Temporary Vs. Permanent Accounts: Understanding The Difference For Financial Reporting

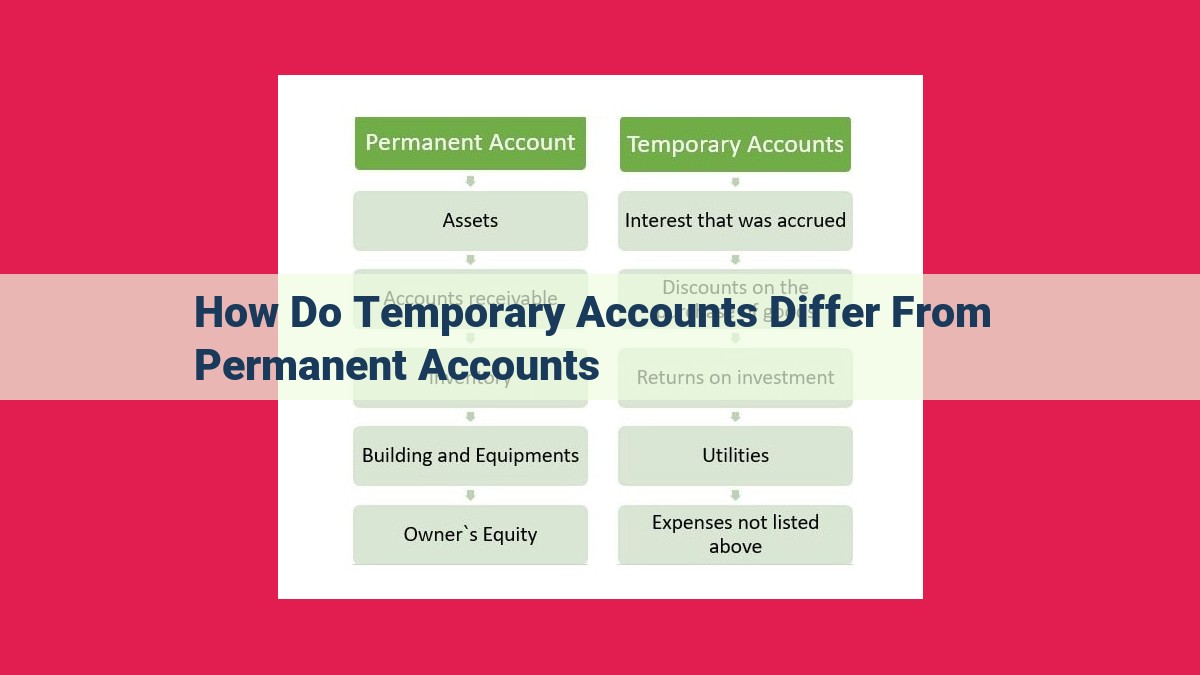

Temporary accounts record transactions over a period and have zero balances at the end of the period, as they are closed to clear balances. Examples include Revenue and Expense accounts. Permanent accounts record assets, liabilities, and equity, carry forward balances, and are not closed at the end of the period. Examples include Cash and Accounts Payable. Temporary accounts are reported on the income statement, while permanent accounts are reported on the balance sheet.

Nature of Temporary and Permanent Accounts

- Explain the different purposes of temporary (recording transactions over a period) and permanent (recording assets/liabilities/equity) accounts.

Understanding the Nature of Temporary and Permanent Accounts

In the realm of accounting, accounts are classified into two distinct categories: temporary and permanent. Each type serves a specific purpose and plays a crucial role in tracking financial information over time.

Temporary Accounts: Capturing Transactions

Temporary accounts are designed to record the day-to-day transactions of a business during a specific period, typically a month or a year. These accounts document revenue earned, expenses incurred, and other temporary changes to the financial position of the company. Examples of temporary accounts include Revenue, Expenses, Gains, and Losses.

At the end of the accounting period, temporary accounts are closed to zero balance. This process ensures that only permanent accounts carry forward their balances into the next period, providing a clear snapshot of the company’s financial status.

Permanent Accounts: Assets, Liabilities, and Equity

Permanent accounts, on the other hand, record the long-term financial position of a business and remain open indefinitely. These accounts track the value of assets owned by the company, liabilities owed, and equity held by the owners. Common permanent accounts include Cash, Accounts Receivable, Inventory, Accounts Payable, and Owner’s Equity.

Unlike temporary accounts, permanent accounts retain their balances from one accounting period to the next, reflecting the cumulative changes in the company’s assets, liabilities, and equity. This information is essential for understanding the overall financial health and stability of the business.

The Difference in Account Balances at Period’s End

In the world of accounting, there are two main types of accounts: temporary accounts and permanent accounts. Each type plays a unique role in tracking financial transactions and their impact on a company’s financial position. Understanding the difference between these two types of accounts is crucial for accurate financial reporting.

Temporary accounts are those that record transactions that occur over a specific period of time, typically a month or a quarter. These accounts include revenue, expenses, and gains and losses. At the end of the accounting period, the balances in temporary accounts are typically zero. This is because the purpose of these accounts is to capture the activity that occurs during the period, not to carry forward a balance from one period to the next.

Permanent accounts, on the other hand, are those that record assets, liabilities, and equity. These accounts are used to track the financial position of a company at a specific point in time. Unlike temporary accounts, permanent accounts carry forward their balances from one period to the next. This is because the assets, liabilities, and equity of a company represent its financial health, which is an ongoing state that is not limited to a specific period of time.

