Understanding Inflation: Causes And Consequences In The Economic Landscape

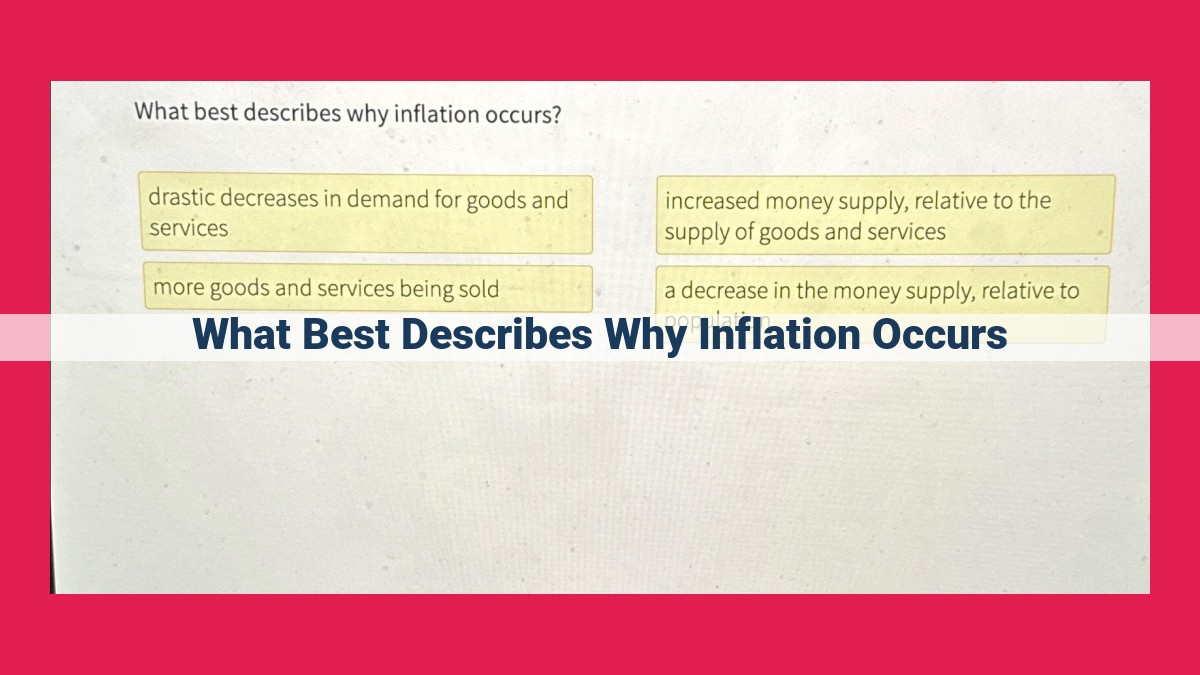

Inflation is an economic phenomenon characterized by a sustained rise in the general price level of goods and services. Scarcity of resources, excess money printing, and increased production costs all contribute to inflation. Limited supply or increased demand can lead to market imbalances, driving prices higher. Excessive creation of money supply by central banks also fuels inflation, as it diminishes its value relative to the goods and services it can buy. Lastly, supply-side factors, such as rising input prices, labor shortages, or disruptions in transportation, can increase production costs, forcing producers to pass these costs on to consumers in the form of higher prices.

Scarcity and Supply-Demand Imbalance: A Tale of Rising Prices

Imagine living in a town where everyone loves freshly baked bread, but only one bakery operates. When the demand for bread exceeds the bakery’s output, what happens? *Scarcity*: the state of having less than you need. With bread becoming a rare commodity, its *price* leaps upward.

This classic example illustrates the fundamental economic principle of supply and demand. When the supply of goods or services falls short of the demand, the natural result is an upward pressure on prices. Economists call this market condition *disequilibrium*. In a market that’s out of balance, prices adjust to restore equilibrium, a state where supply and demand align.

In our bread town, the bakery could increase production to meet the high demand. If they do, the price of bread may stabilize or even decline as supply and demand approach equilibrium. However, if the bakery is unable or unwilling to expand its output, the *shortage persists* and prices continue to **rise.

