Understanding Economic Vs. Accounting Profit: Uncovering The True Cost Of Production

Accounting profit excludes implicit costs (opportunity cost of capital and labor), while economic profit includes them. Implicit costs represent the value of resources used in production that are not explicitly paid for, such as the owner’s labor or the return on their investment. Economic profit measures true profitability by considering all costs, including those not recorded in financial statements. In contrast, accounting profit only considers explicit costs, which can overstate profitability if implicit costs are significant.

- Define profit and its significance in business and finance.

- State the distinction between accounting profit and economic profit.

Profit: The Cornerstone of Business Success

In the realm of business and finance, profit reigns supreme, serving as the lifeblood that sustains the growth and prosperity of organizations. Simply put, profit is the excess of revenue over expenses. It represents the financial reward that businesses strive to attain, providing the impetus for innovation, expansion, and the creation of wealth.

However, there’s more to profit than meets the eye. In the world of finance, two distinct concepts of profit emerge: accounting profit and economic profit. Understanding the subtle yet crucial difference between these two measures is paramount for making informed financial decisions and ensuring long-term business success.

Understanding Costs: The Foundation of Profitability

In the realm of business and finance, understanding costs is paramount to maximizing profitability. Explicit costs, those directly paid to external parties, are easy to identify: rent, salaries, and raw materials. However, another type of cost, often overlooked but equally crucial, is implicit costs.

Implicit costs, also known as imputed costs, are the opportunity costs of using resources within a business rather than selling them on the open market. These costs are particularly relevant for entrepreneurs and small business owners who often invest their own time and capital in their ventures.

Opportunity Cost of Capital

The opportunity cost of capital represents the return that an investor could have earned if they had invested their funds elsewhere. For example, if an entrepreneur invests $100,000 in their business instead of a stock index fund that yields a 5% annual return, the opportunity cost of capital is $5,000 (0.05 x $100,000).

Opportunity Cost of Labor

Similarly, the opportunity cost of labor is the income that an individual could have earned if they were to sell their labor on the open market rather than working in their own business. This cost is especially important for sole proprietors who do not receive a formal salary from their company.

Recognizing these implicit costs is essential for determining the true profitability of a business. Accounting profit, which only considers explicit costs, often overstates profitability. Economic profit, on the other hand, takes into account both explicit and implicit costs, providing a more accurate measure of a company’s financial performance.

Understanding Accounting Profit: A Deeper Dive

In the realm of business and finance, profit reigns supreme as a measure of financial success. While there are various ways to calculate profit, accounting profit stands as a widely recognized metric in corporate finance.

Calculating Accounting Profit:

Accounting profit, also known as net income, is calculated by subtracting total expenses from total revenues. The formula goes like this:

Accounting Profit = Total Revenues - Total Expenses

In simpler terms, accounting profit represents the amount of money a business has left after covering all its costs, such as salaries, rent, and supplies.

Limitations of Accounting Profit:

Despite its popularity, accounting profit has its limitations. One significant drawback is that it relies solely on explicit costs, which are expenses that involve direct monetary outlays. It excludes implicit costs, expenses that are not explicitly paid out but represent an opportunity cost.

Opportunity Cost and Imputed Costs:

Opportunity cost refers to the potential benefits or returns that are given up by choosing one option over another. In business, implicit costs are imputed costs that reflect these opportunity costs. For instance, if the owner of a company is not taking a salary, the salary they could have earned represents an implicit cost. Similarly, if a company uses its own building for operations, the rent it could have earned by renting out the building is an implicit cost.

The Inclusion of Implicit Costs:

Economic profit, in contrast to accounting profit, takes into account both explicit and implicit costs. This broader perspective provides a more accurate picture of a business’s true profitability.

Understanding Economic Profit: A Deeper Dive

In the world of business and finance, understanding the distinction between accounting profit and economic profit is crucial. While accounting profit serves as a measure of a company’s revenue in excess of its explicit expenses, economic profit provides a more comprehensive view of profitability by considering both explicit and implicit costs, thus offering valuable insights for decision-making.

