Understanding Applied Overhead: Allocation, Impact, And Optimization For Financial Performance

Applied overhead refers to a portion of indirect costs allocated to products or services during production. These indirect costs include production expenses not directly attributable to specific production units. The overhead allocation process assigns these costs based on a predetermined rate. By understanding applied overhead, businesses can accurately track production costs and make informed financial decisions. It contributes to financial reporting, providing valuable insights for businesses to optimize production and financial performance.

Overview of Applied Overhead

- Introduction to applied overhead as a portion of indirect costs allocated to products or services during production.

Understanding Applied Overhead: The Key to Accurate Product Costing

Imagine a bustling factory floor, where countless machines whir and workers toil. Behind the scenes, a crucial process is silently taking place: the allocation of applied overhead, the portion of indirect costs assigned to products or services during production.

What is Applied Overhead?

In the world of manufacturing, indirect costs are expenses that cannot be directly traced to specific units of production. These costs include utilities, rent, salaries for administrative staff, and depreciation on equipment. Applied overhead is the method by which these indirect costs are assigned to products or services.

By distributing indirect costs evenly across production units, businesses can accurately calculate the full cost of their products. This cost encompasses not only direct costs like raw materials and labor, but also the hidden expenses that contribute to the overall production process.

Importance of Applied Overhead

Applied overhead plays a pivotal role in:

- Product Costing: Accurately determining the total cost of goods sold is essential for financial reporting and profit analysis.

- Informed Decision-Making: Detailed cost information enables businesses to make informed decisions about pricing, production levels, and resource allocation.

- Financial Reporting: Applied overhead contributes to the preparation of financial statements, providing investors and creditors with a comprehensive view of a company’s financial performance.

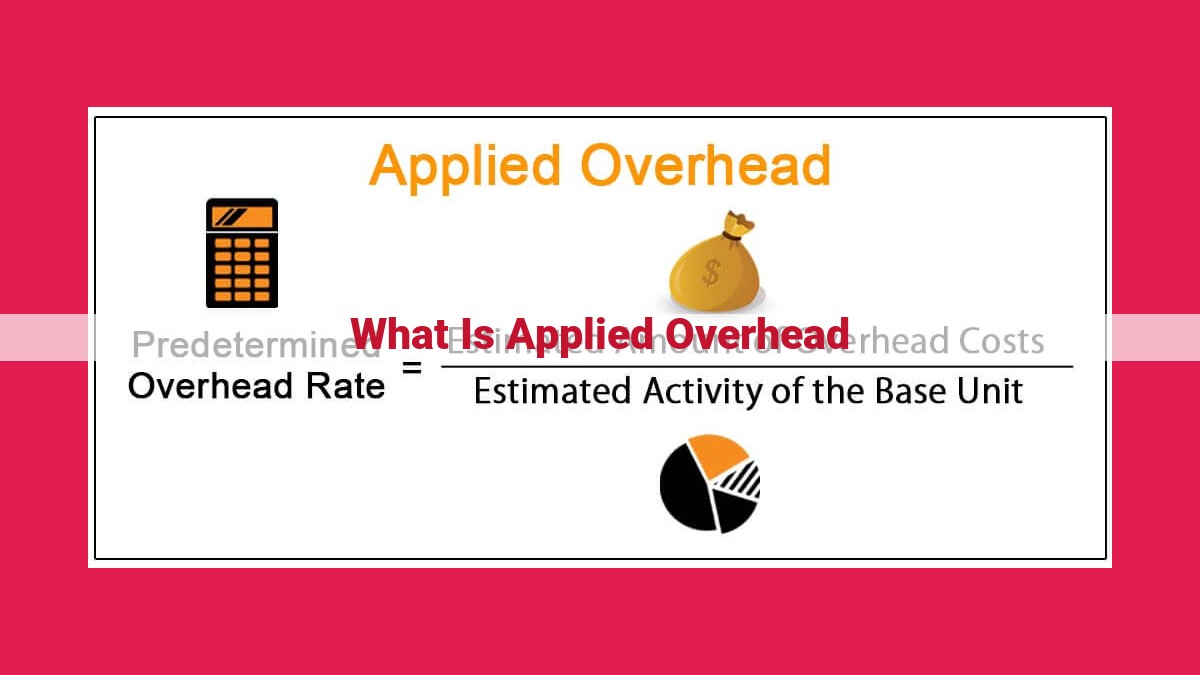

Calculating Applied Overhead

To determine the applied overhead rate, businesses follow a simple formula:

