Fees Earned: A Key Revenue Account For Professional Services Businesses

Fees earned is a revenue account that represents income generated from providing professional services. It has a normal credit balance and appears on the income statement. As services are performed, the fees earned account increases, directly contributing to net income. It relates to other revenue accounts and financial statement components that reflect a company’s financial performance. Accurate reporting is crucial for transparency, decision-making, and financial analysis. Examples include fees from legal services, accounting services, and consulting services.

Understanding Fees Earned: The Lifeblood of Service-Based Businesses

In the realm of accounting, understanding fees earned is crucial for businesses that provide services in exchange for payment. It represents the revenue generated through the performance of professional or consulting services, legal advice, medical examinations, or any other type of expertise-based offering.

Unlike sales revenue, which is derived from the sale of tangible goods or products, fees earned originates from the provision of intangible services. These services may involve advice, consultation, professional expertise, or other forms of value that are not physical in nature.

Key Characteristics of Fees Earned

- Service-Oriented: Fees earned are generated through the execution of services, not the sale of physical products.

- Recognition: Revenue is recognized when services are performed, even if cash is not received immediately. This differs from sales revenue, which is recognized upon the transfer of ownership of goods.

- Impact on Financial Statements: Fees earned directly contribute to a company’s net income and are a key indicator of its profitability.

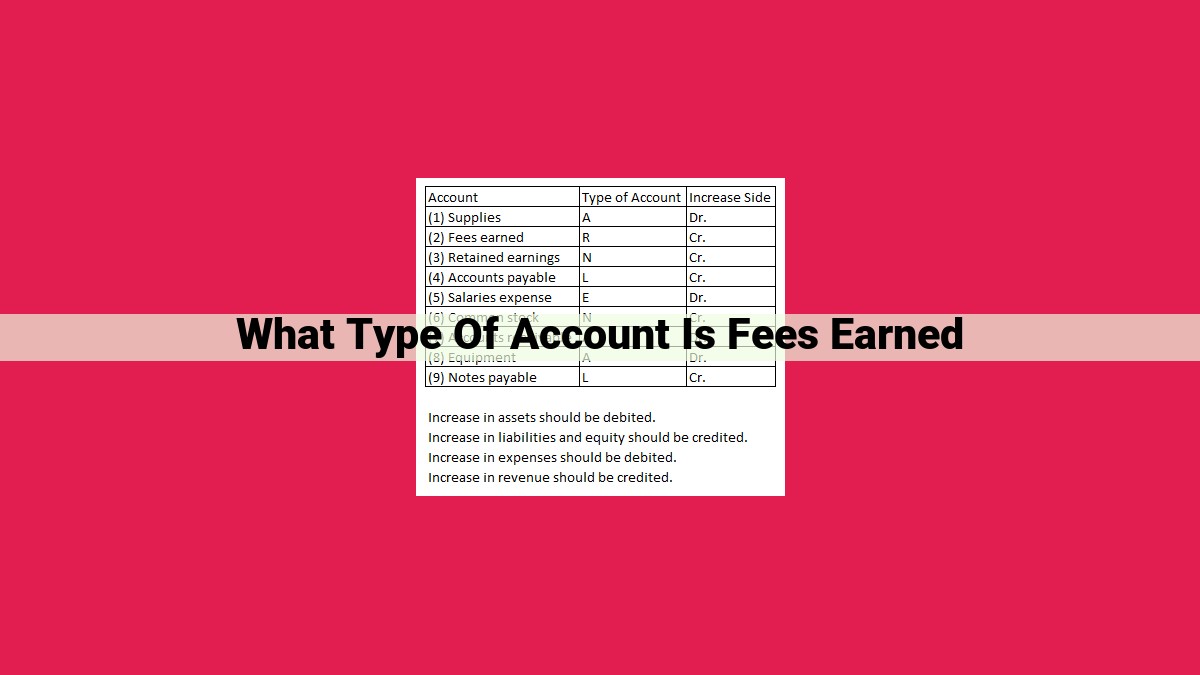

Understanding the Normal Balance of Fees Earned

In the realm of accounting, the concept of “normal balance” refers to the default account balance that typically results from the nature of the transactions recorded in that account. For fees earned, the normal balance is a credit.

