True-Up In Accounting: A Guide To Aligning Interim And Annual Financial Statements For Accurate Reporting

True-up in accounting adjusts interim financial statements to align with annual financial statements. It involves adjusting beginning and closing balances of accounts to reflect actual financial performance. By performing true-up, companies ensure consistency and accuracy in financial reporting. The process involves adjusting for changes in revenue recognition, expenses, and retained earnings. It is essential for providing a clear and reliable picture of a company’s financial position and performance over a reporting period.

Understanding True-Up in Accounting:

- Define true-up and its purpose in adjusting interim financial statements.

Understanding True-Up: Adjusting Interim Financial Statements

In the captivating world of accounting, true-up emerges as a crucial process that ensures the accuracy and integrity of financial reporting. It’s a captivating tale of adjusting interim financial statements to accurately reflect the organization’s financial health.

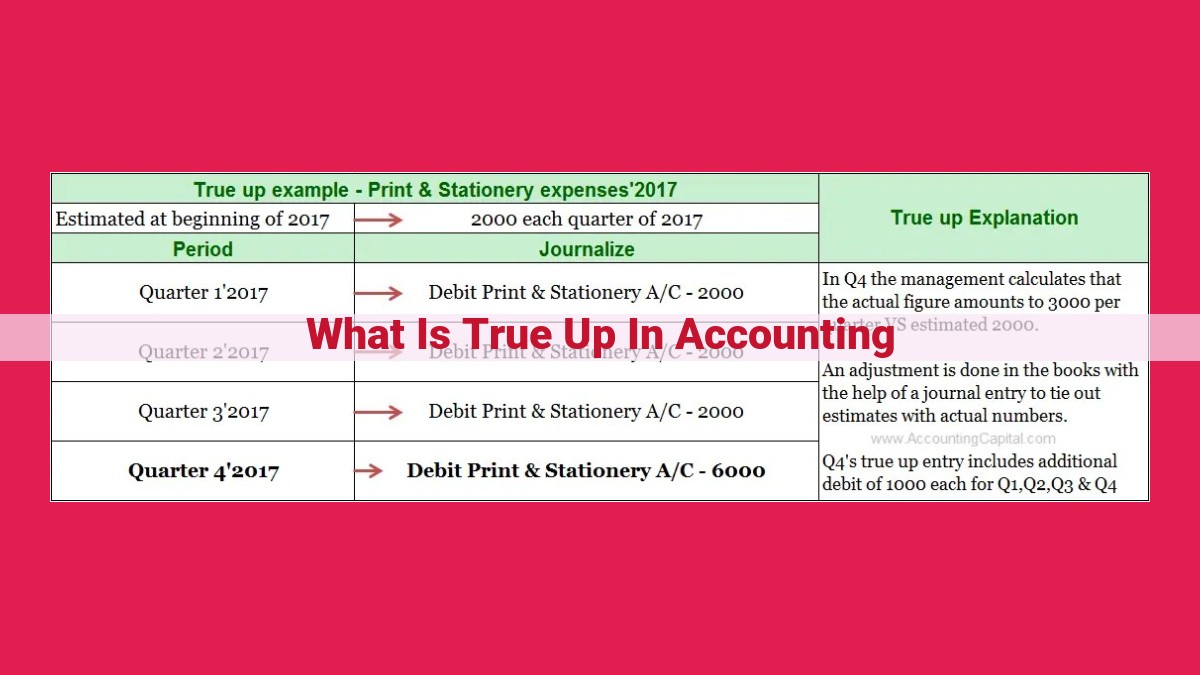

Imagine a company preparing its financial statements for the first quarter of the year. The interim statements are based on estimates and assumptions. However, as the quarter draws to a close, the company has gathered more precise data. True-up steps into the spotlight, performing a reconciliation of the interim figures with the actual results.

This reconciliation involves two essential adjustments:

- Beginning Balance Adjustment: This adjustment corrects the opening balances of accounts in the interim statements, bringing them in line with the actual balances as of the beginning of the period.

- Closing Balance Adjustment: This adjustment ensures that the closing balances of accounts in the interim statements match the actual balances as of the end of the period.

