Maximize Profit: A Comprehensive Guide To Profit Function Optimization

To find a profit function, start by determining the revenue function, which represents total revenue as price times quantity sold. Next, identify the cost function, considering both fixed and variable costs to calculate total costs. The profit function is simply the difference between total revenue and total costs. By analyzing marginal revenue and marginal cost, you can identify the optimal quantity of output for profit maximization. The break-even point is found where total revenue equals total costs. Finally, optimization techniques like the derivative test and second derivative test can be used to find the maximum profit point.

Unveiling the Secrets of Revenue Function: A Comprehensive Guide

Understanding the concept of revenue is paramount in the world of business. It serves as the lifeblood of any organization, representing the income generated from the sale of goods or services. At the heart of calculating revenue lies the revenue function, which unravels the intricate relationship between price, quantity demanded, and the resulting revenue earned.

The total revenue is simply the price of the good or service multiplied by the quantity sold. It paints a clear picture of the total amount of revenue generated by the business. However, to delve deeper into the revenue dynamics, we must explore average revenue, which comes in different forms. The price per unit represents the simple average revenue earned from each unit sold. Alternatively, average revenue per customer gauges the revenue generated from an average customer over a specific period.

The demand function, a critical factor in determining revenue, captures the relationship between price and quantity demanded. This relationship dictates how changes in price influence the amount of goods or services consumers are willing to purchase. Understanding the demand function is essential for businesses to make informed decisions about pricing strategies.

Key Concepts in Revenue Function

- Understand the essence of total revenue: It represents the aggregate revenue received from the sale of all units of a product or service.

- Calculate average revenue accurately: Explore different measures, including average revenue per unit and average revenue per customer.

- Identify the demand function effectively: Recognize the inverse relationship between price and quantity demanded and its impact on revenue generation.

How to Optimize Revenue Function

By grasping the nuances of the revenue function, businesses can optimize their revenue streams. Understanding the dynamics of demand and adapting pricing strategies accordingly becomes crucial. Additionally, managing costs and expenses efficiently while leveraging economies of scale can further enhance revenue generation.

Tips for Crafting a Compelling Blog Post

To ensure your blog post captivates readers, consider these tips:

- Craft an engaging title: Create a title that piques curiosity and entices readers to delve into your content.

- Use storytelling techniques: Employ storytelling to connect with readers on an emotional level and make complex concepts more relatable.

- Highlight important points: Use bold, italics, or underlines to emphasize key points and enhance readability.

- Optimize for SEO: Incorporate relevant keywords throughout your post to improve its visibility in search engine results.

- Proofread meticulously: Ensure your post is free of errors in grammar, spelling, and formatting for a professional and polished presentation.

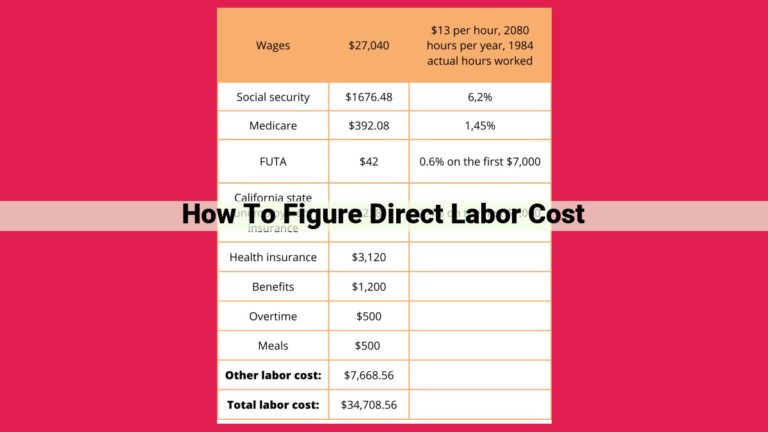

Cost Function

- Fixed Costs vs. Variable Costs: Defining and illustrating the difference between fixed and variable costs.

- Determining Total Costs: Exploring various methods for calculating total costs, including the variable cost approach and the contribution margin method.

- Economies of Scale: Analyzing the impact of production volume on unit costs and how it influences profit maximization.

