Unveiling Job Order Costing: Empowering Profitably Through Specific Production Cost Tracking

Job order costing tracks costs for unique production jobs. It allocates costs into three components: direct materials (directly traceable to jobs), direct labor (attributable to specific jobs), and manufacturing overhead (indirect production costs). Overhead is allocated to jobs using predetermined rates. Each job has a job cost sheet summarizing its costs. Job order costing is crucial for profitability analysis, pricing decisions, and production management, as it provides detailed cost information for specific production orders.

In the realm of manufacturing and production, understanding the true cost of producing goods is paramount for success. Among the various cost accounting methods, job order costing stands out as a valuable tool for businesses that manufacture unique products or execute specific production jobs.

Job order costing provides a detailed and accurate account of all costs incurred during the production of each individual job. This thorough approach ensures that businesses have a clear understanding of their costs, enabling them to make informed decisions regarding pricing, profitability analysis, and production management.

Benefits of Job Order Costing

1. Accurate Cost Tracking:

Job order costing allows businesses to meticulously track the costs associated with each production job. By assigning direct materials, direct labor, and manufacturing overhead costs to specific jobs, businesses gain a granular understanding of their cost structure.

2. Profitability Analysis:

With precise cost data readily available, businesses can pinpoint the profit or loss generated by each job. This information empowers them to identify high-performing jobs and streamline operations for profitability maximization.

3. Pricing Decisions:

Equipped with accurate cost information, businesses can make informed pricing decisions. By understanding the true cost of production, they can set prices that cover their expenses while maintaining competitive margins.

4. Production Management:

Job order costing serves as a valuable tool for managing production processes. By analyzing the costs of various jobs, businesses can identify areas for improvement, reduce waste, and enhance overall efficiency.

Components of Job Order Costing

In the realm of production, understanding the intricacies of job order costing is crucial for any business to accurately track and allocate costs associated with each specific production job. This intricate system relies on three fundamental cost components: direct materials, direct labor, and manufacturing overhead.

Direct Materials

The cornerstone of job order costing, direct materials represent those physical materials that can be directly and unequivocally traced to a specific production job. These materials are often tangible and easy to identify, such as the steel used to fabricate a bridge or the wood utilized in constructing a cabinet. By meticulously tracking direct material costs, businesses gain invaluable insights into the quantities and costs associated with each project.

Direct Labor

Direct labor encompasses the labor costs that can be directly attributed to a particular job. This includes wages and benefits for employees whose primary responsibilities are directly involved in the production process. Artisans crafting a custom-designed piece of furniture, for instance, would be considered direct labor costs. By isolating these labor expenses, businesses can gain a clear understanding of the labor hours and costs required for each job.

Manufacturing Overhead

Manufacturing overhead encompasses all indirect production costs that cannot be directly assigned to a specific job. These costs include expenses such as rent, utilities, insurance, depreciation, and administrative salaries. Unlike direct costs, manufacturing overhead costs are often not easily traced to individual jobs. To account for these indirect costs, businesses employ predetermined overhead rates to systematically allocate manufacturing overhead to each job based on a predefined cost driver, such as direct labor hours or machine hours.

The Essence of the Job: A Cornerstone of Job Order Costing

In the symphony of manufacturing, each product is a distinct melody, and job order costing serves as the conductor, tracking the costs associated with each unique production order. At the heart of this process lies the concept of a job, the foundational element upon which this costing method rests.

A job is defined as a specific, identifiable production order, distinguished by its unique set of costs. It could be an individual product, a customized project, or a batch of items manufactured to meet specific customer requirements. Think of it as a tailor-made suit, crafted meticulously to fit the specifications of each customer’s needs.

Each job is a miniature accounting universe, with its own set of direct materials, direct labor, and manufacturing overhead. These costs are meticulously tracked and allocated to their respective jobs, painting a clear picture of the financial implications of each unique production order.

Direct Materials: The Fabric of the Job

Direct materials are the tangible elements that go into making a product, the threads that weave the fabric of a garment. These materials can be traced directly to a specific job, like the bolts of cloth used in the tailored suit. Their costs are meticulously recorded, ensuring accurate costing for each production order.

Direct Labor: The Artisan’s Touch

Direct labor represents the human effort invested in transforming raw materials into finished goods. It’s the tailor’s deft hands stitching together the garment, giving it shape and form. Direct labor costs are meticulously tracked, ensuring fair compensation for the skilled workers who breathe life into each product.

Manufacturing Overhead: The Hidden Costs of Production

Manufacturing overhead encompasses the indirect costs associated with production, the unseen expenses that support the manufacturing process. These costs can’t be directly traced to a specific job, but they’re essential for the smooth functioning of the production environment. Think of it as the rent for the factory, the electricity that powers the machines, and the salaries of the maintenance crew.

Direct Materials: The Cornerstone of Job Order Costing

When embarking on a new production job, it’s critical to keep a keen eye on the costs involved. That’s where job order costing shines, and direct materials play a pivotal role in this process.

Understanding Direct Materials

Direct materials are the raw materials or components that can be directly linked to the production of a specific job. These materials are physically incorporated into the finished product, making them easily traceable. Think of it as the essential ingredients for your culinary masterpiece.

