Unveiling The Significance Of The Tax Multiplier: Impact On Economic Output

The tax multiplier quantifies the impact of tax changes on economic output. It measures the multiple rounds of spending and investment that result from government spending, investment, exports, and imports. The multiplier effect is influenced by factors such as the marginal propensities to consume and save, and can be positive (boosting economic activity) or negative (contracting it). Thus, the tax multiplier is a crucial tool for governments to gauge the macroeconomic consequences of fiscal policy and make informed decisions about taxation.

The Tax Multiplier: An Economic Rollercoaster

In the turbulent realm of economics, the tax multiplier plays a pivotal role in shaping economic activity. Picture it as a ripple effect that spreads through the economy, magnifying the impact of government policies.

The tax multiplier represents the disproportionate change in aggregate demand (total spending in an economy) that results from a change in government taxation. In simpler terms, when the government increases taxes, spending decreases. Conversely, when taxes are lowered, spending tends to rise.

Related Concepts

To fully grasp the tax multiplier, we need to understand its companions:

- Government Spending: The amount of money the government spends on goods and services.

- Investment: The allocation of funds to create or improve capital goods (e.g., factories, machinery).

- Exports: Goods and services sold to other countries.

- Imports: Goods and services purchased from other countries.

Multiplier Effects: A Deeper Dive

Understanding the Tax Multiplier

Before delving deeper into the multiplier effects, it’s crucial to revisit the concept of the tax multiplier. It measures the impact of tax changes on aggregate demand, which is the total demand for goods and services in an economy. As taxes increase, disposable income decreases, leading to a fall in expenditure and subsequently aggregate demand. Conversely, tax cuts boost disposable income and consumption, resulting in an expansionary multiplier effect on the economy.

Government Spending Multiplier

Government spending directly contributes to aggregate demand by increasing the total consumption of goods and services. The government spending multiplier amplifies this effect as the initial expenditure trickles down through the economy, boosting economic activity. For instance, a government investment in infrastructure projects creates jobs and stimulates demand in other sectors, leading to a positive multiplier effect.

Investment Multiplier

Investment spending plays a vital role in enhancing productive capacity and economic growth. The investment multiplier suggests that an increase in investment leads to a multiplied expansion of aggregate demand. This is because investment generates income for businesses and workers, which they then spend on goods and services, further stimulating the economy.

Exports Multiplier

Exports boost aggregate demand by increasing the overall demand for domestic goods and services. The exports multiplier explains how an increase in exports leads to a multiplied expansion of economic activity. This is because it not only increases the demand for the exported goods but also triggers demand for supporting industries and services.

Imports Multiplier

Imports, on the other hand, have a negative multiplier effect on aggregate demand. This is because imports reduce the demand for domestically produced goods and services, leading to a contractionary effect on the economy. The imports multiplier illustrates how an increase in imports reduces economic activity by its multiplied impact on various sectors.

Factors Influencing the Tax Multiplier

The tax multiplier measures the impact of fiscal policy, particularly tax changes, on overall economic activity. However, this effect is not constant and can vary depending on several key factors:

1. Marginal Propensity to Consume (MPC)

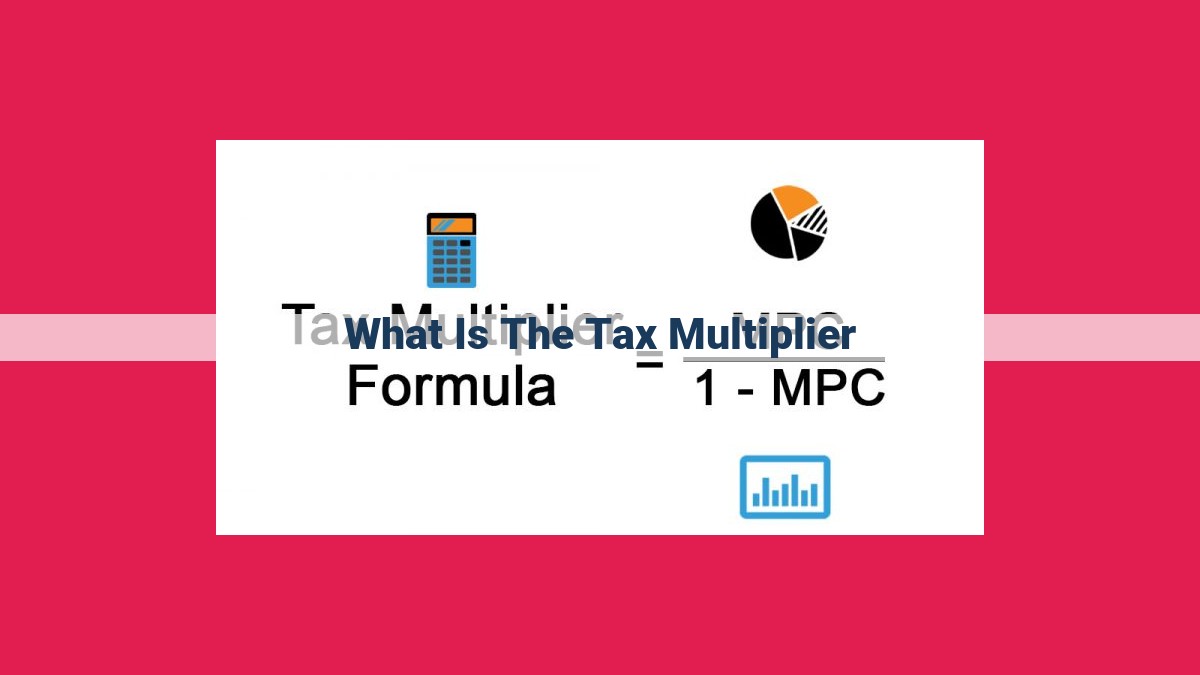

The MPC represents the proportion of additional income that households spend rather than save. A higher MPC implies that a decrease in taxes will lead to a larger increase in aggregate demand, as consumers spend a greater share of their tax savings. Conversely, a lower MPC leads to a smaller multiplier effect.

2. Marginal Propensity to Save (MPS)

The MPS, on the other hand, represents the portion of additional income that households save. A higher MPS means a smaller multiplier effect, as a larger proportion of tax savings is diverted into savings rather than spending.

3. Other Factors

In addition to MPC and MPS, several other factors can influence the tax multiplier, including:

- Tax Structure: Progressive tax systems, where higher earners pay a larger proportion of taxes, tend to have a larger multiplier effect than regressive or flat tax systems.

- Economic Conditions: Economic recessions or expansions can affect the multiplier effect, as households and businesses may alter their spending and saving habits in response to economic uncertainty.

- Government Policies: Other government policies, such as monetary policy, can interact with fiscal policy and impact the effectiveness of the tax multiplier.