Interim Periods and the True-Up Dance

Interim periods, such as quarters or months, serve as snapshots of a company’s financial health at specific points in time. True-up plays a vital role in ensuring that these snapshots are as accurate as possible, allowing stakeholders to make informed decisions.

Retained Earnings: The True-Up’s Foundation

Retained earnings, the accumulated profits from past periods, are a cornerstone of the true-up process. Beginning retained earnings are adjusted to reflect the actual retained earnings at the start of the interim period, while closing retained earnings are adjusted to align with the actual retained earnings at the end of the period.

Connecting the Accounting Puzzle

True-up operates like a master puppeteer, connecting various accounting concepts. It ensures that interim financial statements are consistent with the annual financial statements and that the organization’s financial performance is accurately reflected throughout the year.

The Benefits of True-Up: A Symphony of Precision

The benefits of performing true-up are undeniable. It enhances financial accuracy, improves transparency, and strengthens stakeholder confidence. True-up acts as a beacon of clarity, illuminating the true financial position of an organization.

True-up is an indispensable tool in the accounting landscape. It plays a pivotal role in ensuring the reliability and usefulness of financial statements. By adjusting interim figures to align with actual results, true-up enables organizations to present a clear and accurate picture of their financial performance, fostering confidence and driving informed decision-making.

Components of True-Up:

- Explain the two primary adjustments: beginning balance adjustment and closing balance adjustment.

Components of True-Up

The Beginning Balance Adjustment

Imagine you’re a financial accountant working on the quarterly financial statements for your company. When you start, you notice that the beginning balance for an account doesn’t match what it should be. This is where the beginning balance adjustment comes in.

The beginning balance adjustment corrects this discrepancy. It’s like going back in time and fixing the starting point of your financial data. By adjusting the beginning balance, you ensure that the interim period, which is the period of time your quarterly statements cover, starts with the correct numbers.

The Closing Balance Adjustment

Now, let’s fast-forward to the end of the interim period. The closing balance is the ending point for your quarterly statements. Just like the beginning balance, it might not be accurate. That’s where the closing balance adjustment steps in.

This adjustment ensures that the closing balance on your quarterly statements matches the closing balance on your annual financial statements. It’s like a bridge that connects the two sets of financial data, making sure they’re consistent and accurate.

The Importance of Accurate Adjustments

Accurate true-up adjustments are crucial for reliable financial reporting. They guarantee that your interim statements are in sync with your annual statements, providing a clear picture of your company’s financial performance over time.

Interim Period and Current Income: The Building Blocks of True-Up

In the realm of accounting, understanding the precise definition of an interim period is crucial for grasping the essence of true-up. An interim period, simply put, represents a time interval within a company’s fiscal year, typically shorter than a complete year. Accountants often prepare financial statements during these intervals to keep track of the company’s financial performance throughout the year.

Current Income: A Key Factor in True-Up Calculations

The concept of current income plays a pivotal role in true-up calculations. Current income refers to the net income earned by a company during an interim period. It encompasses all revenues and expenses recognized within that specific period, providing a snapshot of the company’s financial health at that particular point in time.

The Interplay of Interim Periods and Current Income

Interim periods and current income are intricately linked in the true-up process. When preparing financial statements for an interim period, accountants start by using the figures from the previous interim period’s financial statements. This information forms the beginning balance. However, as the company operates during the current interim period, new transactions occur, which affect the financial statements. To account for these changes, accountants perform true-up adjustments to align the beginning balances with the actual financial position at the end of the current interim period.

True-Up: Ensuring Consistency and Accuracy

The significance of true-up lies in its ability to ensure consistency and accuracy in financial reporting. By adjusting the beginning balances to reflect the actual financial position, true-up guarantees that the financial statements accurately depict the company’s performance and financial health for the current interim period.

Retained Earnings: A Vital Component in True-Up

In the realm of accounting, retained earnings hold immense significance in understanding and performing true-up adjustments. These adjustments ensure that interim financial statements align with annual financial records, providing a clearer picture of a company’s financial performance.

Retained earnings, often referred to as undistributed profits, represent the earnings that a company has accumulated over time after deducting dividends paid to shareholders. It is a critical element in determining a company’s financial health and its ability to grow and expand.

