How To Calculate Net Accounts Receivable: A Comprehensive Guide For Accountants

To compute net accounts receivable, begin with the gross amount owed by customers. Deduct net sales (gross sales minus sales returns and allowances), then subtract sales discounts. Estimate bad debt expense using an allowance for doubtful accounts. The net accounts receivable equals gross accounts receivable minus the allowance for doubtful accounts, representing the current amount owed after accounting for potential bad debts.

Understanding Gross Accounts Receivable

- Define gross accounts receivable as the total amount owed by customers for goods or services belum paid for.

- List the components of gross accounts receivable: net sales, sales returns and allowances, sales discounts.

Understanding Gross Accounts Receivable: The Unsung Hero of Business

In the realm of business, understanding the intricacies of gross accounts receivable is paramount. It’s the lifeline that connects businesses to their customers, representing the unpaid balances owed for goods and services rendered.

Delving into the Essence of Gross Accounts Receivable

Gross accounts receivable is the total sum of all outstanding invoices yet to be collected from customers. It encompasses three key components:

- Net Sales: The core revenue generated from sales, excluding any returns or discounts.

- Sales Returns and Allowances: Deductions for merchandise returned or price adjustments, reducing the net sales figure.

- Sales Discounts: Incentives offered for early payments, which are subtracted from net sales.

Calculating Net Sales: A Simple Formula

To determine net sales, it’s as simple as subtracting sales returns and allowances from gross sales. This calculation provides a clearer picture of the actual revenue generated from your sales efforts.

Sales Returns and Allowances: A Necessary Adjustment

Sales returns and allowances act as a correction to net sales, accounting for inevitable product returns and price adjustments. These deductions reduce the amount of revenue recognized, reflecting the reality of business transactions.

Sales Discounts: Encouraging Prompt Payment

Sales discounts serve as a catalyst for faster customer payments. By offering a small incentive for early payment, businesses can improve their cash flow and reduce outstanding balances.

Estimating Bad Debt Expense: A Prudent Measure

Every business faces the risk of uncollectible accounts receivable. Bad debt expense estimates the potential loss from these uncollectible debts, ensuring that businesses are prepared for the inevitable.

Allowance for Doubtful Accounts: A Buffer against Uncollectibility

The allowance for doubtful accounts is a contra-asset account that reduces gross accounts receivable by estimating the amount of bad debts expected. It serves as a buffer against potential losses, providing a cushion for when customers fail to pay.

Write-offs: The Final Step

When specific bad debts become irrecoverable, they are written off and removed from the allowance for doubtful accounts. This process reduces the balance of gross accounts receivable, reflecting the reality of uncollectible debts.

Net Accounts Receivable: A True Picture of Outstanding Balances

Net accounts receivable represents the current amount owed by customers after accounting for estimated bad debts. It provides a more accurate assessment of the business’s financial position, reflecting the likelihood of collection.

Understanding gross accounts receivable is essential for businesses to manage their cash flow, assess their financial health, and mitigate the risks associated with uncollectible debts. By embracing these concepts, businesses can optimize their receivables process, strengthening their financial foundation and ensuring continued success.

Calculating Net Sales

- Net sales represent the revenue generated from sales after deducting sales returns and allowances.

- Explain how to calculate net sales by subtracting sales returns and allowances from gross sales.

Calculating Net Sales: The Foundation of Revenue Recognition

When a business generates sales, it records the total amount as gross sales. However, not all of these sales are recognized as revenue. Why? Because some customers may return merchandise or receive discounts for early payment. To determine the actual revenue earned, businesses must calculate net sales.

What is Net Sales?

- Net sales represent the revenue generated from sales after deducting sales returns and allowances.

- It is the amount of sales that the business can recognize as income on its financial statements.

Calculating Net Sales

Calculating net sales is a straightforward process:

- Step 1: Start with gross sales, which is the total amount of goods or services sold during a period.

- Step 2: Subtract sales returns and allowances. Sales returns occur when customers return merchandise for a refund. Sales allowances are granted when customers receive a price adjustment due to product defects or other reasons.

Formula:

Net Sales = Gross Sales - (Sales Returns + Sales Allowances)

Example:

Let’s say a business had gross sales of $10,000 for the month. During the same period, they received sales returns totaling $500 and granted sales allowances of $200.