Overhead Rate = Total Overhead Costs / Estimated Production Units

Once the overhead rate is established, the applied overhead for a specific production activity can be calculated by multiplying the overhead rate by the actual production output.

Understanding Production Overhead and Indirect Costs

In the realm of manufacturing and production, applied overhead plays a crucial role in ensuring accurate product costing and informed financial decision-making. A significant component of applied overhead is production overhead, which represents the indirect costs incurred throughout the production process. To grasp the concept of production overhead, it’s essential to understand the nature of indirect costs.

Indirect costs are expenses that cannot be directly attributed to specific units of production. Unlike direct costs, such as raw materials and labor, indirect costs are incurred to support the overall production process. These costs often include expenses like rent, utilities, depreciation on equipment, and administrative salaries.

Production overhead encompasses the indirect costs that are incurred specifically during the production process. Unlike direct labor, which can be directly linked to each unit of production, production overhead costs are spread across all units produced during a specific period. This is because these costs provide benefits to the entire production process rather than to any particular unit.

The process of allocating production overhead costs to individual units of production is crucial for determining accurate product costs. By understanding the nature of production overhead and indirect costs, manufacturers can ensure that their applied overhead calculations are precise, enabling them to make informed financial decisions based on accurate cost data.

The Intricate Dance of Overhead Allocation: Assigning Indirect Costs to Products and Services

In the realm of production, costs dance a delicate ballet: direct costs tango with the products or services being crafted, while indirect costs waltz in the background. To ensure that these indirect costs are fairly accounted for, businesses employ the art of overhead allocation.

Imagine your production process as a symphony, with indirect costs like rent, utilities, and insurance playing as the supporting instruments. These costs don’t directly contribute to a specific product, but they’re essential to keep the production line humming. Overhead allocation assigns these costs to each production unit based on a predetermined rate.

This rate is carefully calculated using a formula that divides the estimated total overhead costs by the estimated number of production units. It’s like a secret recipe that ensures each product bears its fair share of the indirect expenses.

The process of overhead allocation is a balancing act, assigning costs without over- or underestimating the burden on a particular unit. It’s a crucial step towards accurately tracking the full cost of production, ensuring that products are priced fairly and businesses can make informed financial decisions.

Calculating the Overhead Rate: A Key Ingredient in Product Costing

When it comes to manufacturing, understanding the true cost of producing goods is essential for efficient operations and informed decision-making. Applied overhead plays a crucial role in this process, and it all starts with calculating the overhead rate.

What is Overhead?

Overhead costs are indirect expenses incurred during production, such as utilities, rent, and depreciation, that cannot be directly linked to specific products. To accurately determine the full cost of production, these indirect costs must be allocated to the products.

Calculating the Overhead Rate

The overhead rate is a predetermined amount that is used to distribute overhead costs to production units. It is calculated using the following formula:

Overhead Rate = Total Estimated Overhead Costs / Estimated Number of Production Units

Example:

Suppose a manufacturing company estimates the following overhead costs for the next month:

- Utilities: $20,000

- Rent: $15,000

- Depreciation: $10,000

Total Estimated Overhead Costs = $45,000

If the company estimates that it will produce 10,000 units during the month, the overhead rate would be:

Overhead Rate = $45,000 / 10,000 units

= $4.50 per unit

Significance of the Overhead Rate

The overhead rate is a critical factor in determining the applied overhead for each production unit. It helps ensure that all indirect costs are fairly distributed across all manufactured goods. An accurate overhead rate is essential to:

- Track the full cost of production

- Price products competitively

- Make informed production and inventory decisions

Applied Overhead Calculation

- Demonstration of how applied overhead is calculated based on the overhead rate and actual production activity.

