A Comprehensive Guide To Long-Run Equilibrium Price: Unlocking Market Balance And Price Stability

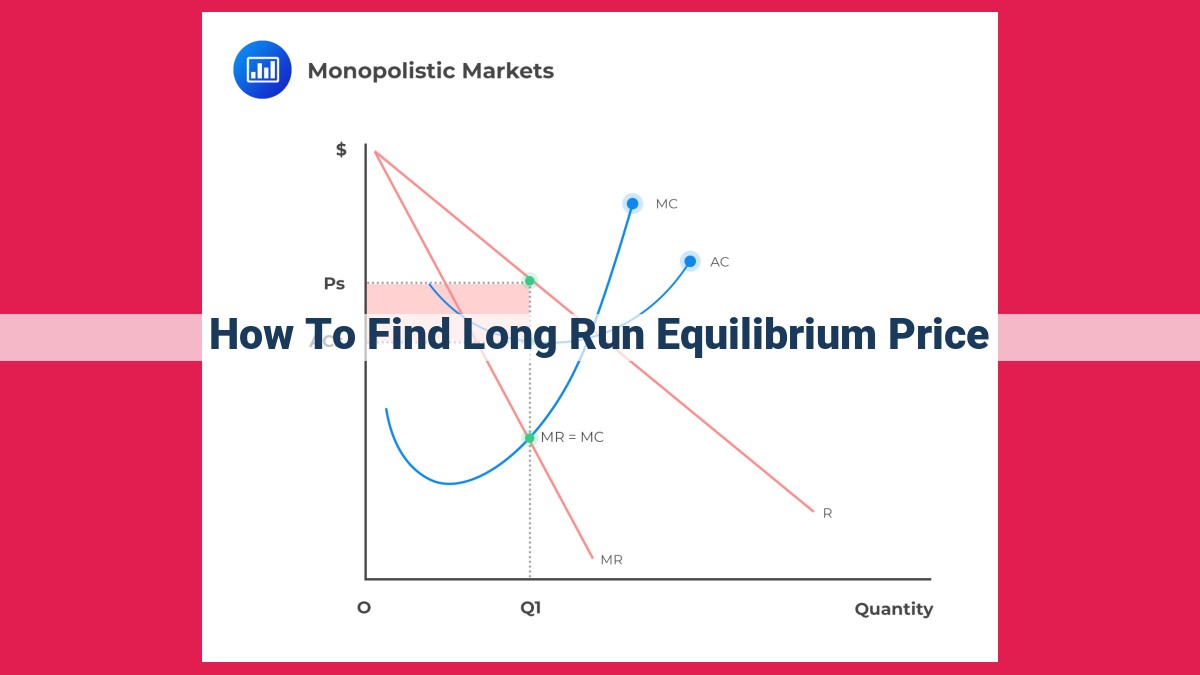

To find long-run equilibrium price, analyze the interaction between supply and demand. Determine the point of equilibrium where supply equals demand. Evaluate the elasticity of supply and demand to understand their responsiveness to price changes. Consider factors that shift supply and demand curves, including technological advancements, government policies, consumer preferences, and market structure. This comprehensive analysis will help you identify the long-run equilibrium price, the point of balance between supply and demand, where market forces have stabilized the price of a good or service.

Understanding Equilibrium Price

- Explain the concept of scarcity and production costs driving supply.

- Discuss consumer demand and how it shapes demand.

Understanding Equilibrium Price: A Tale of Supply and Demand

In the bustling marketplace, where goods and services are exchanged, there exists an invisible force that governs the delicate balance between what’s offered and what’s desired: equilibrium price. This pivotal concept plays a crucial role in shaping market outcomes and ensuring a harmonious flow of economic activity.