Economic Profit: The Formula and Its Components

Economic profit is calculated as Total Revenue minus Explicit Costs minus Implicit Costs. Unlike accounting profit, which only considers explicit costs (such as wages, rent, and raw materials), economic profit incorporates implicit costs—costs incurred but not explicitly paid.

Implicit costs, also known as imputed costs, include:

- Opportunity cost of capital: The potential return on investment that a company forgoes by using its own capital for business operations rather than investing it elsewhere.

- Opportunity cost of labor: The value of the owner’s labor, even if it is not formally compensated.

The Significance of Implicit Costs in Economic Profit

Considering implicit costs in economic profit provides a more accurate representation of the firm’s true profitability because it incorporates the cost of all resources employed. By including these costs, economic profit reveals the true economic value created by the business.

For instance, if a company owner is not formally drawing a salary, the opportunity cost of their labor still needs to be accounted for. This is because the owner could be earning a salary in the job market, but instead, they are choosing to work for their own business. Therefore, this foregone income is an implicit cost and must be considered in calculating economic profit.

Opportunity Cost and Normal Profit: Unlocking Economic Profit

In the realm of business, profit reigns supreme. But not all profits are created equal. Understanding the distinction between accounting profit and economic profit is crucial for making informed business decisions. In this exploration, we’ll delve into the concept of opportunity cost and its pivotal role in economic profit. We’ll also define normal profit and elucidate its significance in business strategy.

~~Opportunity Cost: The Hidden Cost of Choices~~

Opportunity cost is the value of the best alternative option that you give up when making a choice. It’s the cost of what you didn’t do. For instance, if you choose to open a lemonade stand, you forgo the opportunity to work at a part-time job that pays $10 per hour. The opportunity cost of choosing the lemonade stand is thus $10 per hour.

~~Normal Profit: The Reward for Taking Risks~~

In economics, normal profit is the minimum level of profit required to keep businesses in operation. It includes a return on the entrepreneur’s risk-taking and a return on the capital invested. If a business earns less than normal profit, it will eventually shut down. On the other hand, if a business earns more than normal profit, it will attract competitors, driving down profits to the normal level.

~~Economic Profit: The True Measure of Success~~

Economic profit is the profit a business earns after accounting for all costs, including implicit costs. Implicit costs are expenses that don’t involve actual cash disbursements, such as the opportunity cost of the entrepreneur’s labor and the opportunity cost of the capital invested.

By considering implicit costs, economic profit provides a more accurate measure of a business’s true profitability. It also aligns with the principle of profit maximization, which states that businesses should aim to maximize the difference between revenue and total costs, including implicit costs.