Understanding Cost Functions: A Journey into the Economics of Production

In the realm of economics, understanding the intricacies of cost functions is paramount for businesses seeking to optimize their operations and maximize profitability. These functions provide a framework for analyzing the various costs associated with the production of goods and services. Let’s embark on a storytelling exploration of the cost function, unraveling its components and their implications.

Fixed Costs: The Unwavering Pillars of Production

Fixed costs, like steadfast companions, remain unchanged regardless of the quantity of output produced. Think of the rent for your factory or the salaries of your administrative staff. These expenses stand firm even when production halts. They form the bedrock upon which businesses operate.

Variable Costs: The Adaptable Partners of Production

In contrast to their fixed counterparts, variable costs dance to the tune of production volume. Raw materials, utilities, and packaging costs expand and contract with the ebb and flow of output. These costs are the chameleon-like companions of production, adjusting their presence as needed.

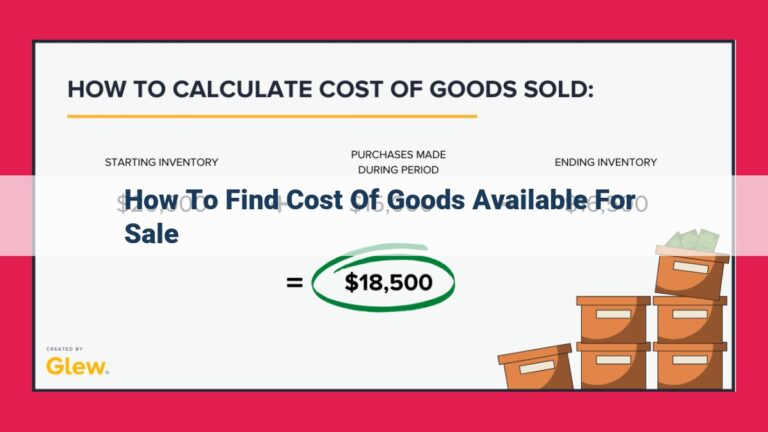

Total Costs: The Sum of All Expenses

Total costs, the grand total of our economic adventure, are the sum of both fixed and variable costs. Calculating total costs unlocks insights into the overall financial requirements of production. Understanding these costs is essential for informed decision-making.

Economies of Scale: The Advantage of Mass Production

As production volumes soar, the cost per unit embarks on a delightful downward spiral, a phenomenon known as economies of scale. This production superpower allows businesses to spread fixed costs over a larger output, reducing the burden on each individual unit. Harnessing economies of scale is the key to unlocking cost efficiency and profitability.

So, there you have it, the captivating tale of cost functions, a fundamental tool for understanding the economics of production. By grasping the concepts of fixed and variable costs, total costs, and economies of scale, businesses can navigate the intricate landscape of production costs and secure a path toward profitability.