As part of true-up, we consider two key balances of retained earnings:

-

Beginning retained earnings: This amount represents the retained earnings balance at the start of the interim period. It forms the basis for adjusting the interim financial statements.

-

Closing retained earnings: The closing retained earnings balance is the retained earnings amount at the end of the interim period. It reflects the company’s profitability during the period and any adjustments made during true-up.

Understanding these balances is essential for accurate financial reporting. By tracking retained earnings carefully, accountants can ensure that interim financial statements provide a clear and up-to-date view of a company’s financial position.

Connecting Related Concepts: True-Up’s Role in Accounting Harmony

True-up, the process of reconciling interim financial statements with the final annual statements, serves as a bridge connecting various accounting concepts, ensuring consistency and accuracy in financial reporting. By seamlessly aligning interim balances with year-end figures, true-up eliminates discrepancies and presents a coherent financial narrative.

Beginning and Closing Balances: The Key to Accuracy

The beginning balance adjustment ensures that interim statements correctly reflect the actual opening balances of accounts. This adjustment corrects any errors or omissions from the initial financial reporting period. Similarly, the closing balance adjustment aligns the interim closing balances with the final year-end balances. By harmonizing these balances, true-up provides a clear and accurate picture of the company’s financial performance throughout the reporting period.

Retained Earnings: Linking the Past and Present

Retained earnings, the accumulation of past profits, play a crucial role in true-up. Beginning retained earnings are adjusted to match their final year-end balance. This adjustment ensures that the interim financial statements accurately reflect the company’s retained earnings position. True-up also ensures the proper calculation of current income, which is derived by subtracting the beginning retained earnings from the closing retained earnings.

Current Income: A Window into Operational Performance

Current income measures the company’s financial performance during the interim period. True-up ensures that current income is accurately reported by adjusting for any errors or omissions in revenue recognition or expense accrual. This adjustment provides reliable insights into the company’s profitability and operational efficiency during the interim period.

True-Up’s Impact on Financial Clarity

True-up is an essential tool for ensuring the consistency and accuracy of financial reporting. By reconciling interim and final financial statements, true-up eliminates inconsistencies, minimizes errors, and provides a clear and comprehensive view of the company’s financial performance. This transparency is vital for both internal decision-making and external reporting to investors, creditors, and other stakeholders.

The Benefits of True-Up: Empowering Accountants with Accuracy and Transparency

In the world of accounting, accuracy and transparency are paramount. True-up, a crucial process in financial reporting, plays a pivotal role in ensuring that financial statements present a faithful representation of a company’s financial health. By understanding the benefits of true-up, accountants can harness its power to enhance the reliability and integrity of their financial reporting.

Improved Financial Accuracy

True-up adjusts interim financial statements to reflect the latest actual results. This process eliminates the need for estimations and assumptions, resulting in more accurate financial reporting. It allows companies to present a clear picture of their current financial position, which is essential for informed decision-making.

Enhanced Financial Transparency

True-up promotes transparency by providing a comprehensive view of a company’s financial activities. It discloses any changes that have occurred since the previous reporting period, such as revenue adjustments, expense accruals, and balance sheet reclassifications. This transparency helps stakeholders, including investors, creditors, and regulators, gain a deeper understanding of the company’s financial performance.

Facilitates Performance Comparison

True-up aligns financial statements with the actual results of a reporting period. This allows for meaningful comparisons between periods and against budgets. By eliminating the impact of estimated and unadjusted amounts, true-up provides a more reliable basis for performance evaluation and trend analysis.

Supports Compliance

True-up ensures compliance with accounting standards and regulations, such as the Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). By following proper true-up procedures, companies can produce financial statements that are in accordance with applicable guidelines, enhancing their credibility and reducing the risk of misstatement.

True-up is an indispensable tool in the accounting profession. Its benefits extend far beyond mere compliance. By improving financial accuracy, enhancing transparency, facilitating performance comparison, and supporting compliance, true-up empowers accountants to provide stakeholders with reliable and meaningful financial information. As a cornerstone of financial reporting, true-up continues to play a critical role in ensuring the integrity and value of financial statements.