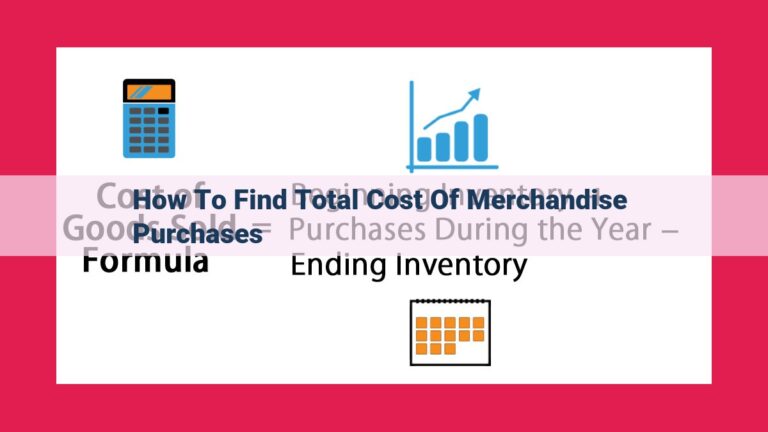

Scarcity and Supply: The Genesis of Supply

Like a whisper from the wind, scarcity reminds producers that resources are finite. This limitation dictates that production costs, such as raw materials, labor, and capital, are not merely wishes but essential elements that drive supply. Each unit produced requires a certain level of these resources, constraining the quantity that can be supplied at any given price.

Consumer Demand: The Engine of Demand

On the other side of the market, consumer demand takes center stage. Consumers, guided by their needs, preferences, and purchasing power, determine the quantity of goods and services they are willing and able to buy. This demand, like a gentle breeze, nudges suppliers in the direction of producing goods that meet the desires of the marketplace.

Supply and Demand Dynamics: The Dance of Prices

Imagine a bustling marketplace where vendors eagerly display their wares, eager to attract customers. On the other side of the equation stand buyers, armed with wallets and specific desires. In this vibrant setting, a dance unfolds – the dance of supply and demand.

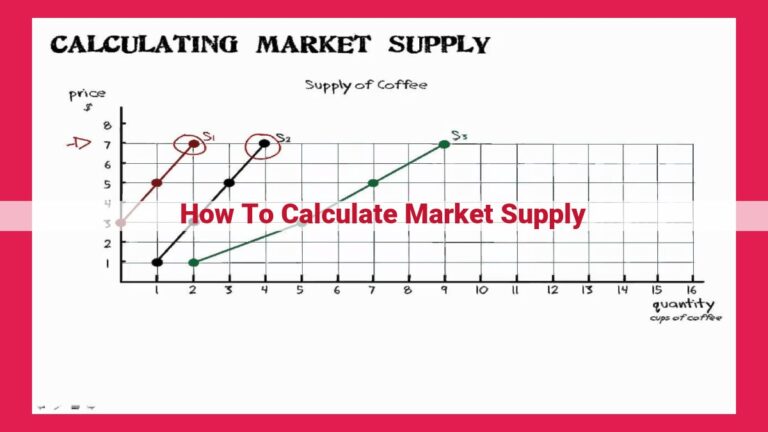

The Interplay of Curves

Visualize two lines on a graph: one sloping upward, representing supply, and the other sloping downward, depicting demand. The point where these lines cross is the equilibrium point, the sweet spot where the quantity suppliers are willing to sell meets the quantity consumers wish to buy. At this delicate balance, the market is content.

Equilibrium: A Symphony of Needs and Availability

Equilibrium is like a delicate symphony, with supply and demand playing harmonious tunes. Supply represents the amount of goods or services producers are willing and able to deliver at various prices. Demand, on the other hand, reflects the quantity consumers desire at given prices. When these two forces align, a harmonious rhythm emerges.

Elasticity: A Measure of Sensitivity

The sensitivity of supply and demand to price changes is measured by elasticity. Price elasticity of demand gauges how responsive buyers are to price fluctuations, while price elasticity of supply measures the extent to which suppliers adjust production based on price signals. Elasticity helps us understand how buyers and sellers respond to market changes, informing efficient decision-making.

Achieving Market Equilibrium: The Balancing Act of Supply and Demand

In the dance of economics, the concept of market equilibrium holds sway, where the forces of supply and demand meet to strike a delicate balance. This magical point, where the quantity supplied equals the quantity demanded, is the sweet spot of economic harmony.

Equilibrium price, the meeting point of supply and demand curves, is like a seesaw. As supply increases, pushing the curve to the right, the equilibrium price tends to fall, enticing consumers to buy more. Conversely, when demand rises, shifting the curve to the left, the equilibrium price typically climbs, encouraging producers to increase supply.

