Market Supply: Understanding The Relationship Between Price And Quantity

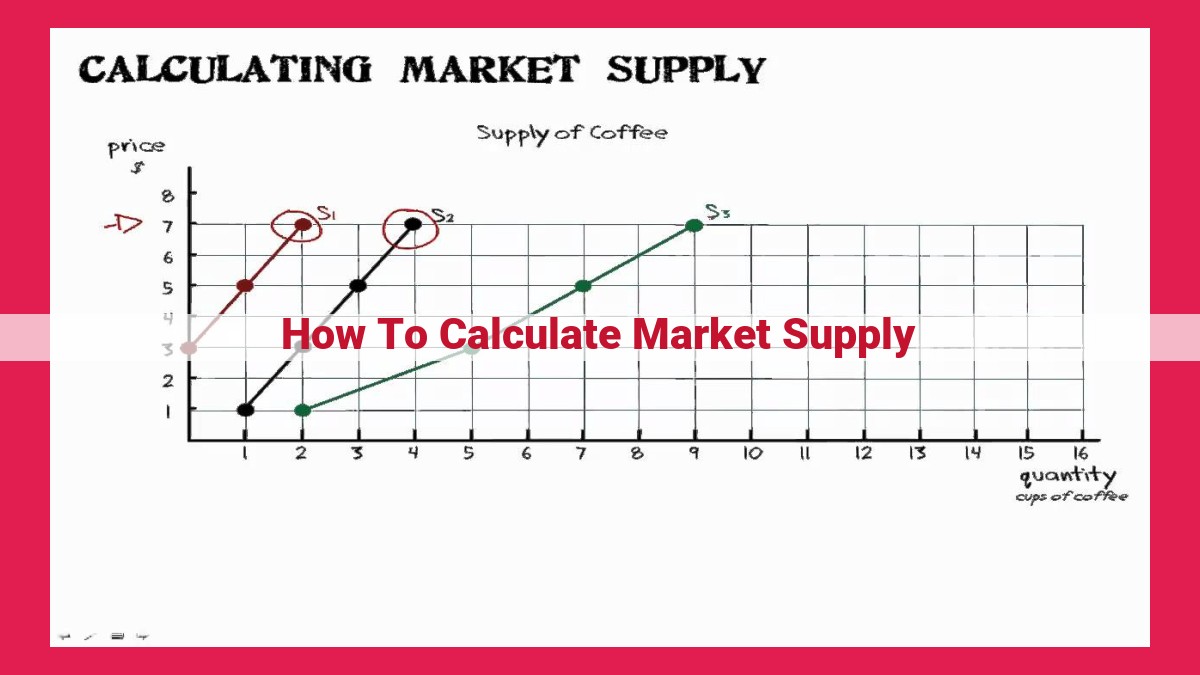

Market supply represents the total quantity of a good or service offered by all producers at various prices in a specific market. To calculate market supply, sum the individual supply curves of all producers horizontally. The market supply curve indicates the positive relationship between price and quantity supplied. At the equilibrium price, where supply equals demand, producers determine the quantity supplied based on profit-maximizing decisions influenced by production costs and other factors. Shifts in the supply curve, caused by changes in production costs or expectations, impact the equilibrium price and quantity supplied.

Market Supply: The Cornerstone of Price and Quantity

In the realm of economics, market supply plays a pivotal role in shaping the equilibrium of goods and services. It refers to the total quantity of a product or service that producers are willing and able to provide to the market at a given price.

Understanding market supply is crucial because it helps us determine the optimal price and quantity that balances the needs of both consumers and producers. When supply is aligned with demand, it creates an equilibrium where the market is in a stable state.

Significance of Market Supply

Market supply is a dynamic concept that influences various aspects of the market, including:

- Price determination: The interaction between supply and demand ultimately determines the equilibrium price of a product or service.

- Scarcity and surplus: Supply and demand can create situations of either scarcity (when supply is less than demand) or surplus (when supply exceeds demand).

- Resource allocation: The quantity supplied indicates how resources are allocated within the market. It shows how much of a particular product or service is produced and available to consumers.

- Economic growth: A healthy supply of goods and services is essential for economic growth and consumer well-being. It ensures that there is enough to meet the needs and wants of the population.