Tracking Direct Materials

To ensure accurate accounting, direct materials are tracked meticulously throughout the production process. This includes careful monitoring of quantities used and their associated costs. By keeping a watchful eye on these metrics, businesses can accurately allocate material costs to each job.

Impact on Job Costing

Direct materials make up a significant portion of overall production costs. Their accurate tracking is paramount for calculating job profitability and making informed pricing decisions. Without reliable information on direct material costs, businesses may struggle to determine the true cost of their products and services.

Direct materials are the backbone of job order costing, providing businesses with the essential foundation for efficient production and financial decision-making. By carefully tracking and allocating direct material costs, organizations can gain a clear picture of their expenses, optimize production processes, and maximize profitability.

Understanding Direct Labor in Job Order Costing

In the world of business, accurately tracking costs is crucial for profitability and sound decision-making. When it comes to specialized manufacturing processes, job order costing emerges as a valuable tool to allocate costs to specific production jobs. Among its essential components, direct labor stands out as a significant cost category.

Direct labor, as the name suggests, encompasses labor expenses that can be directly linked to a specific job. This includes wages paid to employees who physically work on and contribute to the production of that particular job. Unlike manufacturing overhead, which represents indirect costs, direct labor costs are easily identifiable and quantifiable.

Identifying direct labor costs involves assigning specific labor hours to each job. This can be achieved through the use of time cards or production reports, which meticulously track employee time dedicated to each project. By attributing labor costs directly to jobs, manufacturers gain a clearer understanding of the human resources required for each production task.

Once labor hours are determined, manufacturers must calculate labor rates. These rates are typically based on factors such as job complexity, employee experience level, and prevailing wage rates in the industry. Labor rates are then multiplied by labor hours to arrive at the total direct labor cost for each job.

By capturing direct labor costs accurately, manufacturers empower themselves to:

- Determine the profitability of individual jobs

- Optimize labor allocation for maximum efficiency

- Enhance cost control measures

- Make informed pricing decisions

- Improve overall production planning and scheduling

In conclusion, understanding direct labor is paramount in job order costing. It not only provides valuable insights into labor-related expenses but also serves as a cornerstone for accurate cost allocation, effective production management, and ultimately, improved business outcomes.

Manufacturing Overhead: The Indirect Costs of Production

In the realm of job order costing, understanding the intricacies of manufacturing overhead is crucial. These costs play a pivotal role in capturing all production expenses, even those that can’t be directly traced to specific jobs.

Envision a bustling factory floor, where a symphony of machines hums in unison. Amidst this industrial ballet, various indirect expenses arise, such as the electricity powering the machinery, the salaries of supervisors overseeing production, and the depreciation of the building housing the operation. These expenses are essential to the production process yet cannot be directly assigned to individual jobs.

Examples abound in this realm of indirect costs. The rent paid for the factory, the utilities consumed, and the insurance premiums safeguarding the operation – all fall under this umbrella. Additionally, indirect labor costs for personnel involved in quality control or materials handling are included in manufacturing overhead.

Acknowledging and capturing these indirect expenses is paramount for accurate job costing. By allocating manufacturing overhead to specific jobs, businesses can gain a comprehensive understanding of the true cost of production. This knowledge empowers them to make informed decisions regarding pricing, profitability, and operational efficiency.

Applied Overhead:

- Explain the process of allocating manufacturing overhead to jobs using predetermined overhead rates.

Allocating Manufacturing Overhead to Jobs

In the world of manufacturing, where meticulous cost tracking is crucial, understanding how manufacturing overhead is allocated to jobs is a key aspect of job order costing. Manufacturing overhead, also known as indirect costs, includes expenses that cannot be directly tied to a specific job. These expenses encompass a wide range of items, such as factory rent, utilities, and depreciation on equipment.

To ensure accurate cost allocation, manufacturers use predetermined overhead rates. These rates are calculated based on past experience and estimates of future overhead costs. By applying these rates, manufacturers can distribute overhead costs across jobs in a fair and consistent manner.

For instance, let’s imagine a manufacturing company that uses a predetermined overhead rate of 150% of direct labor costs. This means that for every $1 of direct labor incurred on a particular job, an additional $1.50 is added to the job’s overhead costs. This approach ensures that overhead costs are proportionally distributed based on the level of direct labor required for each job.

The allocation of manufacturing overhead is a critical step in job order costing, as it allows manufacturers to accurately determine the total cost of each job. This information is vital for profitability analysis, pricing decisions, and effective production management. By understanding how manufacturing overhead is allocated to jobs, manufacturers can gain a deeper insight into their production processes and make informed choices to improve their operations.

