The Role Of Planned Investment In Economic Growth: Maximizing Efficiency And Innovation

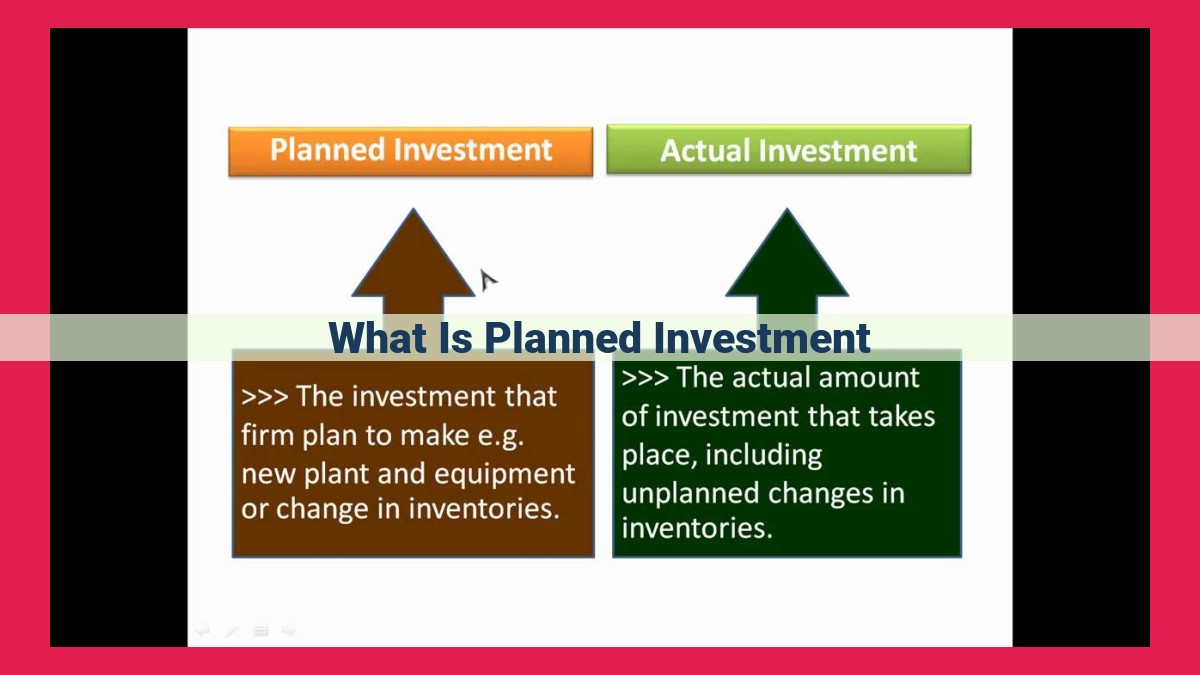

Planned investment, a crucial component of gross investment, involves the deliberate allocation of resources for acquiring new capital goods or maintaining existing ones. By increasing productivity, fostering technological progress, and stimulating economic expansion, planned investment plays a vital role in economic growth. It includes net investment (growth in capital stock) and replacement investment (maintaining existing capital). Factors like interest rates, profitability, and government policies influence investment decisions.

Planned Investment: The Foundation of Economic Prosperity

In the tapestry of economic growth, planned investment stands as a vibrant thread, intertwining with the threads of productivity, innovation, and expansion. It is the deliberate allocation of resources, both financial and physical, to create or maintain capital goods that drive economic progress.

The Essence of Planned Investment

Planned investment, distinct from impulsive or unplanned spending, is characterized by its foresight. It is a conscious decision to channel resources today for future economic gain. This foresight is driven by an understanding of the relationship between investment and productivity: increasing investment in capital goods enhances efficiency and output, boosting overall economic productivity.

The Interplay of Gross and Net Investment

Gross investment encompasses all investments made in capital goods, including new machinery, infrastructure, and buildings. However, a portion of gross investment is used to replace depreciated capital stock, known as replacement investment. Net investment, on the other hand, represents the creation of new capital goods beyond what is needed for replacement. This distinction is crucial, as net investment is the true indicator of economic growth, expanding the productive capacity of the economy.