Achieving market equilibrium is akin to a game of tug-of-war. Demand-side factors, such as consumer preferences, income levels, and population growth, pull the demand curve higher or lower. On the supply-side, advancements in technology, changes in resource costs, and government subsidies can nudge the supply curve to the right or left.

The result is a dynamic interplay, where the constant jostling of supply and demand forces the market to seek equilibrium. This intricate dance determines market outcomes, influencing the price of goods and services, the quantity produced and consumed, and ultimately the well-being of consumers and producers.

Understanding Price Elasticity

In the realm of economics, where supply and demand dance like partners in a waltz, understanding price elasticity is crucial for deciphering how these forces interact. Price elasticity measures the sensitivity of demand or supply to changes in the price of a good or service.

Price Elasticity of Demand

Let’s delve into the world of consumers first. Price elasticity of demand quantifies how responsive demand is to price changes. When a price rises, consumers may switch to cheaper alternatives or reduce their consumption, leading to elastic demand. On the other hand, if demand remains relatively stable despite price increases, it’s considered inelastic. Factors influencing elasticity include consumer preferences and substitute availability.

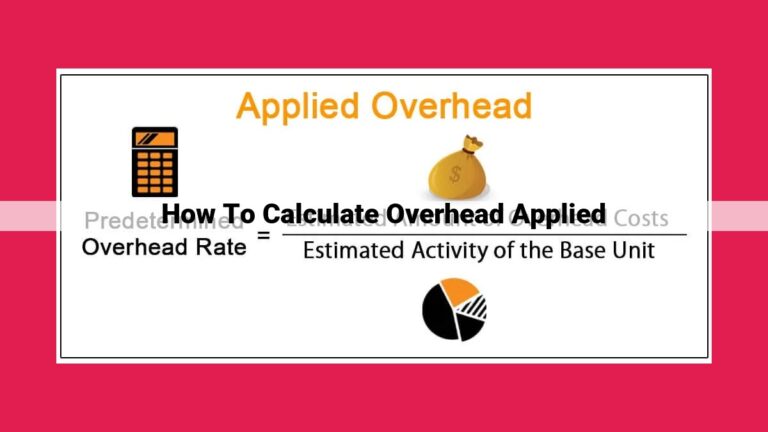

Price Elasticity of Supply

Now, let’s consider the producers’ perspective. Price elasticity of supply measures how flexible supply is when prices fluctuate. If producers can easily ramp up production to meet increased demand at a higher price, supply is elastic. Conversely, when supply is constrained by factors like production costs or resource availability, it’s inelastic. Technological advancements and producer capacity play a role here.

Understanding Elasticity’s Impact

Grasping price elasticity provides invaluable insights for businesses and policymakers. It helps predict consumer and producer behavior, optimize pricing strategies, and craft effective economic policies that foster a healthy market balance.

Shifters of Supply and Demand

Understanding the forces that shift supply and demand curves is crucial for comprehending market dynamics. These factors can significantly alter equilibrium prices and quantities, influencing the market outcomes.

Technological Advancements

Technological breakthroughs can dramatically increase supply by lowering production costs, improving efficiency, or introducing new products. This** shifts the supply curve** to the right, potentially lowering equilibrium prices and increasing equilibrium quantities.

Government Policies

Government regulations, subsidies, and taxes can reshape both supply and demand. For instance, import tariffs increase the cost of imports, shifting demand towards domestic suppliers. Conversely, price ceilings can limit seller revenues, reducing supply and leading to shortages.

Consumer Tastes

Changes in consumer preferences and tastes can shift demand curves. For example, a growing preference for healthy eating can increase demand for organic produce, shifting the demand curve to the right. This can lead to higher equilibrium prices and increased production.

Market Structure

The structure of a market, such as the number of buyers and sellers, also affects supply and demand. In a monopoly, a single seller controls supply, giving them significant market power to influence prices and quantities. Conversely, in a perfectly competitive market, numerous small buyers and sellers participate, limiting individual market influence.

By understanding these shifters, businesses and policymakers can anticipate and respond to changes in market equilibrium. These factors play a critical role in shaping market outcomes, influencing prices, profits, and consumer choices.