By understanding the concept of market supply, we can gain valuable insights into the dynamics of markets and the forces that shape them. It empowers us to make informed decisions as consumers, producers, and policymakers.

Perfectly Competitive Market: Defining the Arena of Pure Competition

In the realm of economics, markets exist in a spectrum of structures. One of the most fundamental and widely studied is the perfectly competitive market. This type of market is characterized by a unique set of assumptions that create an environment of pure competition.

Key Features of a Perfectly Competitive Market

Imagine a bustling marketplace where countless producers offer an indistinguishable product. This is the essence of a perfectly competitive market, where the number of producers is vast and the size of each producer is relatively small. This abundance of sellers implies that no single entity has the power to influence the market price, which is solely determined by the invisible hand of supply and demand.

Another hallmark of perfect competition is the homogeneity of the product. All units of the good or service are identical in terms of quality and features, making it impossible for consumers to differentiate between offerings. This absence of product differentiation ensures that producers compete solely on price.

In this market structure, the price is taken as given by each producer. They have no control over the price level and must adapt their production strategies accordingly. This price signals act as a guiding force, influencing the quantity supplied and the overall market equilibrium.

Implications for Producers and Consumers

In a perfectly competitive market, the emphasis shifts from individual producers to the collective behavior of the market as a whole. Each producer operates as a price taker, adjusting their output to maximize profits. They produce and sell at the prevailing market price, accepting it as an unchangeable fact.

For consumers, perfect competition offers a plethora of benefits. The presence of numerous producers ensures a wide selection of products and competitive prices. The absence of market power eliminates the possibility of exploitation by dominant players. Additionally, the transparency of the market provides consumers with accurate information on prices and product availability, fostering informed decision-making.

Benefits of Understanding Perfect Competition

Grasping the concept of perfect competition provides valuable insights into real-world markets. It serves as a benchmark against which other market structures can be compared. By understanding how prices are determined and how producers respond to market signals, economists can make informed predictions about market behavior and the impact of government policies.

Price: A Catalyst in the Symphony of Supply and Demand

In the realm of economics, the interplay between supply and demand is a delicate dance, with price acting as the conductor. It’s a force that orchestrates the decisions of producers, shaping the quantity of goods and services that flow into the market.

The Supply Side: A Response to Price

For individual producers, price is a beacon that guides their production decisions. When prices rise, like the sun peeking through clouds, it incentivizes them to increase output, hoping to bask in the glow of higher profits. They expand production, utilizing more resources and ramping up operations to meet the growing demand. Conversely, when prices dip, like a rainstorm dampening spirits, producers may retreat, scaling back production to mitigate losses.

The Market Symphony: Aggregation of Individual Notes

As each producer adjusts their output based on price, a harmonic chorus emerges—the market supply curve. It represents the collective willingness of all producers to offer their goods or services at different price points. The market supply curve, like a symphony’s rising crescendo, captures the aggregate quantity supplied for each possible price, painting a picture of the market’s productive capacity.

The Equilibrium: A Harmony of Sounds

The market supply curve interacts with its counterpart, the demand curve, to create the economic equivalent of a harmonious equilibrium. At the equilibrium price, the quantity supplied by producers effortlessly matches the quantity demanded by consumers, like two notes intertwining in perfect unison. This delicate balance ensures market stability, with no pressure for prices to rise or fall.

Factors Affecting Supply: Changing the Tune

The market supply curve, like any musical composition, can undergo dynamic shifts due to external factors. Improvements in technology, for instance, are like skilled musicians joining the orchestra, enhancing productivity and lowering production costs. This happy tune translates into a rightward shift of the supply curve, leading to lower equilibrium prices and higher quantities supplied.

Conversely, natural disasters or sudden cost increases can act like discordant notes, disrupting production and shifting the supply curve to the left. The result is higher equilibrium prices and potentially reduced quantities supplied, like a soloist struggling to hit the right pitch.

Price, the maestro of supply and demand, plays a crucial role in orchestrating the flow of goods and services in the market. It guides producers’ decisions, shaping the market supply curve and ultimately determining the equilibrium price and quantity. By understanding the dynamics of price and its impact on supply, we can better appreciate the intricate performance that is our economic system.