The Role of Planned Investment in Economic Growth

Planned investment is the cornerstone of economic growth. It fuels innovation, creating new products and processes that enhance productivity. It also fosters expansion, increasing the capacity of businesses to produce goods and services, leading to job creation and increased consumer spending. In this virtuous cycle, planned investment lays the foundation for sustained economic growth and prosperity.

Planned Investment: The Key to Economic Growth

When we think of investment, we often imagine individuals putting money into stocks or bonds. But investment goes beyond personal finance. It’s a crucial component of economic growth and development, played by businesses and governments alike. Planned investment is a deliberate allocation of resources to increase economic productivity and potential.

Components of Gross Investment

Gross investment encompasses all resources devoted to maintaining and expanding the capital stock of a country.** This includes:

- Net investment: Creating new capital goods, such as equipment or infrastructure, to increase productive capacity.

- Replacement investment: Maintaining existing capital stock by replacing worn-out or obsolete equipment.

- Expansionary investment: Creating additional capital goods beyond what is needed to maintain current capacity, fostering economic expansion.

Net investment is a particularly important indicator of economic growth. It represents the actual increase in the country’s productive capacity and sets the stage for future growth.

What Distinguishes Gross from Replacement Investment: Essential Concepts

In the realm of finance, gross investment represents the total expenditure on physical assets, comprising net investment and replacement investment.

Net investment captures investments that expand the existing capital stock, leading to an increase in productive capacity. In contrast, replacement investment aims to maintain the existing capital stock, ensuring its functionality and productivity levels.

Understanding this distinction is crucial. Gross investment provides a broad measure of investment activity, encompassing both growth and maintenance, while net investment serves as a more precise indicator of economic expansion. A positive net investment signals a growing economy, while a negative figure indicates depletion of productive capacity.

Consider this analogy: A company that invests in new machinery and equipment to increase production has made a net investment. On the other hand, a company that replaces aging machinery to sustain current operations has made a replacement investment.

These concepts are fundamental to understanding investment and its impact on economic growth. Planned investment plays a pivotal role in driving productivity, technological progress, and economic expansion, factors essential for a nation’s prosperity.

Planned Investment: A Cornerstone of Economic Growth

Planned investment plays a pivotal role in the prosperity of any economy. It’s the force majeure behind progress and a barometer of future growth.

Net Investment: A Glimpse into Economic Health

Gross investment measures the total value of new assets created in a period. But to truly gauge economic growth, we must distinguish between net and replacement investment.

Net Investment: The Growth Indicator

Net investment represents the addition of new capital goods to the economy, fostering expansion and productivity. It’s the heart of economic growth, as it increases the nation’s productive capacity.

When businesses invest in new factories, machines, or technologies, they create opportunities for more products and services. This surge in production leads to higher incomes, increased employment, and a thriving economy.

Planned investment is a crucial indicator of economic health. Net investment, in particular, paints a clear picture of growth prospects. Recognizing the importance of investment empowers policymakers and businesses to create an environment that fosters innovation, productivity, and economic well-being.

What is Planned Investment: A Cornerstone for Economic Growth

Planned investment is an essential pillar of any economy, supporting economic growth, job creation, and overall prosperity. It refers to the deliberate allocation of resources into productive activities with the aim of generating future income.

Concepts Related to Planned Investment

Gross Investment

Gross investment encompasses the total expenditures made to maintain and expand the existing capital stock. It consists of three main components:

- Net Investment: The amount of investment used to create new capital goods, boosting economic capacity.

- Replacement Investment: The portion allocated to maintain and replace existing capital stock, preserving productivity levels.

- Expansionary Investment: The investment directed towards creating new capital goods, leading to economic growth.

Factors Influencing Investment

Several factors influence investment decisions, including:

- Interest Rates: Higher interest rates can discourage borrowing and investment.

- Expected Profitability: Investors are more likely to invest in projects with higher potential returns.

- Technological Change: Advancements in technology create new investment opportunities.

- Government Policies: Tax incentives and regulations can impact investment decisions.

- Economic Conditions: Economic stability and growth encourage investment.

Replacement Investment: Preserving the Productivity Engine

Replacement investment is crucial for maintaining the efficiency of an economy’s capital stock. It ensures that existing equipment, infrastructure, and machinery continue to operate at optimal levels. Without proper replacement, productivity and economic growth can suffer. By replacing outdated capital, businesses can reduce maintenance costs, improve efficiency, and stay competitive.

