Understanding Net Income: A Comprehensive Guide For Merchandisers

To compute net income, a merchandiser starts with revenue, which includes income from the sale of goods. They then deduct cost of goods sold (COGS), which represents direct costs incurred to acquire or produce the goods sold. Next, they subtract operating expenses, which cover expenses related to the business’s daily operations (excluding COGS). The resulting gross profit is reduced by operating expenses to determine operating profit. Finally, they may consider non-operating income/expenses, interest expense, and taxes to arrive at the net income, a key indicator of the business’s overall profitability.

Unraveling the Secrets of Net Income: A Guide to Business Profitability

In the realm of business, determining profitability is a critical undertaking, and understanding net income is the key to unlocking this mystery. Net income represents the true earnings generated by a company after subtracting all expenses from its revenue. It’s a crucial financial indicator that provides invaluable insights into a business’s financial health.

What is Net Income and Why Does it Matter?

Think of net income as the ultimate scorecard for your business. It reveals how effectively you’re converting revenue into profit, the lifeblood of any successful enterprise. Analyzing net income allows you to gauge your company’s profitability, assess its financial performance, and make informed decisions about growth and strategy. Whether you’re a seasoned entrepreneur or just starting out, understanding how to calculate and interpret net income is essential for staying ahead in the competitive business landscape.

Heading towards Net Income: A Step-by-Step Journey

Embarking on the journey towards net income requires navigating a few key financial concepts. Let’s break it down into manageable segments:

-

Revenue: The lifeblood of any business, revenue represents the inflow of economic benefits generated from selling goods or services. It’s the starting point for calculating net income.

-

Cost of Goods Sold (COGS): These are the direct costs associated with producing or acquiring goods that are then sold to customers. Think of COGS as the raw materials, labor, and overhead expenses incurred in bringing products to market.

-

Operating Expenses: Beyond COGS, businesses also incur day-to-day expenses that support their operations but aren’t directly tied to creating goods. These include expenses like marketing, rent, salaries, and utilities.

Profitability Unraveled: The Building Blocks of Net Income

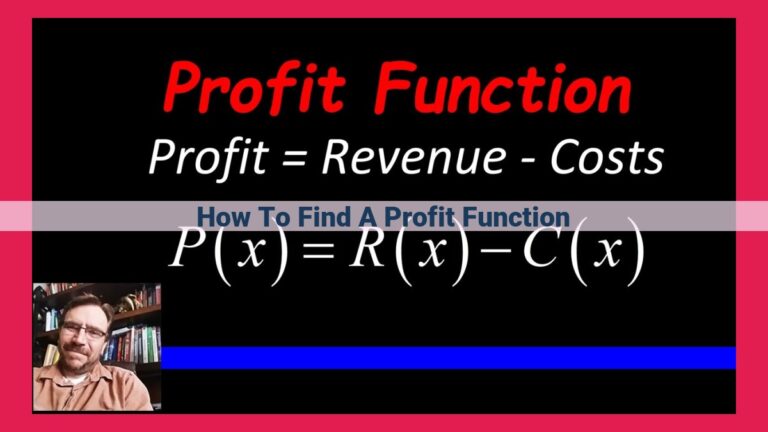

Armed with these foundational concepts, we can now dissect the formula for net income:

Net Income = Revenue – COGS – Operating Expenses

-

Gross Profit: The first step towards net income is calculating gross profit, which is simply revenue minus COGS. It reflects the profit earned from selling goods, excluding operating expenses.

-

Operating Profit: Subtracting operating expenses from gross profit reveals operating profit. This metric provides a clear picture of how profitable your core business operations are, excluding the impact of financial factors like interest payments.

-

Net Income: Finally, we arrive at net income, the ultimate reflection of your business’s profitability. It represents the true earnings of your company after accounting for all expenses, including both COGS and operating expenses.

Understanding Revenue: The Lifeblood of Business

In the intricate world of business, the concept of revenue takes center stage, akin to the beating heart that propels a company forward. Revenue, simply put, is the monetary value of the products or services sold by a business. It represents the inflow of economic benefits that enables a company to not only sustain itself but also thrive.

Imagine a bustling marketplace brimming with vendors offering an array of goods and services. As customers make purchases, they contribute to the revenue of those businesses. This revenue serves as the foundation upon which businesses build their profits, invest in growth, and ultimately achieve their financial goals.

So, where does revenue come from? The sources are as diverse as the businesses themselves. For merchandisers, who purchase finished goods to sell at a profit, the primary source of revenue is through the sale of these goods. Think clothing stores, electronics retailers, and grocery chains.

Companies offering services also rely on revenue to stay afloat. Consulting firms, healthcare providers, and software developers generate revenue by providing valuable expertise, treatments, or technological solutions to their clients.

Understanding the concept of revenue is not merely an academic exercise; it’s crucial for business owners to master this knowledge in order to make informed decisions that drive profitability. A keen eye on revenue trends, coupled with an ability to identify new revenue streams, can lead a business to newfound heights of success.

Understanding Cost of Goods Sold (COGS): The Key to Accurate Net Income Calculation

In the realm of financial reporting, every business aims to determine its profitability. To do this, understanding the concept of net income is crucial. One of the primary components of net income is Cost of Goods Sold (COGS), which plays a vital role in its calculation.

COGS represents the direct costs incurred by a merchandiser in acquiring or producing the goods sold to customers. It is a measure of the cost of the inventory that has been sold during a specific accounting period.