Individual Supply Curve: The Backbone of Supply

In the realm of economics, understanding the concept of supply is crucial in deciphering the intricate dance between producers and consumers. Individual supply curve plays a pivotal role in this equation, serving as the backbone of market supply.

Imagine a producer, a craftsperson who toils tirelessly in their workshop to create unique and exquisite pieces. Their individual supply curve is a graphical representation of the relationship between the price they can sell their creations for and the quantity they are willing and able to supply.

The slope of this curve is positive, reflecting the producer’s incentive to produce more when the price rises. This is driven by the prospect of higher profits, which motivates them to allocate more resources and effort to production. Conversely, a lower price reduces their incentive to supply, leading to a decrease in the quantity produced.

Several factors can cause the individual supply curve to shift. Changes in production costs are a primary driver. When costs rise, such as due to increased raw material prices or higher labor expenses, the curve will shift to the left, indicating a reduced willingness to supply at any given price. Conversely, a decrease in production costs will shift the curve to the right, encouraging producers to supply more.

Technological advancements also exert an influence on the supply curve. Innovations that enhance productivity or efficiency can reduce production costs, effectively shifting the curve to the right. This enables producers to supply more at a lower price, increasing market efficiency.

By understanding the individual supply curve, we gain a deeper appreciation for the intricate forces that shape the market supply. It serves as a roadmap, guiding producers in their decision-making and helping them navigate the ever-changing economic landscape.

The Market Supply Curve: A Symphony of Producers’ Wills

Just as individual supply curves reveal the willingness of a single producer to supply goods or services at various prices, the market supply curve paints a broader picture. It’s the mesmerizing product of the collective decisions of all producers in a market, a beautiful aggregation of individual voices.

Imagine a concert hall filled with musicians, each playing their unique melody. As the conductor raises their baton, they blend their individual harmonies into a captivating symphony. The market supply curve is akin to that conductor, orchestrating the collective supply decisions of producers to create a cohesive representation of the entire market.

The process of constructing the market supply curve is like a mathematical dance. We begin by placing each individual supply curve side by side on a graph. Then, just as we add apples to a basket, we horizontally sum these individual curves. The resulting curve represents the cumulative quantity that all producers are willing and able to supply at each price point.

The market supply curve serves as a powerful tool for understanding market dynamics. By analyzing its slope, position, and shifts, economists can glean insights into the factors that drive supply and the impact of these forces on prices and quantities. Whether it’s fluctuations in production costs, changes in technology, or shifts in consumer preferences, the market supply curve captures the essence of how producers respond to market conditions.

The Law of Supply: A Direct Correlation Between Price and Quantity

In the realm of economics, the law of supply is a fundamental principle that governs the behavior of producers in a market. It postulates a direct relationship between the price of a good or service and the quantity of that good or service that producers are willing and able to supply.

Simply put, as the price of a product increases, producers are incentivized to increase their production. This is because the higher price offers them the potential for greater profits. Conversely, when the price of a product falls, producers may reduce their production to avoid losses. This relationship is often represented graphically as an upward-sloping line known as a supply curve.

Implications of the Law of Supply

The law of supply has several important implications for the functioning of markets:

- Price elasticity: The elasticity of supply, which measures the responsiveness of producers to price changes, can influence the slope of the supply curve. A highly elastic supply means that producers are quick to increase or decrease production in response to price fluctuations.

- Market equilibrium: The interaction between the law of supply and the law of demand determines the market equilibrium price and quantity. At equilibrium, the quantity supplied equals the quantity demanded, resulting in a stable market situation.

- Government intervention: Governments sometimes intervene in markets to influence the supply of certain goods or services. For example, price controls may be implemented to keep prices artificially low, which can have unintended consequences such as shortages or black markets.

Understanding the Law of Supply

Comprehending the law of supply is crucial for understanding the behavior of producers and the dynamics of markets. It helps us predict how producers will respond to changes in market conditions and anticipate the impact of government policies on supply and demand.

Equilibrium Price: Where Supply and Demand Meet

Imagine a bustling marketplace where buyers and sellers come together to exchange goods and services. Amidst the cacophony of voices and the vibrant colors of merchandise, a dance unfolds – a delicate balancing act between supply and demand.

