Understanding Ledger Balances: A Comprehensive Guide For Accurate Financial Reporting

A ledger balance represents the cumulative effect of transactions recorded in an accounting ledger account. It provides the beginning and ending balances for each account, indicating the net value of assets, liabilities, and equity. Ledger balances can be debit (positive) or credit (negative), and their normal balance depends on the account type. Subledgers provide detailed records for specific account categories, while general ledgers consolidate all ledger accounts. Ledger (T-account) representation graphically illustrates the account’s balance and transactions. The trial balance verifies the equality of debits and credits, and ledger balances contribute to the preparation of the balance sheet, which summarizes an organization’s financial position.

Understanding Ledger Balances

- Definition and importance of ledger balances in accounting.

Understanding Ledger Balances: A Key to Accounting Accuracy

In the world of accounting, ledger balances play a pivotal role in maintaining the integrity and accuracy of financial records. Imagine a vast library, filled with shelves upon shelves of books, each representing an account in your business’s financial ledger. Each book has a page dedicated to recording transactions, and the balance of that account is akin to the running total of the page.

Just as a librarian keeps track of each book’s contents, understanding ledger balances is crucial for accountants to ensure that all financial transactions are properly documented and summarized. These balances provide a snapshot of the account’s activity at any given point in time, allowing businesses to monitor their financial health, make informed decisions, and meet their reporting obligations.

Types of Ledger Balances: A Window into Your Financial Landscape

Understanding ledger balances is crucial for navigating the intricate world of accounting. Among the various types of ledger balances, two fundamental categories stand out: beginning and ending balances, and debit and credit balances.

Beginning and Ending Balances: The Starting and Closing Points

Beginning balances represent the initial amount recorded in an account at the start of an accounting period. They provide a snapshot of the account’s status at that moment. In contrast, ending balances reflect the account’s value at the end of the period, after all transactions have been accounted for. They serve as the starting point for the next period’s beginning balance.

Debit and Credit Balances: The Balancing Act

Debit balances typically appear in asset and expense accounts, representing values being added to the business. On the other hand, credit balances are commonly found in liability, equity, and revenue accounts, signifying values being subtracted from the business.

- Assets (e.g., Cash, Accounts Receivable): Debit balances indicate the amount the business owns or is owed.

- Liabilities (e.g., Accounts Payable, Loans): Credit balances represent obligations the business owes to others.

- Equity (e.g., Capital, Retained Earnings): Credit balances reflect the owners’ investment and earnings retained in the business.

- Revenues (e.g., Sales Revenue): Credit balances record income generated by the business.

- Expenses (e.g., Salaries Expense, Rent Expense): Debit balances depict costs incurred by the business.

Understanding the types of ledger balances and their characteristics is essential for maintaining accurate financial records and gaining insights into your business’s financial health.

Normal Account Balances: The Cornerstone of Accounting

In the realm of accounting, ledger balances are the lifeblood of financial records, providing a snapshot of an account’s activity and its ending balance. Normal account balances refer to the expected balance type (debit or credit) for each type of account, based on established accounting principles.

Assets, expenses, and losses are typically debit balances, meaning they increase when debited and decrease when credited. Liabilities, equity, revenue, and gains, on the other hand, are usually credit balances, increasing when credited and decreasing when debited.

This distinction stems from the basic accounting equation: Assets = Liabilities + Equity. Assets are resources owned by a company, while liabilities are obligations it owes. Equity represents the owners’ claim on the company’s assets. Revenues and expenses affect equity by increasing or decreasing it, respectively.

Understanding normal account balances is crucial for accurate financial reporting. It ensures that transactions are properly recorded and that the trial balance, a summary of all ledger accounts, balances (i.e., the total debits equal the total credits).

Moreover, normal account balances facilitate the preparation of financial statements, such as the balance sheet. The balance sheet reports the company’s financial position at a specific point in time, and the ending balances of ledger accounts are used to create this snapshot.

By adhering to normal account balances, accountants can maintain the integrity of financial records and ensure their reliability for decision-making purposes. It’s a fundamental principle of accounting that underpins the accuracy and transparency of financial reporting.

Understanding Subledgers and General Ledgers

In the financial world, ledger balances play a crucial role in tracking the financial health of organizations. Ledger accounts act as individual “buckets” that hold information about specific aspects of an organization’s financial performance. To ensure accuracy and organization, subledgers and general ledgers are used to manage these accounts.