- Net Sales = $10,000 – ($500 + $200)

- Net Sales = $9,300

Therefore, the business recognizes $9,300 as revenue for the month.

Understanding Sales Returns and Allowances: A Deeper Dive into Revenue Adjustments

In the realm of accounting, sales returns and allowances play a crucial role in accurately capturing the true revenue earned by a business. These deductions reflect the value of returned merchandise and price adjustments, offering a more comprehensive view of the net sales figure.

Sales Returns: When Buyers Send Goods Back

Sales returns arise when customers return purchased goods for a variety of reasons, such as dissatisfaction, damage, or incorrect orders. These returns represent reversals of the initial sales transactions and have a direct impact on the net sales revenue. By deducting the value of returned merchandise from the gross sales, businesses obtain a more precise calculation of the revenue they have actually earned.

Sales Allowances: Adjusting Prices for Imperfections

Sales allowances, on the other hand, differ from sales returns in that they involve price adjustments made without the return of goods. This typically occurs when customers discover defects or imperfections in the products they have purchased. Rather than returning the items, they negotiate a price reduction with the seller. Sales allowances are deducted from net sales to reflect the reduced amount received by the business.

Impact on Revenue: A Tale of Two Adjustments

Both sales returns and allowances have a significant impact on the revenue of a company. Returns reduce revenue by eliminating the value of the returned goods, while allowances decrease revenue by adjusting the price originally agreed upon. These deductions ensure that businesses only recognize revenue that they have actually earned, providing a more accurate representation of their financial performance.

Sales returns and allowances are essential elements of accounting that help businesses maintain accurate financial records and present a true picture of their revenue. By considering these deductions, companies can avoid overstating revenue and ensure that their financial statements reflect the reality of their operations. This accuracy is paramount for decision-making, financial reporting, and maintaining the integrity of the accounting system.

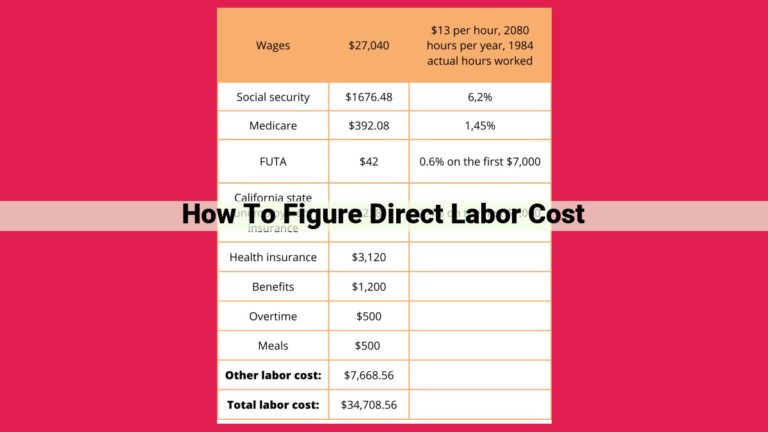

Calculating Sales Discounts: A Step-by-Step Guide

When customers make purchases on credit, it’s common for businesses to offer sales discounts as an incentive for prompt payment. These discounts are typically stated as a percentage of the invoice amount and are deducted from the net sales figure. Understanding how to calculate sales discounts is crucial for businesses to optimize their revenue and cash flow.

To calculate a sales discount, you’ll need the following information:

- Invoice amount: The total amount of the invoice before any deductions.

- Discount percentage: The percentage of the invoice amount that is offered as a discount for early payment.

The formula for calculating a sales discount is:

Sales Discount = Invoice Amount x Discount Percentage

For example, let’s say you have an invoice for $1,000 and offer a 2% discount for early payment. The sales discount would be calculated as follows:

Sales Discount = $1,000 x 0.02 = $20

This means that if the customer pays the invoice within the specified discount period, they will only owe $980 ($1,000 – $20).

Sales discounts can provide several benefits for businesses. They can incentivize customers to pay early, which helps businesses improve their cash flow. Additionally, it can reduce the risk of bad debts, as customers are more likely to pay their invoices on time when they receive a discount.

However, it’s important to weigh the cost of offering sales discounts against the benefits. If the discount percentage is too high, it can significantly reduce your profit margin. Therefore, businesses should carefully consider the optimal discount percentage to offer, taking into account factors such as industry norms, customer payment patterns, and the desired impact on cash flow.