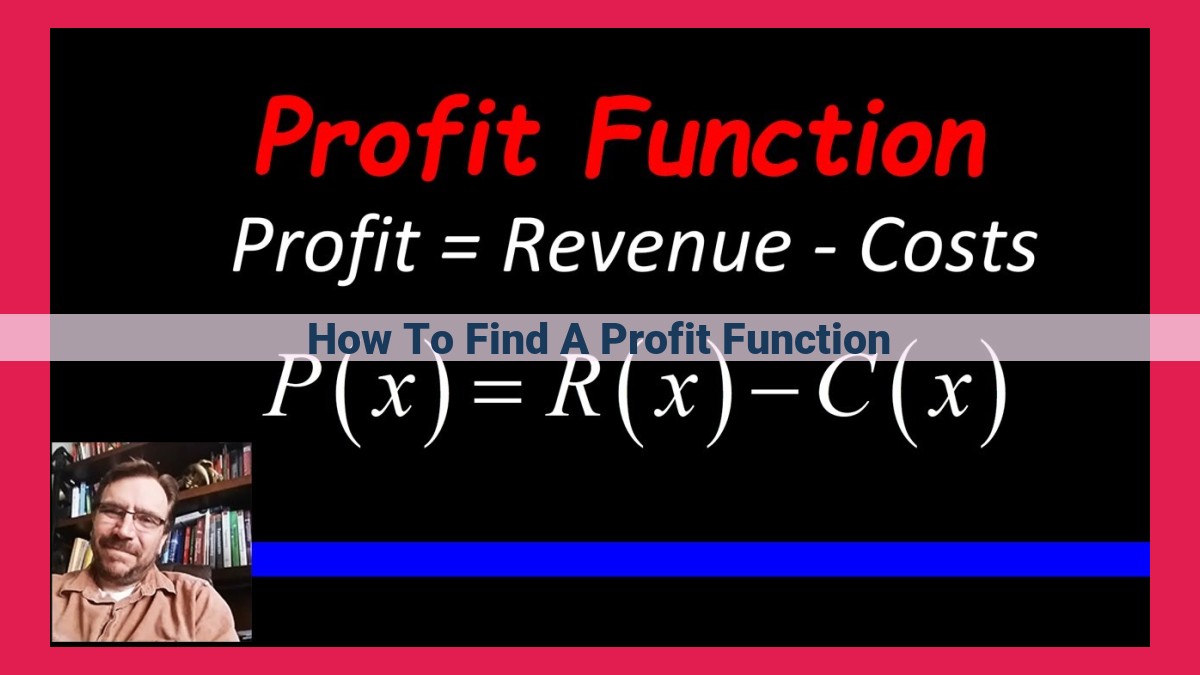

The Profit Function: Unlocking Maximum Earnings

In the realm of business and economics, the profit function holds immense significance, enabling companies to determine their optimal output levels for maximum profitability. This function captures the relationship between revenue, costs, and the resulting profit.

Total Profit: The Ultimate Goal

Total profit, the cornerstone of the profit function, is calculated by subtracting total costs from total revenue. It represents the net income earned by a company after accounting for all expenses incurred in producing and selling its products or services.

Calculating Marginal Profit: Incremental Earnings

Marginal profit, a crucial concept in profit optimization, measures the additional profit gained by selling one additional unit of output. It is calculated as the change in total revenue divided by the change in quantity sold. Monitoring marginal profit provides valuable insights into the profitability of each additional sale.

Profit Maximization: The Holy Grail of Business

Maximizing profit is the ultimate objective of any business. To achieve this coveted goal, companies must carefully balance costs and revenue. The profit function serves as a guide, indicating the quantity of output that yields the highest total profit. Various strategies, such as adjusting prices, optimizing production processes, and controlling costs, can be employed to reach this profit maximization point.

The profit function is a fundamental tool in business and economics. By understanding the concepts of total profit, marginal profit, and profit maximization, companies can make informed decisions to optimize their operations and achieve sustainable profitability.

Marginal Revenue

- Measuring Changes in Revenue: Explaining how marginal revenue measures the change in total revenue resulting from the sale of one more unit of output.

- Analyzing Elasticity of Demand: Exploring the relationship between price changes and changes in quantity demanded and how it affects marginal revenue.

Unlocking the Power of Marginal Revenue: A Comprehensive Guide

In the competitive landscape of business, understanding the concept of marginal revenue is crucial for profit maximization and strategic decision-making. Marginal revenue measures the change in total revenue resulting from the sale of one additional unit of output. This seemingly simple metric holds the power to unlock important insights into consumer behavior, market dynamics, and ultimately, optimal pricing strategies.

One key aspect of marginal revenue is its relationship with the elasticity of demand. Elasticity measures the responsiveness of quantity demanded to changes in price. If demand is highly elastic, small price reductions can lead to significant increases in quantity demanded, resulting in higher marginal revenue. Conversely, inelastic demand means that price changes have little impact on quantity demanded, leading to lower marginal revenue.

By analyzing the elasticity of demand, businesses can fine-tune their pricing strategies to maximize revenue. When demand is elastic, lowering prices may actually increase total revenue as the increased sales volume more than compensates for the lower unit price. On the other hand, when demand is inelastic, raising prices may only minimally reduce quantity demanded, leading to a higher profit margin per unit sold.

Understanding marginal revenue provides valuable insights for businesses of all sizes. It allows them to:

- Make informed decisions on pricing to maximize revenue

- Forecast the impact of price changes on sales volume

- Optimize production and inventory levels based on demand elasticity

- Identify market segments with the highest potential for revenue growth

Harnessing the power of marginal revenue is a key step towards achieving profitability and sustainable business success. By understanding this fundamental concept and its relationship with elasticity of demand, businesses can gain a competitive edge and unlock the full potential of their revenue-generating strategies.