Components of COGS

COGS encompasses three main components:

- Raw Materials: The cost of materials used in the production of the goods.

- Labor: Wages and salaries paid to employees directly involved in the production process.

- Related Expenses: Additional costs incurred in the production process, such as utilities, depreciation, and factory overhead.

Significance of COGS

Calculating COGS accurately is essential for determining a company’s gross profit, operating profit, and ultimately, net income. Gross profit is the difference between revenue and COGS, while operating profit subtracts operating expenses from gross profit.

Accurate COGS calculation provides valuable insights into the profitability of selling goods. It helps businesses assess their efficiency in managing inventory costs, control expenses, and optimize operations.

Understanding the concept of COGS is paramount for any merchandiser. It is the foundation upon which other profitability metrics are built. By carefully tracking and analyzing COGS, businesses can gain a clear picture of their cost structure and identify areas for improvement. This knowledge empowers them to make informed decisions that maximize profitability and drive long-term success.

Operating Expenses:

- Define operating expenses as expenses incurred in the day-to-day operations of the business, excluding COGS.

- Discuss common operating expenses, including selling, general, and administrative (SG&A) expenses, depreciation, and amortization.

Operating Expenses: The Day-to-Day Costs of Running a Business

Just as we need to pay for groceries, utilities, and rent in our personal lives, businesses also incur expenses to keep their operations running smoothly. These expenses are known as operating expenses and form a crucial part of calculating a company’s net income.

What Qualifies as an Operating Expense?

Unlike cost of goods sold, which refers to expenses directly related to producing or acquiring the products or services sold, operating expenses cover a wide range of costs necessary for the day-to-day functioning of the business, such as:

- Selling expenses: These expenses are incurred to generate sales, including:

- Salespeople salaries and commissions

- Advertising and marketing costs

- Customer service expenses

- General and administrative expenses (SG&A): These expenses support the overall operations of the business, such as:

- Salaries for non-production employees (e.g., administrative staff, managers)

- Office supplies and rent

- Insurance and legal fees

- Depreciation: This represents the gradual reduction in value of long-term assets (e.g., equipment, buildings) over their useful lives.

- Amortization: Similar to depreciation, amortization refers to the spreading out of the cost of intangible assets (e.g., patents, copyrights) over their useful lives.

Importance of Operating Expenses

Understanding operating expenses is crucial for several reasons. Firstly, it helps identify the costs involved in running a business and allows for accurate budgeting and forecasting. Secondly, analyzing operating expenses can reveal areas where cost reductions can be implemented. Finally, operating expenses significantly impact a company’s profitability, as they are deducted from revenue to arrive at gross profit and eventually net income.

Gross Profit: The Gateway to Understanding Your Business’s Profitability

Imagine you’re running a lemonade stand on a hot summer day. You sell a glass of lemonade for $1, and it costs you 50 cents to make it. The gross profit you earn from each glass is the difference between these two amounts: $0.50. This simple calculation is the foundation for understanding the profitability of your business.

Gross profit is the lifeblood of any merchandising business. It represents the profit you earn from the sale of your products after accounting for the direct costs of producing or acquiring them. These costs include raw materials, labor, and any other expenses directly related to the production or purchase of the goods.

Calculating gross profit is essential because it provides valuable insights into the efficiency of your operations. A high gross profit margin indicates that you’re effectively managing your costs and generating a healthy profit from your sales. Conversely, a low gross profit margin could signal inefficiencies or competitive pressures that need to be addressed.

Gross profit serves as a benchmark for comparing your business to industry standards and competitors. It helps you identify areas where you can improve your profitability by optimizing your supply chain, negotiating better terms with suppliers, or adjusting your pricing strategy.

By understanding the concept of gross profit and its importance, you can make informed decisions that drive the growth and profitability of your business. It’s the first step towards unlocking the secrets of financial success.

Demystifying Operating Profit: Unraveling the Core Profitability of a Business

Introduction

In the realm of business, profitability reigns supreme. Understanding how to compute net income is akin to unlocking the secrets of a treasure map, guiding us toward the ultimate prize of financial success. Net income, like the glittering gold at the end of the rainbow, represents the true profit earned by a business after all expenses have been accounted for.

The Journey to Compute Net Income

Similar to an explorer traversing treacherous terrain, computing net income requires navigating a series of accounting concepts. Let’s embark on this journey, starting with revenue, the lifeblood of any business. Revenue gushes in like a mighty river, representing the inflow of economic benefits from the sale of goods or services.

Next, we encounter cost of goods sold (COGS), the direct costs incurred in acquiring or producing those goods. These costs, like rocks in the riverbed, impede the flow of profit. Then come operating expenses, the day-to-day expenses that keep the business afloat, from rent to salaries.

Gross Profit: The Oasis in the Desert

The difference between revenue and COGS yields gross profit, a beacon of hope in the financial wilderness. It signifies the profit earned from the sale of goods, a testament to the business’s ability to generate income.

Operating Profit: The Core of Profitability

Venturing further, we stumble upon operating profit, also known as EBIT (earnings before interest and taxes) or EBITDA (earnings before interest, taxes, depreciation, and amortization). Operating profit, like a golden nugget, represents the core profitability of the business, excluding factors such as financing and non-operating expenses.

By delving into these concepts and their interplay, we gain the tools to accurately compute net income, illuminating the true financial health of a business. Net income serves as a beacon of success, guiding investors, creditors, and decision-makers toward informed choices.