Planned investment is like a well-oiled machine, driving economic progress. By allocating resources wisely, economies can boost productivity, promote technological advancement, and foster sustainable growth. It is essential for governments and businesses to recognize the importance of planned investment and create an environment that encourages and supports it. With a strategic approach to investment, societies can unlock economic prosperity and secure a brighter future.

Planned Investment: Preserving Productivity for Economic Prosperity

Planned investment plays a pivotal role in maintaining economic productivity, the efficiency of a nation’s economy in transforming inputs into valuable outputs. As businesses invest in new capital goods and technology, they improve their ability to produce goods and services, leading to increased output and economic growth. One crucial aspect of planned investment is replacement investment, which is essential for preserving existing capital stock and ensuring that businesses can maintain their current level of productivity.

The Importance of Replacement Investment

Replacement investment is the process of replacing worn-out or obsolete equipment and infrastructure to maintain the existing level of capital stock. Unlike expansionary investment, which increases the nation’s capital stock, replacement investment simply sustains it. This type of investment is critical for preserving the economy’s productive capacity and preventing a decline in output over time.

Consider the following example: a manufacturing plant uses machinery that has a lifespan of 10 years. To maintain its current production capacity, the plant must replace the machinery every 10 years. If the plant fails to make this replacement investment, the machinery will become increasingly inefficient and output will decline. This decrease in productivity can have a ripple effect on the entire economy, leading to lower economic growth and decreased employment opportunities.

Benefits of Replacement Investment

- Maintains Productive Capacity: Replacement investment ensures that businesses have the necessary capital stock to operate at their optimal level of efficiency. This translates into higher output and productivity, contributing to overall economic growth.

- Prevents Economic Decline: By replacing aging capital stock, businesses avoid the potential decline in productivity and output that can occur if obsolete equipment is not replaced. This helps maintain economic stability and prevent a downturn in business activity.

- Reduces Maintenance Costs: Replacing old equipment with newer, more efficient models can reduce maintenance costs over time. This cost savings can be reinvested into other productive activities, further stimulating economic growth.

- Contributes to Environmental Sustainability: Replacing old equipment with more energy-efficient models can reduce energy consumption and greenhouse gas emissions. This contributes to environmental sustainability and can help businesses reduce their environmental footprint.

Planned investment is essential for maintaining economic productivity and fostering economic growth. Replacement investment, in particular, plays a crucial role in preserving existing capital stock and ensuring that businesses can continue to operate at their optimal level of efficiency. By investing in replacement assets, businesses can sustain their productive capacity, prevent economic decline, reduce maintenance costs, and contribute to environmental sustainability. Recognizing the importance of replacement investment is critical for policymakers and businesses alike to promote long-term economic prosperity.

Planned Investment: The Fuel for Economic Growth

In the realm of economics, planned investment holds exceptional significance as the driving force behind economic well-being. It refers to the deliberate allocation of resources to create or enhance capital goods with the aim of boosting productivity and fostering growth.

Concepts Related to Planned Investment

Planned investment is intricately linked to several key concepts:

Gross Investment

Gross investment encompasses three components: net investment, replacement investment, and expansionary investment. Net investment is the portion that increases the stock of capital goods, while replacement investment maintains the existing stock. Expansionary investment, on the other hand, is the creation of new capital goods, a vital step for economic expansion.

Expansionary Investment: The Path to Progress

Expansionary investment plays a crucial role in unlocking economic growth. It involves creating new capital goods such as factories, machinery, and infrastructure. This not only boosts production capacity but also creates new jobs and stimulates consumer spending, setting off a chain reaction of economic expansion.

Factors Influencing Investment

Investment decisions are influenced by a complex interplay of factors, including interest rates, expected profitability, technological change, government policies, and economic conditions. These factors act as a compass for businesses and investors, guiding their allocation of capital and shaping the overall investment landscape.

Role of Planned Investment in Economic Growth

Planned investment serves as the lifeblood of economic growth, propelling nations towards prosperity:

Productivity: By investing in new technologies and equipment, businesses can improve efficiency and increase output, resulting in higher productivity and economic growth.

Technological Progress: Planned investment fuels innovation and research, paving the way for technological advancements that further boost productivity and drive economic expansion.

Economic Expansion: Expansionary investment creates jobs and stimulates consumer spending, triggering a positive feedback loop that leads to increased economic growth. This virtuous cycle benefits businesses, consumers, and the economy as a whole.