This means that when a company provides a service to a customer and earns revenue, a credit entry is made to the fees earned account. This credit balance signifies the increase in the company’s earned income resulting from the service provided.

The underlying accounting principle behind this normal balance is the accrual accounting concept. Accrual accounting requires that revenues be recognized when they are earned, even if cash has not yet been received. Hence, when services are performed and fees are earned, a credit entry is made to fees earned to recognize the revenue, regardless of whether the customer has paid or not.

The normal credit balance of fees earned is important because it allows financial statements to present a true and fair view of a company’s financial position and performance. By reflecting all earned revenues, regardless of cash receipt, the income statement provides a more accurate picture of the company’s operating results.

Additionally, the consistent use of normal balances for different types of accounts facilitates the preparation and analysis of financial statements. It enables accountants to easily identify and compare different account balances, track changes over time, and make informed financial decisions.

Financial Statement Presentation of Fees Earned

When reviewing a company’s income statement, you’ll likely encounter the term “fees earned.” Understanding where this revenue stream appears and how it contributes to the bigger financial picture is crucial for grasping its significance.

Fees earned typically grace the income statement under the heading of operating revenues. This section captures the core revenue-generating activities of a business. For service-based organizations, fees earned represent the primary source of income. They reflect the value of services rendered to clients.

By analyzing fees earned, investors and analysts can gain insights into a company’s operational performance. Consistent growth in fees earned often indicates an expanding customer base and increased demand for the company’s services. Conversely, a decline in fees earned may signal challenges in attracting or retaining clients.

Furthermore, fees earned directly impact a company’s gross profit and net income. As service revenues increase, gross profit generally rises, and net income follows suit. This is because the primary expense associated with fees earned is the cost of providing the services. Therefore, higher fees earned typically translate into higher profitability.

Impact of Fees Earned on Net Income

When a company provides services, it records the fees it charges as fees earned. This account plays a crucial role in determining the company’s financial performance, as it directly influences its net income.

Net income, also known as the bottom line, represents the profit left after subtracting expenses from revenue. Fees earned are a significant revenue source for many businesses and have a substantial impact on this calculation.

By recording fees earned, a company recognizes the revenue it has generated from its operations. The amount of fees earned is then subtracted from the company’s expenses to arrive at its net income. Therefore, an increase in fees earned leads to a higher net income, indicating improved profitability.

Conversely, a decrease in fees earned can have a negative impact on net income. If expenses remain constant, a reduction in fees earned will result in a lower net income. This can affect the company’s financial health and profitability assessments.

For investors and analysts, fees earned are a key metric used to evaluate a company’s financial performance. A consistent and growing fees earned stream indicates a profitable and sustainable business model.

Therefore, accurate and timely recognition of fees earned is essential for businesses to provide reliable financial information and maintain the trust of stakeholders. It allows users of the company’s financial statements to make informed decisions about its financial performance and investment potential.

Related Concepts

- Introduce and briefly discuss other revenue accounts and financial statement components that relate to fees earned.

Related Concepts

When it comes to fees earned, several related revenue accounts and financial statement components come into play:

-

Service Revenue: This account records revenue earned from the provision of services, similar to fees earned. However, service revenue may cover a broader range of services, while fees earned usually refers specifically to professional or consulting services.

-

Sales Revenue: Unlike fees earned, sales revenue is associated with the sale of physical goods. The recognition and timing of sales revenue typically follows the transfer of ownership to the customer.

-

Interest Income: This account captures revenue earned from financial investments, such as interest earned on bonds or loans. Interest income is typically recognized when earned, regardless of when the cash is received.

-

Dividend Income: Dividend income represents the portion of profits distributed by a company to its shareholders. Dividends are usually recognized when declared by the company, even if the cash is received later.