Marginal Cost

- Calculating Changes in Cost: Defining and calculating marginal cost as the change in total cost resulting from the production of one more unit of output.

- Considering Diminishing Returns: Discussing the concept of diminishing returns and its implications for marginal cost.

Marginal Cost: The Hidden Driver of Profit

In the realm of business, the pursuit of profit is a constant endeavor. Understanding the intricacies of cost structure is crucial for maximizing profitability. One key concept that plays a pivotal role in this quest is marginal cost—the change in total cost resulting from the production of one additional unit of output.

Calculating Marginal Cost

Determining marginal cost is a straightforward process. It simply involves subtracting the total cost of producing a given number of units from the total cost of producing one more unit. For example, if it costs $100 to produce 100 units and $105 to produce 101 units, the marginal cost is $5 (i.e., $105 – $100).

Diminishing Returns

When exploring marginal cost, it’s essential to consider the concept of diminishing returns. This refers to the phenomenon where as more units are produced, the increase in output from each additional unit becomes smaller. In other words, the more you produce, the more difficult and costly it becomes to produce each additional unit.

Understanding diminishing returns is crucial for profit maximization. As marginal cost increases, it eventually reaches a point where it exceeds the additional revenue generated by selling the extra unit. At this point, further production would lead to a decrease in profit.

Optimizing Profit through Marginal Cost Analysis

Profit maximization is a delicate balance between revenue and cost. By understanding marginal cost, businesses can determine the optimal level of output to produce. The ideal production level is where marginal cost is equal to marginal revenue—the additional revenue generated from selling the last unit.

By carefully analyzing marginal cost and its relationship to diminishing returns, businesses can make informed decisions about production levels and pricing strategies to maximize their profitability. It’s like having a secret weapon in the pursuit of financial success.

Unraveling the Enigma of the Break-Even Point

In the realm of business, understanding the intricacies of revenue and costs is paramount. One crucial concept in this arena is the break-even point, where the scales of revenue and costs balance, resulting in zero profit. Grasping the essence of this point is essential for businesses to make informed decisions about production, pricing, and maximizing profitability.

One way to determine the break-even point is through the lens of contribution margin. This metric represents the portion of revenue that remains after deducting variable costs. By dividing the contribution margin by the unit selling price, businesses can calculate the break-even point in terms of units sold. For instance, if a product’s unit selling price is $10 and its variable cost is $5, its contribution margin would be $5, and the break-even point would be reached when 2 units are sold (5 / 10 = 2 units).

Understanding the break-even point empowers businesses to establish realistic sales targets and optimize their pricing strategies. By leveraging this knowledge, they can minimize losses and pave the way for profitability.

Optimization: Maximizing Profit with Mathematical Tools

In the realm of business, profitability is paramount. To achieve maximum success, companies must understand how to optimize their operations and maximize their profits. Enter the power of optimization, a set of mathematical techniques that empowers businesses to make informed decisions and elevate their bottom line.

The Derivative Test: Finding Extrema

The derivative test is a fundamental concept in optimization. It allows us to identify points of extrema, or maximums and minimums, of a function. In the context of profit maximization, we apply this test to the profit function. By finding the derivative of the profit function and setting it equal to zero, we can determine the quantity of output that yields the highest profit.

The Second Derivative Test: Identifying the Nature of Extrema

The second derivative test is a complementary tool that helps us determine whether the extrema we’ve found are maximums or minimums. By evaluating the second derivative at the extrema points, we can discern if the function is concave upward (indicating a maximum) or concave downward (a minimum).

Constrained Optimization for Profit Maximization

In the real world, profit maximization is not always straightforward. Businesses may face constraints such as limited production capacity or fixed costs. To handle these scenarios, we employ constrained optimization techniques. These methods allow us to find the optimal solution while taking into account the limitations imposed by the constraints.

By utilizing the derivative and second derivative tests, combined with constrained optimization techniques, businesses can navigate the complexities of the marketplace and find the optimal path to profit maximization. These mathematical tools provide a roadmap for success, enabling companies to achieve their full potential and soar to new heights of profitability.