Planned investment is the cornerstone of economic well-being, promoting productivity, technological progress, and economic expansion. By carefully allocating resources to create and enhance capital goods, governments and businesses can unlock the full potential of their economies and pave the way for a thriving future.

Planned Investment: A Catalyst for Economic Expansion

In the realm of economics, planned investment stands as a cornerstone for fostering economic growth. It’s the intentional allocation of resources towards capital goods that enhance productivity and create more goods and services.

Expansionary investment, a crucial aspect of planned investment, plays a pivotal role in driving economic expansion. By creating new capital goods, such as factories, machinery, and infrastructure, expansionary investment increases the productive capacity of the economy.

Imagine a small town where a new factory is built. The factory employs workers, generating income and boosting consumer spending. The increased demand for goods and services leads to the opening of new businesses, creating a ripple effect of economic activity throughout the community.

Expansionary investment also fosters innovation and technological advancements. By investing in research and development, businesses can create new products and processes that improve efficiency and productivity. This cycle of innovation and growth propels the economy forward.

Moreover, expansionary investment stimulates job creation. As businesses invest in new capital goods, they require skilled workers to operate and maintain them. This influx of new jobs boosts economic growth and improves living standards.

In essence, expansionary investment serves as a powerful engine for economic expansion. By enhancing productivity, driving innovation, creating jobs, and increasing consumer spending, it lays the foundation for a thriving and prosperous economy.

Unveiling the Key Factors that Shape Investment Decisions: A Journey into Planned Investment

In the realm of economics, planned investment holds immense significance as a driving force for economic growth and prosperity. Understanding the factors that influence investment decisions is crucial for businesses, policymakers, and investors alike. Let’s embark on a storytelling journey to explore these key factors and their profound impact on investment behavior.

Interest Rates: The Borrower’s Compass

Interest rates act as a beacon for investors, guiding their decisions like a compass. When interest rates are low, borrowing becomes more attractive, lowering the cost of capital for businesses. This encourages firms to invest in new projects, expanding their operations and stimulating economic growth. Conversely, high interest rates increase the cost of borrowing, making investments less feasible and slowing down economic activity.

Expected Profitability: The Incentive Magnet

Investors seek profitability, the backbone of their investment decisions. When they anticipate a favorable return on their investment, they are more likely to commit capital. Economic conditions, such as strong consumer demand or technological advancements, can increase profitability expectations, boosting investment. However, if profitability prospects appear bleak, investors may hesitate to invest, leading to a contraction in investment activity.

Technological Change: The Innovation Spark

Technological advancements act as catalysts for investment. New technologies often create new markets and opportunities, prompting businesses to invest in research and development. This innovation-driven investment fuels economic growth by improving efficiency, reducing costs, and unlocking new frontiers.

Government Policies: The Shaping Hand

Government policies play a pivotal role in shaping investment decisions. Favorable policies, such as tax incentives and support for infrastructure, can encourage investment by making it more attractive for businesses. Conversely, unfavorable policies, such as high taxes or regulatory barriers, can discourage investment, hindering economic growth.

Economic Conditions: The Contextual Canvas

The overall economic climate sets the stage for investment decisions. A stable and growing economy fosters confidence among investors, encouraging them to take risks and invest in new projects. This investment, in turn, contributes to sustained economic expansion. However, economic downturns and market volatility can shake investor confidence, leading to a decline in investment and exacerbating the economic slowdown.

In conclusion, the factors influencing planned investment are multifaceted, ranging from interest rates to technological change and government policies. Understanding these factors is essential for businesses to make informed investment decisions, policymakers to craft growth-oriented policies, and investors to navigate the complexities of the investment landscape. By acknowledging the interconnectedness of these factors, we can unlock the transformative power of planned investment, driving economic growth and enhancing the well-being of society.

Planned Investment: A Catalyst for Economic Productivity

In the realm of economics, planned investment stands as a cornerstone for economic prosperity. It’s the deliberate allocation of resources to create or enhance the productive capacity of an economy. Unlike unplanned investments, which are often driven by speculation or market sentiments, planned investments are guided by a strategic vision to improve efficiency, enhance output, and boost overall economic productivity.