Applied Overhead Calculation: Understanding the Allocation of Indirect Costs

When companies manufacture goods or provide services, they incur a range of costs, some of which can be directly attributed to specific units of production. However, there are also indirect costs that cannot be assigned so directly, such as rent, utilities, and administrative salaries. These costs are called production overhead, and they must be allocated to products or services in order to determine their full cost of production.

The process of allocating overhead costs involves calculating an overhead rate, which is then used to determine the applied overhead for each unit of production. The overhead rate is calculated by dividing the total estimated overhead costs by the estimated number of production units.

Once the overhead rate is established, it can be used to calculate the applied overhead for each unit of production. This is done by multiplying the overhead rate by the actual number of units produced.

For example, if a company estimates that it will incur $100,000 in overhead costs during the production of 10,000 units, the overhead rate would be $10 per unit. If the company actually produces 9,000 units, the applied overhead would be $90,000 (9,000 units x $10 per unit).

Applied overhead is an important concept in product costing. By accurately allocating indirect costs to units of production, companies can ensure that they are tracking the full cost of their products or services. This information is essential for pricing decisions, inventory valuation, and financial reporting.

The Significance of Applied Overhead in Product Costing

In the realm of business, accurate product costing is paramount for informed decision-making and profitability determination. Applied overhead plays a pivotal role in ensuring the precision of product costs, providing a clear understanding of the total expenses incurred during production.

Applied overhead refers to a portion of indirect costs that are allocated to products or services based on a predetermined rate. Indirect costs are expenses that cannot be directly attributed to specific production units, such as utilities, rent, and administrative salaries. By assigning these costs to products, businesses can accurately capture the full cost of production and establish competitive pricing strategies.

The calculation of applied overhead involves establishing an overhead rate. This rate is derived by dividing the total estimated overhead costs by the estimated number of production units. By multiplying the overhead rate by the actual production activity, businesses can determine the applied overhead for each unit produced.

The significance of applied overhead in product costing cannot be overstated. It provides the foundation for precise inventory valuation, ensuring that the value of inventory reflects the true cost of production. Accurate inventory valuation is essential for financial reporting, compliance with accounting standards, and tax compliance.

Furthermore, applied overhead enables businesses to allocate costs more efficiently and avoid over or underestimating the cost of products. This helps companies optimize production processes, identify areas of cost savings, and make informed decisions regarding pricing, product mix, and resource allocation.

By understanding the importance of applied overhead in product costing, businesses can gain a competitive advantage. Accurate product costing empowers them to make data-driven decisions, optimize operations, and maximize profitability.

Financial Reporting and Informed Decision-Making

Applied overhead plays a pivotal role in financial reporting, providing a clear picture of a company’s production costs. By allocating indirect costs to products or services, applied overhead enhances the accuracy of financial reporting, offering insights that inform decision-making and drive business growth.

Financial statements, such as the income statement and balance sheet, rely on accurate cost data to calculate profitability and financial position. Applied overhead ensures that all production costs are captured, preventing under or overestimation of expenses. This leads to more transparent financial reporting, fostering trust among stakeholders, including investors and creditors.

Informed decision-making hinges on the availability of reliable financial information. Applied overhead provides businesses with a detailed understanding of their cost structure, highlighting areas where efficiencies can be gained. By understanding the overhead rate and actual production activity, managers can identify bottlenecks and inefficiencies, enabling them to optimize operations and minimize costs.

Furthermore, applied overhead contributes to strategic planning by providing insights into the relationship between production costs and output. By analyzing the impact of overhead on product lines or services, businesses can make informed decisions about pricing, production levels, and product mix. This knowledge empowers them to allocate resources effectively, maximizing profitability and competitiveness.

In conclusion, applied overhead is an integral part of financial reporting and informed decision-making. By accurately capturing indirect costs, businesses gain a clear understanding of their cost structure, enhancing financial reporting, and enabling insightful decision-making. This empowers them to optimize operations, allocate resources effectively, and drive long-term business success.