-

Net Income: Fees earned significantly contribute to a company’s net income. Net income represents the total revenue minus expenses, presenting the final profit for a given period. Understanding the relationship between fees earned and net income is crucial for assessing profitability.

Examples of Fees Earned: Understanding How Businesses Generate Revenue

In the realm of accounting, fees earned represent a crucial component of a company’s financial health. They constitute the payment received for services rendered, contributing directly to the core operations of countless businesses. To fully grasp the significance of fees earned, let’s delve into real-world examples that illustrate how various entities generate this form of revenue:

Legal Fees

Lawyers provide expert legal counsel and representation to clients, typically charging fees earned based on the time spent working on a case. These fees cover a range of services, from initial consultations to complex litigation. Legal fees can be structured as fixed hourly rates, contingency agreements, or retainers, ensuring fair compensation for the legal expertise provided.

Consulting Fees

Consulting firms offer a broad spectrum of advisory and support services to businesses, including strategic planning, financial analysis, and marketing campaigns. Their fees earned are derived from the value they bring to their clients by helping them overcome challenges, improve efficiency, and achieve their goals. Consulting fees can vary depending on the scope of the project and the expertise required.

Accounting Fees

Accountants play a vital role in maintaining accurate financial records and providing valuable insights to businesses. Their fees earned stem from the services they provide, such as preparing tax returns, auditing financial statements, and offering accounting consulting. These fees ensure businesses adhere to regulatory compliance and make informed decisions based on reliable financial information.

Medical Fees

Healthcare professionals, including doctors, nurses, and dentists, earn fees for providing medical services to patients. These fees earned cover examinations, procedures, surgeries, and other treatments. Medical fees are often regulated by insurance companies or government agencies to ensure fairness and affordability for patients.

Educational Fees

Educational institutions generate fees earned from the tuition and fees charged to students. These fees cover the cost of instruction, facilities, and support services. Educational institutions may also receive additional fees for specialized programs, extracurricular activities, or housing.

Fitness Fees

Fitness centers and personal trainers earn fees earned from the services they provide to clients. These fees cover gym memberships, group classes, and one-on-one training sessions. Fitness fees contribute to the maintenance and operation of fitness facilities and provide compensation for the expertise of trainers.

By understanding these examples, we gain a deeper appreciation for the diverse ways in which businesses generate fees earned. This knowledge is crucial for investors, financial analysts, and business owners alike to accurately assess a company’s financial performance and make informed decisions.

The Critical Importance of Accurate Fees Earned Reporting

In the realm of financial reporting, accuracy is paramount, and this principle holds true for the meticulous recording of fees earned. This revenue stream serves as the lifeblood of many businesses, providing a direct measure of the value they deliver to their customers. However, the importance of accurate fees earned reporting extends far beyond mere compliance. It underpins financial transparency, sound decision-making, and reliable financial analysis.

Transparency for Stakeholders:

Accurate fees earned reporting fosters transparency among businesses and their stakeholders. Investors, creditors, and regulators rely on financial statements to assess a company’s financial health and performance. Transparent reporting of fees earned ensures that these stakeholders have a clear understanding of the organization’s financial position and its ability to generate revenue.

Data-Driven Decision-Making:

Sound decision-making at all levels of an organization requires access to accurate and reliable financial data. Accurate fees earned reporting provides management with a reliable basis for making strategic decisions, such as pricing adjustments, resource allocation, and expansion plans. By understanding the trends and patterns in their fees earned, businesses can make informed choices that drive growth and profitability.

Reliable Financial Analysis:

Accurate fees earned reporting is a cornerstone of reliable financial analysis. Financial analysts, investors, and other stakeholders use this information to assess a company’s financial performance, evaluate its risk profile, and make investment decisions. Inaccurate or misleading fees earned figures can undermine the reliability of these analyses, potentially leading to erroneous conclusions and poor investment outcomes.

In conclusion, accurate fees earned reporting is not merely a compliance exercise but an essential pillar of financial transparency, sound decision-making, and reliable financial analysis. By ensuring the integrity of this revenue stream, businesses empower their stakeholders with confidence and create a solid foundation for future growth and success.