Unleashing the Power of Innovation

One of the most profound impacts of planned investment lies in its ability to foster innovation and technological advancements. By committing resources to research and development, businesses and governments create the fertile ground for new technologies, products, and processes. These innovations enhance efficiency, reduce costs, and open up new markets, ultimately driving economic growth.

Modernizing and Expanding Infrastructure

Planned investment also plays a critical role in modernizing and expanding infrastructure. By constructing new roads, bridges, and public transportation systems, governments create the physical foundations for economic activity. Efficient infrastructure reduces transportation costs, improves logistics, and facilitates the smooth flow of goods and services, contributing to overall productivity and economic growth.

Investing in Human Capital

Beyond physical infrastructure, planned investment can also be directed towards human capital. Allocating resources to education, training, and healthcare improves the skills and knowledge of the workforce, enhancing productivity and innovation. A skilled and educated workforce is the backbone of a thriving economy, driving economic growth and competitiveness.

Enhancing Production Capacity

Another key aspect of planned investment is its ability to expand production capacity. By investing in new machinery, equipment, and factories, businesses can increase their output, meet rising demand, and contribute to overall economic growth. This expansionary investment lays the foundation for future productivity gains and sustained economic development.

Attracting Foreign Investment

Planned investment has the potential to attract foreign investment, bringing in fresh capital, expertise, and technology from abroad. Stable and predictable investment environments, coupled with supportive government policies, create an attractive destination for global investors. Foreign investment can further enhance productivity, create jobs, and foster economic growth.

Planned investment is an indispensable tool for economic growth and prosperity. By promoting innovation, modernizing infrastructure, investing in human capital, expanding production capacity, and attracting foreign investment, it creates a fertile environment for businesses to thrive, workers to prosper, and economies to flourish. Understanding the significance of planned investment and creating an enabling environment for it are crucial steps towards achieving sustainable economic growth and long-term well-being.

The Role of Planned Investment in Driving Technological Progress

Planned investment plays a pivotal role in shaping the economic landscape by driving technological advancements. It fuels innovation and research, paving the way for breakthroughs that transform industries and improve our daily lives.

Funding Innovation and Research

Planned investment provides the necessary capital for businesses to invest in research and development (R&D). This fosters new ideas, innovative technologies, and improved products that enhance productivity and efficiency. By supporting startups and academic institutions dedicated to scientific advancements, planned investment helps bring groundbreaking concepts to fruition.

Driving Technological Advancements

Planned investment enables the development of state-of-the-art infrastructure and advanced machinery. These investments increase production capacity, improve reliability, and reduce operating costs, leading to a more efficient and competitive economy. Moreover, planned investment supports ongoing research and development, fostering a cycle of innovation that continuously drives technological advancements.

Benefits of Technological Progress

The technological advancements spurred by planned investment bring a myriad of benefits to society:

- Increased productivity: Automated processes and advanced technologies enhance efficiency, allowing businesses to produce more goods and services with fewer resources.

- Improved quality of life: Technological progress drives the development of innovative products and services that meet evolving needs, improve living standards, and enhance healthcare and education.

- Job creation: R&D and technology implementation create new employment opportunities in research, engineering, and manufacturing, fueling economic expansion.

Planned investment is a cornerstone of economic growth and prosperity, and its role in driving technological advancements is particularly profound. By funding innovation and research, it creates a fertile ground for new ideas and cutting-edge technologies that transform industries and improve our lives. Therefore, it is essential for governments and businesses to recognize the importance of planned investment and continue investing in the future of technology.

Planned Investment: A Catalyst for Economic Growth

In the realm of economics, planned investment stands as a pivotal force, shaping the trajectory of nations and improving the lives of countless individuals. It is the deliberate allocation of resources to enhance the productive capacity of an economy, encompassing investments that build new infrastructure, automate processes, and fuel research and development.

Job Creation: The Employment Lifeline

Planned investment acts as an employment lifeline, creating a ripple effect that benefits the entire workforce. As businesses invest in expanding their operations or upgrading their equipment, they require additional personnel to operate and maintain these new assets. This surge in job creation not only reduces unemployment but also broadens the pool of skilled workers, contributing to the overall efficiency and productivity of the economy.

Increased Consumer Spending: The Economic Multiplier

The employment gains generated by planned investment translate into increased consumer spending, further propelling economic growth. With stable incomes and a brighter economic outlook, individuals are more likely to open their wallets and indulge in goods and services, stimulating demand across various industries. This multiplier effect fuels economic activity, creates new jobs, and generates a virtuous cycle that benefits the entire community.