Determining Bad Debt Expense

In the world of business, it’s essential to account for the potential losses associated with uncollectible debts. This is where bad debt expense comes into play. It represents the estimated amount of money a company may never recover from customers who fail to pay their bills.

Bad debt expense is crucial for maintaining a company’s financial health. By accurately estimating this expense, businesses can avoid overstating their assets and provide a more realistic picture of their financial performance.

Estimating Bad Debt Expense

Estimating bad debt expense requires careful consideration and analysis. One common method involves using an allowance for doubtful accounts, which is a contra-asset account that reduces gross accounts receivable. This allowance serves as a cushion against potential uncollectible debts.

To estimate the allowance for doubtful accounts, businesses can use historical data and industry benchmarks. They consider factors such as the customer’s credit history, the length of time an invoice has been outstanding, and the current economic climate. Companies may also use aging schedules to categorize accounts receivable based on their age, which can help identify accounts at higher risk of being uncollectible.

Journal Entries

Once the allowance for doubtful accounts has been estimated, it is recorded in the company’s accounting records through journal entries. These entries typically involve crediting the allowance for doubtful accounts and debiting bad debt expense.

Other Considerations

Apart from estimating bad debt expense, companies should also have policies in place for writing off specific bad debts. This involves removing them from the allowance for doubtful accounts and reducing the balance of gross accounts receivable.

Regularly monitoring accounts receivable and communicating with customers about outstanding invoices are essential in preventing bad debts. By taking these steps, businesses can minimize losses and maintain a healthy financial position.

The Allowance for Doubtful Accounts: A Lifeline for Uncollectible Debts

Every business faces the unfortunate reality of customers who don’t pay their bills. While it’s impossible to avoid occasional bad debts, the allowance for doubtful accounts provides a crucial lifeline, shielding businesses from the financial consequences of uncollectible receivables.

The allowance for doubtful accounts is a contra-asset account that reduces the value of gross accounts receivable, mirroring its existence while having an opposite effect. It acts as a buffer, estimating the amount of money your business may never collect.

By maintaining an allowance for doubtful accounts, businesses can anticipate and absorb bad debt expense. It’s a proactive measure that allows them to minimize the impact of uncollectible receivables on their financial statements. It’s like a financial airbag, softening the blow of lost revenue.

The allowance is typically calculated as a percentage of gross accounts receivable. This percentage is based on historical experience, industry trends, and current economic conditions. By adjusting the allowance periodically, businesses can ensure that it accurately reflects the likelihood of uncollectible debts.

As bad debts are identified and removed from the allowance for doubtful accounts, the balance of gross accounts receivable decreases. This reflects the fact that the value of accounts receivable has been reduced by the estimated amount of uncollectible receivables. The allowance serves as a cushion, preventing these uncollectible debts from distorting the company’s financial health.

By utilizing the allowance for doubtful accounts, businesses can maintain an accurate representation of their financial position. It provides a realistic view of expected cash flow, allowing them to make informed decisions about credit management, inventory levels, and overall financial strategy.

Write-Offs: Cleaning Up Your Accounts Receivable

When a customer fails to pay their invoice, it’s time to face reality: that debt may be uncollectible. To keep your books accurate and avoid overstating your assets, you need to write off the bad debt as a loss.

What is a Write-Off?

A write-off is the specific removal of a bad debt from your allowance for doubtful accounts. It’s the point where you officially recognize that the money is gone.

How Write-Offs Work

When you establish an allowance for doubtful accounts, you estimate the amount of accounts receivable that you expect to become uncollectible. This estimate is based on historical data or industry averages.

As time goes on, some of your customers will default on their invoices. When this happens, you’ll transfer the bad debt from the allowance for doubtful accounts to your expense account as a write-off.

Impact on Gross Accounts Receivable

Write-offs reduce the balance of your gross accounts receivable. This is because the bad debt is no longer considered an asset. It’s now reflected as a loss on your income statement.

Writing off bad debts can affect your company’s liquidity and profitability. A high number of write-offs can reduce your cash flow and eat into your bottom line.

Write-offs are an essential part of managing accounts receivable. They allow you to remove uncollectible debts from your books and prevent them from overstating your financial performance. By carefully monitoring your accounts receivable and write-offs, you can minimize the impact of bad debts on your business.