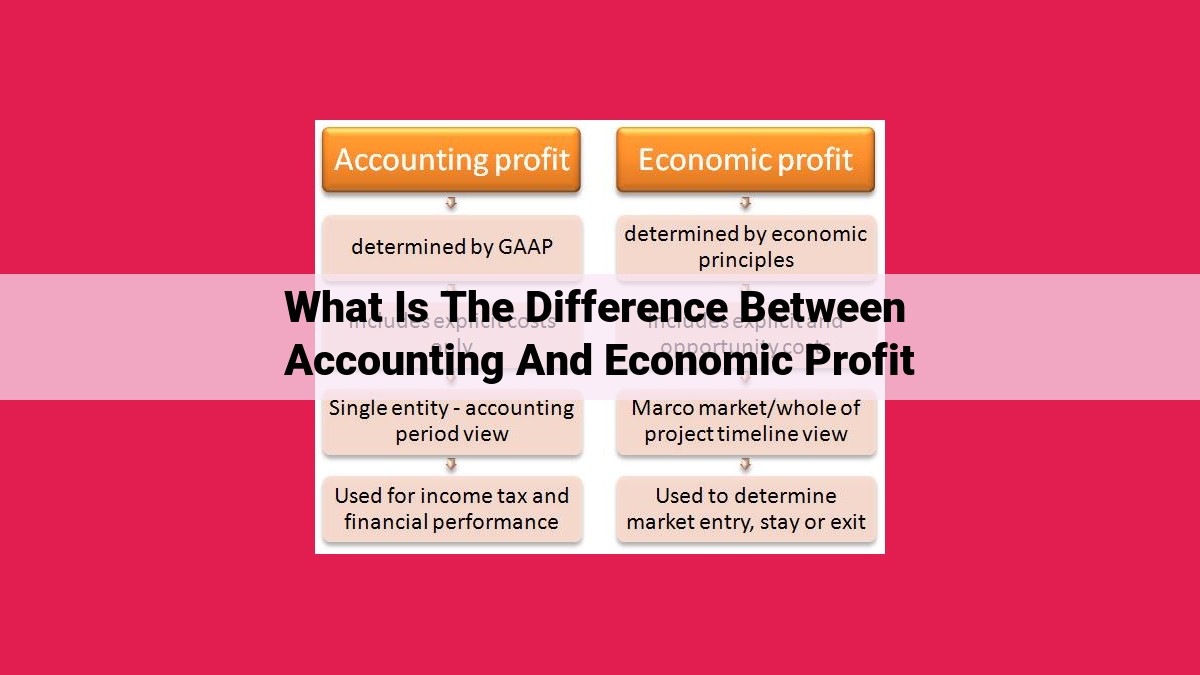

The Difference Between Accounting and Economic Profit

When it comes to measuring a company’s profitability, two key concepts emerge: accounting profit and economic profit. While often used interchangeably, these measures differ significantly in their treatment of costs, offering distinct insights into a business’s financial health.

Accounting Profit: The Explicit Perspective

Accounting profit, also known as book profit, focuses solely on explicit costs. These are direct expenses incurred by a company, such as raw materials, labor, and operating expenses. By subtracting these costs from revenue, accounting profit provides a snapshot of the company’s financial performance within a specific accounting period.

Economic Profit: The Implicit Advantage

Economic profit, on the other hand, takes a more comprehensive approach. It considers not only explicit costs but also implicit costs, often referred to as imputed costs. These represent the value of resources that a company could have earned if they were allocated elsewhere. Opportunity cost of capital (the return on equity that could have been earned by investing elsewhere) and opportunity cost of labor (the salary that the business owner could have earned if working elsewhere) are prime examples of implicit costs.

By incorporating implicit costs, economic profit provides a more accurate measure of a company’s true profitability. It reflects the economic sacrifices made in pursuit of profits and helps assess whether a business is generating returns that exceed the costs of its resource allocation.

The Formulaic Distinction

Mathematically, the key difference between accounting and economic profit lies in the treatment of implicit costs. Accounting profit is calculated as:

Accounting Profit = Revenue - Explicit Costs

Whereas, economic profit is calculated as:

Economic Profit = Revenue - (Explicit Costs + Implicit Costs)

Example: Unveiling the Difference

Consider a company with $1 million in revenue, $600,000 in explicit costs, and an opportunity cost of capital of $100,000. Its accounting profit would be $400,000.

However, its economic profit would be $300,000, reflecting the opportunity cost of the capital used to fund the business. This difference highlights the importance of considering implicit costs when evaluating a company’s profitability.

Implications in Decision-Making

Understanding the distinction between accounting and economic profit is crucial for sound business decisions. Economic profit provides a more accurate representation of a company’s long-term viability and potential for growth. It enables businesses to:

- Identify areas where resource allocation can be optimized.

- Determine if investments are generating sufficient returns.

- Assess the opportunity cost of alternative projects and investments.

- Make informed decisions regarding resource allocation and investment strategies.

While accounting profit offers a surface-level view of profitability, economic profit delves deeper, unveiling the true financial performance of a business. By incorporating implicit costs, economic profit provides a more comprehensive assessment, empowering businesses to make informed decisions that drive long-term growth and prosperity.