Economic Expansion: Unveiling the Growth Potential

Planned investment lays the foundation for economic expansion by expanding the capacity of the economy to produce goods and services. As businesses invest in new technologies, automate processes, and expand their infrastructure, they unlock the potential for increased production. This, in turn, leads to higher outputs, lower costs, and increased profitability, creating a favorable environment for sustained economic growth and prosperity.

In conclusion, planned investment is the lifeblood of a thriving economy. It creates jobs, increases consumer spending, and stimulates economic expansion. By fostering innovation, productivity, and employment, it empowers businesses and individuals alike, paving the way for a brighter economic future.

Summarize the key concepts and their interrelationships.

Planned Investment: The Engine of Economic Growth

In the realm of economics, planned investment stands as a crucial concept that can propel a nation to prosperity. It involves the purposeful allocation of resources with the intention of enhancing future output and economic well-being.

At its core, planned investment encompasses the decision to defer current consumption in favor of increasing productive capacity. This involves channeling funds into various forms of capital goods, such as machinery, infrastructure, and research and development.

Components of Planned Investment

Understanding the components of planned investment is essential. Gross investment encompasses all investment activities, including:

- _Net investment: The creation of new capital stock, which signifies economic growth.

- _Replacement investment: Maintaining existing capital stock to preserve productivity levels.

- _Expansionary investment: Creating additional capital goods to foster economic expansion.

Factors Influencing Planned Investment

A multitude of factors shape the level of planned investment, including:

- Interest rates

- Expected profitability

- Technological change

- Government policies

- Economic conditions

Role of Planned Investment in Economic Growth

Planned investment plays a pivotal role in stimulating economic growth by:

- _Boosting Productivity: New capital stock and technological advancements enhance efficiency and output.

- _Driving Technological Progress: Investment funds innovation and research, fueling technological advancements that drive economic growth.

- _Creating Economic Expansion: Investment creates jobs, increases consumer spending, and stimulates overall economic activity.

Interrelationships

These key concepts are interconnected:

- Net investment creates new capital stock, which contributes to gross investment.

- Replacement investment maintains existing capital stock, which supports net investment.

- Expansionary investment builds on net investment, fostering economic growth.

- Factors influencing planned investment, such as interest rates and technological change, impact the level of gross investment, net investment, and expansionary investment.

Planned investment is the lifeblood of economic progress, leading to increased productivity, technological advancements, and economic expansion. By understanding the components, factors, and interrelationships of planned investment, we can better appreciate its crucial role in driving economic prosperity.

Planned Investment: A Catalyst for Economic Well-being

In the tapestry of economic growth, planned investment stands out as an indispensable thread. It’s the deliberate allocation of resources towards capital goods, setting the stage for a nation’s prosperity.

Components of Planned Investment

Planned investment is an umbrella term encompassing various categories:

- Gross Investment: Encompassing net investment, replacement investment, and expansionary investment.

- Net Investment: The increase in capital stock, critical for spurring economic growth by boosting productivity.

- Replacement Investment: Maintaining existing capital, ensuring productivity levels are preserved amidst wear and tear.

- Expansionary Investment: Creating new capital goods, driving economic expansion through increased production capacity.

Factors Shaping Investment Decisions

Several factors influence the ebb and flow of investment:

- Interest rates: Higher rates make borrowing more expensive, curbing investment.

- Expected profitability: Profitable ventures attract investment, fueling economic growth.

- Technological change: Innovations drive investment in new technologies, enhancing productivity.

- Government policies: Incentives and regulations can influence investment decisions.

- Economic conditions: Economic stability and growth prospects create a conducive environment for investment.

The Vital Role of Planned Investment in Economic Health

- Increased Productivity: Planned investment in machinery and equipment enhances efficiency, maximizing output.

- Technological Progress: Investment in research and development fuels innovation, driving technological advancements that boost productivity and economic growth.

- Economic Expansion: Investment creates jobs, increases consumer spending, and expands the overall economy. It acts as an economic flywheel, propelling the nation forward.

In conclusion, planned investment is a cornerstone of economic well-being. By judiciously allocating resources, nations can unleash the potential for increased productivity, technological progress, and economic expansion. The wise stewardship of investment decisions ensures a prosperous future for generations to come.