced Labor Productivity: Workers with more capital at their disposal can produce more output per hour.

- Increased Efficiency: Capital helps automate tasks, reduce waste, and improve production processes.

- Technological Advancements: Capital investments often drive research and development, leading to technological innovations that further enhance productivity.

Importance for Policymakers and Businesses

Capital per worker is essential information for policymakers and businesses. It allows them to:

- Assess Economic Performance: Track a country’s productivity and competitiveness over time.

- Identify Investment Opportunities: Determine areas where additional capital investment could yield the highest returns.

- Forecast Growth: Estimate future economic growth based on projected changes in capital per worker.

- Allocate Resources Effectively: Optimize resource allocation by directing investments towards sectors with the greatest potential for productivity growth.

Capital per worker is a fundamental metric that sheds light on the productivity of an economy. By understanding this key indicator, policymakers and businesses can make informed decisions that promote economic growth, job creation, and sustainable development.

**The Significance of Capital per Worker: A Tale of Productivity and Economic Growth**

In the realm of economics, capital per worker plays a pivotal role in shaping a nation’s economic prowess. It is a metric that measures the amount of physical capital, such as machinery, buildings, and infrastructure, available to each worker in the labor force.

What Makes Capital per Worker Important?

Capital per worker serves as an indispensable indicator of a country’s economic productivity and growth potential. When workers have access to more capital, they can produce more goods and services, leading to higher output for the economy as a whole. This enhanced productivity translates into improved living standards and economic prosperity.

The Correlation with Labor Productivity and Efficiency

A higher capital per worker is inextricably linked to increased labor productivity. With access to modern machinery, efficient infrastructure, and advanced technologies, workers can work faster, smarter, and produce more output. This surge in productivity also leads to significant cost savings, as businesses can produce goods and services more efficiently.

Moreover, ample capital per worker enables technological advancements. Businesses can invest in research and development, leading to the creation of new and innovative products and processes. This continuous innovation drives economic growth and competitiveness in the global marketplace.

Implications for Policymakers and Businesses

Understanding capital per worker is paramount for both policymakers and business leaders. By assessing this metric, policymakers can make informed decisions regarding investments in infrastructure, education, and innovation, all of which contribute to increasing capital per worker and fostering economic growth.

For businesses, capital per worker is a crucial factor to consider when making investment decisions. By investing in physical capital, such as new equipment or training programs, businesses can enhance their productivity and competitiveness, leading to increased profitability and sustainability.

The Significance of Capital per Worker for Policymakers and Businesses

Understanding capital per worker is crucial for policymakers and businesses to make informed decisions that drive economic growth and prosperity. This metric provides valuable insights into a nation’s economic performance and serves as a guiding light for investment strategies and resource allocation.

For policymakers, capital per worker offers a comprehensive measure of the economy’s productive capacity. By tracking its trends, policymakers can identify areas of strength and weakness within industries and sectors. This knowledge empowers them to craft policies that promote innovation, facilitate investment, and enhance labor productivity. For instance, if capital per worker in the manufacturing sector is declining, it could signal the need for government incentives to stimulate capital spending and research and development.

Businesses, too, benefit immensely from understanding capital per worker. It helps them assess their competitive position and make strategic investment decisions. By comparing their capital per worker ratio to industry benchmarks, companies can identify areas for improvement and seize opportunities for growth. For example, a technology firm with a higher capital per worker than its competitors may consider investing in new technologies to further boost its productivity.

Moreover, capital per worker aids businesses in forecasting economic growth and making informed resource allocation decisions. A rising capital per worker ratio often indicates increased investment in technology and automation, which can lead to higher productivity and economic expansion. Businesses can anticipate future demand and adjust their production plans accordingly. Additionally, by understanding capital per worker, businesses can optimize their labor force planning and resource allocation, ensuring they have the necessary capital and workforce to meet market needs.