Closing of Accounts

- Explain the process of closing temporary accounts to clear their balances, while permanent accounts remain open.

Closing of Accounts: A Balancing Act

Imagine you’re running a business. Every transaction you make is recorded in temporary accounts, like your checkbook. These accounts track activities over a specific period, such as a month or a quarter. At the end of the period, it’s time for a financial checkup – and that’s where the concept of closing accounts comes in.

Temporary Accounts: Resetting for a New Beginning

Think of closing temporary accounts as hitting the reset button. Once the period ends, these accounts need to be cleared out. Revenue and Expense accounts, which record income and expenses over the period, are the most common temporary accounts. Closing these accounts zeroes out their balances, preparing them for the next period’s transactions.

Permanent Accounts: Carrying the Torch

Unlike temporary accounts, permanent accounts keep their balances from period to period. These accounts hold critical financial information about your business, such as Cash, Accounts Receivable, and Inventory. When you close temporary accounts, their balances are not lost but instead transferred to permanent accounts.

The Closing Process: A Step-by-Step Guide

-

Calculate net income: Add up all revenue and subtract all expenses to determine the net income or loss for the period.

-

Close revenue accounts: Transfer the balances of all revenue accounts to the Income Summary account.

-

Close expense accounts: Transfer the balances of all expense accounts to the Income Summary account.

-

Close Income Summary account: Transfer the balance of the Income Summary account to the Retained Earnings account. Retained Earnings is a permanent account that accumulates net income or loss over time.

The Power of Closing

Closing accounts is not just about tidying up the books. It also helps in:

- Financial reporting: Closing temporary accounts makes it easier to create accurate financial statements, such as the income statement and balance sheet.

- Analysis: By resetting temporary accounts, you can compare the financial performance of different periods.

- Planning: Zeroed-out temporary accounts provide a clean slate for budgeting and forecasting future performance.

So, just like your checkbook, closing accounts is an essential financial practice that helps you stay on top of your business’s finances. Remember, it’s not about making everything disappear but about preparing for a new chapter of growth and success.

Temporary and Permanent Accounts: A Guide to Financial Reporting

Let’s take a journey into the world of accounting, shall we? As we embark on this adventure, we’ll discover the intriguing nature of temporary and permanent accounts, their fundamental roles in financial reporting, and how they elegantly paint a picture of a company’s financial well-being.

Meet Temporary Accounts, the Transients

Imagine temporary accounts as the ever-changing travelers in the world of accounting. They diligently chronicle the day-to-day transactions that shape a company’s operations over a specific period, such as revenue earned or expenses incurred. However, these accounts are like the nomads of the accounting realm; their balances tend to dwindle to zero at the end of each accounting cycle, leaving no trace of their transient existence.

Permanent Accounts, the Guardians of Time

In contrast to their fleeting counterparts, permanent accounts stand tall like ancient monuments, steadfastly recording the assets, liabilities, and equity of a company. They carry their balances forward from period to period, providing a continuous record of the company’s financial position. They’re the guardians of time, preserving the company’s financial history for future generations.

Closing the Curtain on Temporary Accounts

As the accounting cycle draws to a close, temporary accounts gracefully take their leave. Through a process known as “closing,” their balances are transferred to permanent accounts, leaving them once again with a pristine zero balance. This ensures that the income statement, which summarizes a company’s financial performance during a specific period, is a clean slate, ready to capture the story of the next chapter.

Shining a Light on Financial Statements

The true power of these accounts shines through in financial statements. Temporary accounts take center stage on the income statement, narrating the tale of a company’s revenues, expenses, and profits over the reporting period. Permanent accounts, on the other hand, adorn the balance sheet, showcasing the company’s assets, liabilities, and equity at a specific point in time.

Real-World Examples to Illuminate the Concept

Let’s bring these abstract concepts to life with some tangible examples. Revenue is a quintessential temporary account, meticulously tracking the income generated by a company. Cash, on the other hand, is a permanent account, vigilantly monitoring the company’s liquid assets.

Together, temporary and permanent accounts weave an intricate tapestry of financial information, providing valuable insights into a company’s financial health and future prospects.

Examples of Temporary and Permanent Accounts

- Provide concrete examples of temporary accounts (e.g., Revenue) and permanent accounts (e.g., Cash).

Examples of Temporary and Permanent Accounts

Understanding the nature and functions of temporary and permanent accounts is crucial for maintaining accurate financial records.

Temporary accounts, also known as nominal accounts, track transactions over a specific period. They record revenues, expenses, gains, and losses incurred during the accounting period. At the end of the period, their balances are closed to zero. This is done to provide a clean slate for the next accounting period. Examples of temporary accounts include:

- Revenue: Records income earned from sales or services

- Expenses: Tracks costs incurred in operating the business

- Gains: Records increases in assets or decreases in liabilities

- Losses: Records decreases in assets or increases in liabilities

In contrast, permanent accounts, also called real accounts, track assets, liabilities, and equity. These accounts carry forward their balances from one accounting period to the next. They represent the financial position of the business as of a specific date. Examples of permanent accounts include:

- Cash: Represents the amount of cash on hand and in the bank

- Accounts receivable: Records amounts owed to the business by customers

- Inventory: Tracks the cost of unsold goods available for sale

- Equipment: Captures the value of machinery and equipment used in the business

- Shareholder’s equity: Represents the ownership interest in the business

By understanding the nature and functions of temporary and permanent accounts, you can effectively maintain accurate financial records and gain insights into the financial health of your business.