Subledgers are detailed records that track specific types of accounts. For example, a company may have a subledger for accounts receivable, which keeps track of all invoices owed by customers. Subledgers provide a deeper level of detail than the general ledger, allowing for a more comprehensive understanding of specific areas.

On the other hand, the general ledger is a collection of all the ledger accounts used by an organization. It provides a summary of the balances of all the subledgers, giving a consolidated view of the organization’s financial position. By combining the information from all the subledgers, the general ledger presents a high-level overview of the company’s financial performance.

Imagine a company with multiple store locations. Each store has its own sales and cash records, which are kept in subledgers. The general ledger combines the data from all the store subledgers, providing a consolidated view of the company’s overall sales and cash position. This allows management to make informed decisions about resource allocation and financial planning.

Subledgers and general ledgers work hand-in-hand to ensure the accuracy and completeness of financial records. Subledgers provide the detailed information, while the general ledger provides the comprehensive overview. Together, they form the foundation of an organization’s accounting system, enabling the company to make informed decisions, prepare financial statements, and comply with regulatory requirements.

Ledger (T-Account) Representation: Decoding the Language of Accounting

Imagine you’re venturing into the realm of accounting, where numbers dance and tell tales of a company’s financial health. One of the most fundamental concepts you’ll encounter is the ledger balance, a snapshot of an account’s activity at a given point in time. To understand these balances, let’s explore the graphical representation known as a T-account.

Think of a T-account as a balance beam, with two sides: the left for debits, and the right for credits. Just like a seesaw, these sides must always be in equilibrium, ensuring that the total debits equal the total credits. The result is the account’s balance, which can be positive (excess debits) or negative (excess credits).

To visualize this, imagine a simple cash account. On the debit side, you might see an inflow of cash, such as a deposit. This inflow increases the account’s balance. Conversely, on the credit side, you might see an outflow of cash, such as a withdrawal. This outflow decreases the account’s balance.

The T-account provides a clear and concise way to track these transactions and the resulting balance. The account’s beginning balance, the balance at a specific starting point, is recorded on either the debit or credit side, depending on the account type. As transactions occur, they are posted to the corresponding sides of the account, affecting the balance accordingly. The ending balance, the balance at a specific ending point, represents the net effect of all transactions posted to the account.

By analyzing T-accounts, accountants can quickly determine the status of an account and identify any discrepancies. This visual representation helps them ensure the accuracy and integrity of the accounting records.

Trial Balances: Ensuring Accounting Accuracy

Maintaining the integrity and accuracy of accounting records is crucial for any business or organization. A trial balance plays a vital role in ensuring that the accounting books are in balance, guaranteeing the reliability of financial statements.

In its simplest form, a trial balance is a summarized list of all ledger account balances at a specific point in time. It lists each account’s name, its debit balance, and its credit balance. The total of all debit balances should equal the total of all credit balances, ensuring that the accounting equation (Assets = Liabilities + Owner’s Equity) remains in balance.

The significance of the trial balance lies in its ability to detect accounting errors. If debits do not equal credits, it indicates that there has been an oversight or mistake in the recording or posting of transactions. This alerts accountants to potential issues, allowing them to investigate and rectify errors promptly.

To illustrate, suppose that a company’s trial balance reveals a difference of $1,000 between debits and credits. This discrepancy could be caused by a simple transposition error, where a debit of $900 was mistakenly entered as a credit of $600. Or it could be an indication of a more serious issue, such as an unrecorded transaction. By identifying such errors early on, the trial balance helps prevent the accumulation of accounting inaccuracies and ensures the integrity of financial reporting.