Thus, the limited availability of goods and services can trigger an inflationary spiral. As prices climb, consumers may have less money to spend on other goods, leading to a slowdown in overall economic activity. Understanding the role of scarcity and supply-demand imbalance is crucial for policymakers seeking to manage inflation.

Printing Excess Money and Monetary Policy

- Define inflation as the general price increase due to increased money supply

- Explain the role of monetary policy in controlling money supply and interest rates

- Describe quantitative easing as a monetary policy that can lead to inflation

Printing Excess Money and the Impact on Monetary Policy

In the realm of economics, one of the most complex and influential forces at play is monetary policy. This set of tools, wielded by central banks, aims to control the money supply and interest rates within an economy. However, when the boundaries are pushed too far, printing excess money can ignite a chain reaction with far-reaching consequences, including the dreaded specter of inflation.

Inflation, by definition, is the sustained increase in the price of goods and services across the board. Its root cause lies in a simple equation: when money supply outstrips the availability of goods and services, a disequilibrium occurs, causing prices to spiral upward. Monetary policy plays a pivotal role in this equation. By manipulating the money supply, central banks can influence inflation.

Quantitative easing, a monetary policy tool, is a prime example of how printing excess money can fuel inflation. It involves the central bank purchasing large quantities of government bonds or other financial assets, effectively injecting vast amounts of money into the financial system. While quantitative easing may provide temporary relief to the economy during downturns, the long-term implications can be significant.

The influx of new money created through quantitative easing can lead to an overabundance of liquidity, ultimately driving up the prices of assets. As investment capital flows into stocks, bonds, and real estate, the cost of these assets climbs, inflating their value. This, in turn, can spill over into the broader economy, affecting the prices of consumer goods and services.

Moreover, printing excess money can distort interest rates, making them artificially low. This can lead businesses to borrow more and invest more, further stimulating economic activity and demand. However, if this demand outpaces the supply of goods and services, inflation can take hold. The resulting rise in prices can erode the value of savings and investments, squeezing consumers and undermining the stability of the economy.

In conclusion, printing excess money can have significant implications for inflation and the overall health of an economy. Monetary policy, while a powerful tool for managing economic fluctuations, must be used with prudence to avoid the negative consequences of inflation. By controlling money supply and interest rates responsibly, central banks can play a critical role in maintaining price stability and fostering long-term economic growth.

Cost-Push Factors: The Supply-Side Impact on Inflation

Understanding inflation and its causes is crucial for informed decision-making and economic stability. While scarcity and monetary expansion play significant roles, cost-push factors also have a profound impact on price increases.

Production Costs: The Driving Force

Businesses face an array of expenses in producing goods and delivering services. These costs include raw materials, labor, transportation, and utilities. When input prices, such as the cost of oil or steel, rise, businesses often have no choice but to pass on the increased costs to consumers. This leads to higher prices for finished goods and services, contributing to inflation.

Supply-Side Disruptions: Beyond Input Prices

Beyond input prices, supply-side disruptions can also drive up production costs. Natural disasters, labor shortages, transportation bottlenecks, and geopolitical conflicts can hamper businesses’ ability to produce and distribute goods. These disruptions limit supply, making it difficult for businesses to meet demand. As a result, prices escalate to reflect the reduced availability of products and services.

Labor Shortages: A Double-Edged Sword

A tight labor market is generally seen as a positive indicator of economic growth. However, when the demand for workers outstrips the supply, businesses may struggle to find skilled labor. This can lead to higher wages and employee benefits, which businesses may pass on to consumers in the form of price increases.

Transportation Issues: Connecting the Dots

Transportation plays a vital role in delivering goods from producers to consumers. Delays, disruptions, and rising fuel costs can add significant to the overall cost of production. When transportation becomes more expensive, businesses may increase their prices to cover the additional expenses. This can have a ripple effect, with higher transportation costs affecting the prices of a wide range of goods and services.

Addressing Cost-Push Inflation

Addressing cost-push inflation requires a multifaceted approach. Governments and policymakers may consider measures such as increasing production capacity, investing in infrastructure, and providing support to businesses affected by supply-side disruptions. Additionally, addressing root causes of labor shortages and transportation bottlenecks can help mitigate their inflationary impact.