At any given moment, the quantity supplied by sellers reflects their willingness to sell at a particular price. On the other hand, the quantity demanded by buyers represents their desire to purchase at a specific price. When these two forces align, a harmonious state of equilibrium is achieved.

Equilibrium price, the point where supply equals demand, is the magical spot where the market finds its sweet spot. At this price, no one is left wanting more or less than what they desire. Buyers have all they need, while sellers have sold all they intended.

The equilibrium price ensures stability in the market. Above it, a surplus exists – too many goods chasing too few buyers, leading to a price drop. Below it, there’s a shortage – buyers hungry for more than what’s available, driving prices up. But at equilibrium, the dance is perfect – a delicate balance that keeps everyone satisfied.

So, when you encounter a hot item flying off the shelves or a bargain that’s almost too good to be true, remember that these are but ripples in the marea of supply and demand. And at the heart of it all lies the equilibrium price, the silent orchestrator of market harmony.

Quantity Supplied: Determination at Equilibrium Price

In the dance of supply and demand, the equilibrium price plays the pivotal role of determining the quantity supplied by producers. At this sweet spot, where the quantity supplied equals the quantity demanded, the market finds its balance.

Factors such as production costs, technology advancements, and producer expectations sway the supply curve. When these factors shift, the equilibrium price adjusts accordingly, influencing the quantity supplied.

For instance, if production costs plummet, the supply curve shifts to the right, signaling an increase in the quantity supplied at each price level. This surge in supply exerts downward pressure on the equilibrium price, leading to a lower price and a higher quantity supplied.

Conversely, when production costs escalate, the supply curve shifts to the left, indicating a decrease in the quantity supplied at each price level. This scarcity forces the equilibrium price upward, resulting in a higher price and a lower quantity supplied.

In essence, the equilibrium price acts as a compass, guiding producers in their decision-making. It dictates the quantity they are willing and able to supply, enabling the market to achieve its state of equilibrium.

Shifts in the Supply Curve: Uncovering the Impact on Equilibrium

The supply curve, a cornerstone of economic theory, plays a pivotal role in determining the price and quantity of goods and services in a market. However, this curve is not static and can experience shifts due to various factors. Understanding these shifts is crucial for businesses, policymakers, and anyone interested in grasping the dynamics of supply and demand.

Factors Shifting the Supply Curve

Several key factors can cause the supply curve to shift. These include:

- Changes in production costs: A decline in production costs, such as raw materials or labor, can lead to an increase in supply. Conversely, an increase in costs can result in a decrease in supply.

- Technological advancements: Innovations that enhance production efficiency can expand the supply by reducing production costs or increasing output capacity.

- Expectations: Producers’ expectations about future market conditions can influence their willingness to supply. Positive expectations can lead to an increase in supply, while negative expectations can result in a decrease.

- Government policies: Government regulations, subsidies, or taxes can impact production costs or incentives, causing shifts in the supply curve.

Consequences of Supply Curve Shifts

Shifts in the supply curve have significant consequences for the equilibrium price and quantity in a market:

- Rightward shift: An increase in supply, represented by a rightward shift of the curve, leads to a lower equilibrium price and higher equilibrium quantity. More goods and services are available at a lower cost.

- Leftward shift: Conversely, a decrease in supply, represented by a leftward shift of the curve, results in a higher equilibrium price and lower equilibrium quantity. Goods and services become scarcer and more expensive.

Practical Implications

Understanding shifts in the supply curve has practical implications for various stakeholders:

- Businesses: By analyzing factors that can affect supply, businesses can adjust their production strategies to optimize profits.

- Policymakers: Governments can use policies to influence the supply curve, fostering economic growth or addressing supply shortages.

- Consumers: Shifts in the supply curve directly impact consumer prices and availability of goods and services, affecting their purchasing decisions and welfare.

In conclusion, the supply curve is a dynamic tool that captures the relationship between price and quantity supplied. Shifts in the curve can have profound implications for equilibrium prices and quantities, highlighting the importance of understanding the factors driving these shifts for businesses, policymakers, and consumers alike.