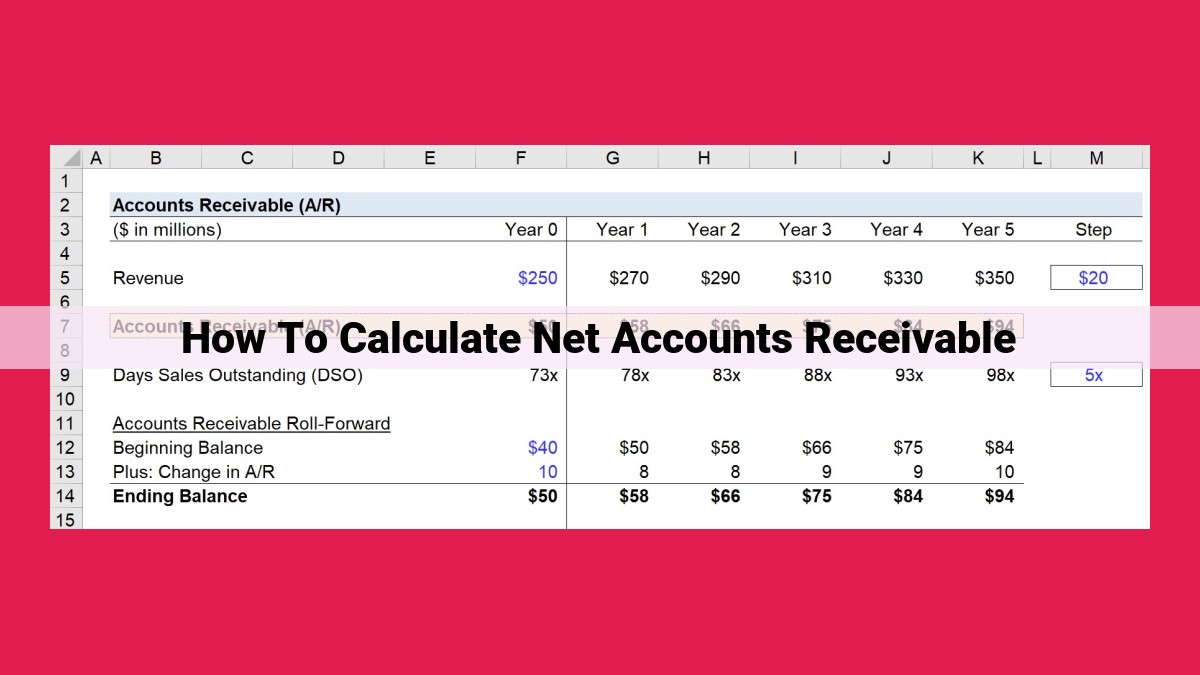

Calculating Net Accounts Receivables

- Provide the formula for calculating net accounts receivable: Gross Accounts Receivable – Allowance for Doubtful Accounts.

- Explain that net accounts receivable represents the current amount owed by customers after accounting for estimated bad debts.

Calculating Net Accounts Receivable: The Final Step in Understanding Customer Debt

Throughout our discussion on accounts receivable, we’ve delved into gross accounts receivable, net sales, sales returns and allowances, and sales discounts. Now, we’ll wrap up with the crucial step: calculating net accounts receivable.

Net accounts receivable represents the current amount owed by customers after accounting for estimated uncollectible debts. This amount is crucial for businesses as it provides a clearer picture of their liquidity and financial health.

Formula for Calculating Net Accounts Receivable

The formula for calculating net accounts receivable is straightforward:

Net Accounts Receivable = Gross Accounts Receivable – Allowance for Doubtful Accounts

Breaking Down the Formula

- Gross Accounts Receivable: This amount represents the total amount owed by customers for products or services sold on credit.

- Allowance for Doubtful Accounts: This is a contra-asset account that reduces the value of gross accounts receivable. It represents the estimated amount of customer debts that are unlikely to be collected.

Understanding the Significance

Net accounts receivable provides a more accurate representation of the current value of accounts receivable. By estimating bad debts and reducing them from the gross amount, businesses gain a clearer understanding of the collectible cash they can expect to receive. This information is essential for cash flow forecasting and decision-making.

Optimizing Net Accounts Receivable

To optimize net accounts receivable, businesses can focus on reducing the allowance for doubtful accounts. This can be achieved by implementing strict credit policies, conducting thorough customer background checks, and actively managing existing accounts receivable. By minimizing the risk of uncollectible debts, businesses can improve their cash flow and overall financial performance.