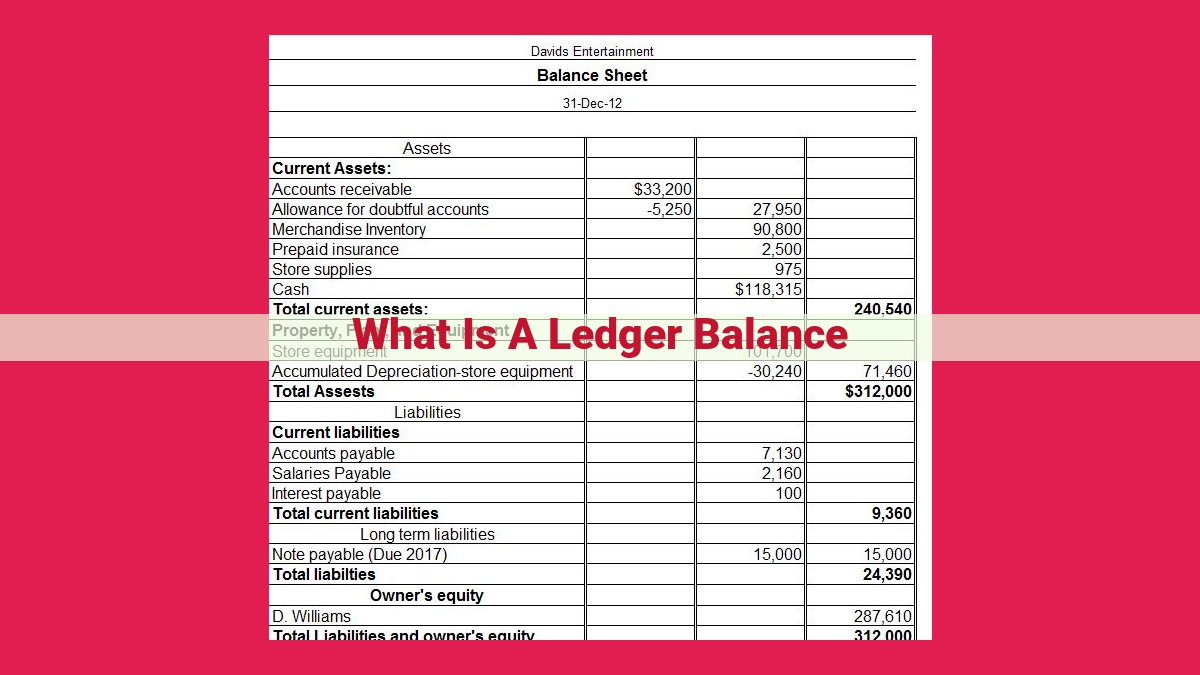

In addition to detecting errors, a trial balance also provides a basis for preparing financial statements. The debit and credit balances from the trial balance are used to compile the balance sheet, which provides a snapshot of an organization’s financial position at a specific point in time. Thus, the trial balance serves as a foundation for the entire accounting process, ensuring the reliability and accuracy of financial information.

Ledger Balances and the Balance Sheet: Unraveling the Secrets of Financial Position

Every business’s financial health is accurately captured in its balance sheet, which provides a comprehensive snapshot of its assets, liabilities, and equity at a specific point in time. At the heart of this crucial financial statement lie ledger balances, the unsung heroes that play a pivotal role in shaping the narrative of a company’s financial position.

Ledger balances represent the cumulative summary of all transactions that have flowed through an account during a specific accounting period. These balances provide a window into the company’s financial activities, revealing the opening and closing points of each account. For instance, the cash balance at the beginning of the year tells us how much money was in the bank on January 1, while the ending balance at the end of the year indicates how much cash remains on December 31.

Just as humans have unique characteristics, so do ledger balances. Some accounts, such as assets, are expected to have debit balances (more money coming in than going out), while others, such as liabilities, are expected to have credit balances (more money going out than coming in). These normal balances are fundamental accounting principles that ensure the balance sheet’s accuracy and integrity.

To further enhance the accuracy of financial reporting, businesses often employ subledgers, detailed records that provide additional information about specific account types. These subledgers allow accountants to drill down into the details of individual transactions, ensuring a more comprehensive understanding of the company’s financial activities.

The culmination of all ledger balances is the general ledger, which is the central repository of all accounting transactions. Think of it as the financial backbone of the company, providing a complete and organized record of every financial event.

Ledger balances are not mere numbers; they are the building blocks upon which the balance sheet is constructed. They empower accountants and financial analysts to assess the financial health of a company, enabling them to make informed decisions about its future.

By understanding the role of ledger balances in the balance sheet, we gain a deeper appreciation for the intricate interplay of financial data. It’s like solving a puzzle, where each piece (ledger balance) contributes to the completion of the overall picture (balance sheet). So the next time you look at a balance sheet, remember the hidden heroes behind the numbers – the ledger balances that tell the true story of a company’s financial position.