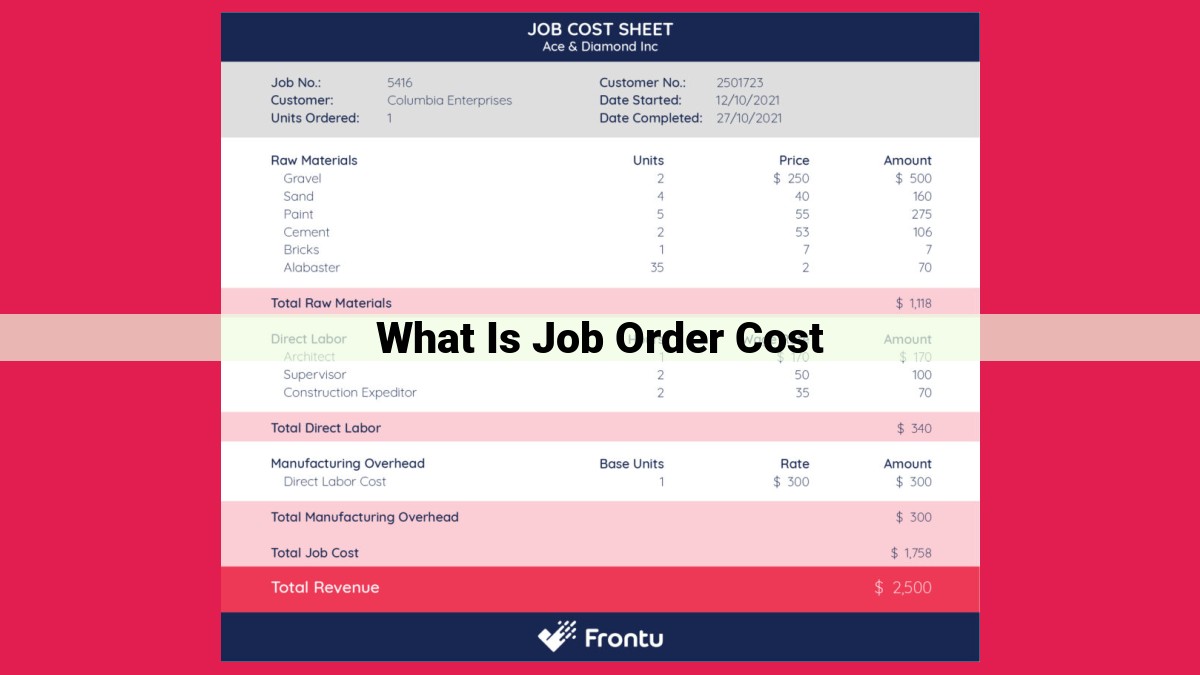

Job Cost Sheet: The Key to Tracking Job Costs

In the intricate world of production, keeping track of the costs associated with each unique job is crucial. This is where the job cost sheet comes into play – a vital document that serves as the comprehensive record of all costs incurred for a specific production order.

Imagine you’re a furniture maker crafting a custom table. Every piece of wood, every hour of labor, and every drop of paint contributes to the final price. The job cost sheet becomes your roadmap, meticulously tracking these costs and ensuring that your profitability is not left to chance.

On this sheet, you’ll find three primary cost components:

-

Direct materials: The raw materials that can be directly traced to the job, such as the wood for your table.

-

Direct labor: The wages paid to the craftspeople who work directly on the job, such as the time spent cutting, sanding, and finishing your table.

-

Manufacturing overhead: The indirect costs that support production but cannot be directly assigned to a specific job, such as factory rent, utilities, and equipment depreciation.

These costs are then allocated to the job using predetermined overhead rates, ensuring that each component bears its fair share of the total production cost.

The job cost sheet is a living document, updated regularly as materials are used, labor is performed, and overhead costs are incurred. It provides a real-time snapshot of the job’s financial status, allowing you to monitor progress and make informed decisions.

By analyzing the job cost sheet, you can:

-

Assess profitability: Calculate the difference between the total production cost and the sale price to determine if the job is profitable.

-

Set prices: Use the cost information to inform your pricing decisions, ensuring that you cover all expenses and generate a reasonable profit.

-

Optimize production: Identify areas where costs can be reduced without sacrificing quality, streamlining your production process and maximizing efficiency.

The job cost sheet is an invaluable tool for any business engaged in job-order costing, providing the foundation for accurate cost accounting, informed decision-making, and ultimately, profitability.

The Importance of Job Order Costing: Unlocking Profitability and Efficiency

In the manufacturing world, understanding the costs associated with producing specific items is crucial for profitability and operational success. This is where job order costing comes into play – a valuable tool that provides detailed cost accounting for individual production jobs.

Job order costing enables manufacturers to accurately track and allocate costs to each job, ensuring that they have a clear understanding of the profitability of each project. By identifying inefficiencies and optimizing production processes, it empowers businesses to make informed decisions that enhance profitability.

Furthermore, job order costing plays a vital role in setting accurate pricing strategies. By knowing the exact costs involved in producing each item, manufacturers can determine appropriate prices that ensure a reasonable profit margin while remaining competitive in the market. This prevents both underpricing and overpricing, maximizing revenue and profitability.

In addition, job order costing provides valuable insights for production management. It helps identify areas where costs can be reduced and efficiency can be improved. By analyzing the cost data from previous jobs, manufacturers can make data-driven decisions to optimize material usage, minimize labor costs, and reduce overhead expenses, ultimately leading to higher profit margins and improved production efficiency.