Job Order Costing: A Comprehensive Guide For Manufacturing Cost Control

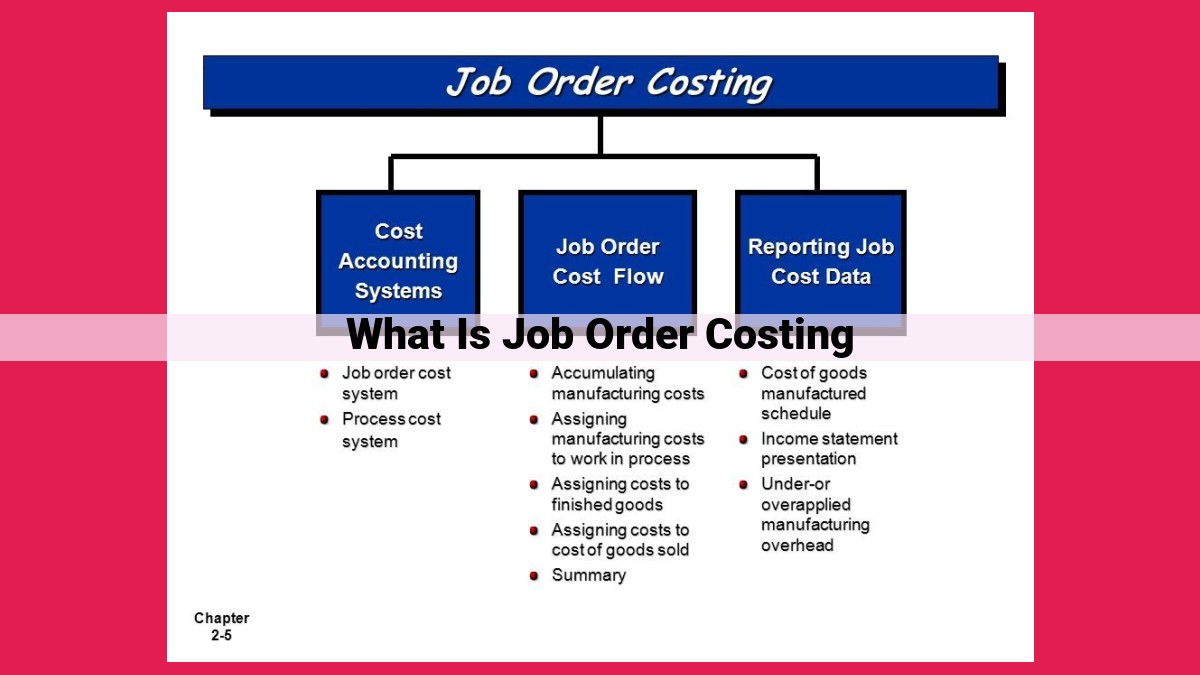

Job order costing (JOC) is a costing method used in manufacturing environments to assign costs to individual production jobs or batches. It involves tracking direct materials, direct labor, and manufacturing overhead incurred for each job, and allocating overhead costs using appropriate methods. JOC provides accurate cost information for specific jobs, enabling decision-making, pricing, inventory management, and cost control. However, it can be complex and time-consuming compared to other costing methods, requiring robust record-keeping and cost tracing.

In the realm of accounting, Job Order Costing (JOC) plays a crucial role in providing precise cost data for unique production jobs. Unlike other costing methods, JOC tracks costs individually for each job, allowing businesses to understand the true cost structure of their products or services. This specialized costing system is particularly valuable for organizations that produce custom or one-of-a-kind items.

Defining Job Order Costing: A Closer Look

JOC is a comprehensive methodology designed to accumulate and assign costs to specific production jobs. Each job is treated as a self-contained cost center, and all costs incurred in producing that particular job are meticulously captured. This granular approach provides unparalleled visibility into the costs associated with each project.

How Job Order Costing (JOC) Works: A Step-by-Step Guide

In job order costing (JOC), each production order is treated as a separate job. Each job has its own dedicated job cost sheet, which tracks the costs incurred during production.

Concept of a Job

A job is a distinct production order that is unique in terms of its specifications, materials, and manufacturing process. Examples of jobs could be custom-designed furniture, specialized machinery, or limited-edition artwork. JOC is ideal for low-volume, high-variety production environments where each job has distinct characteristics.

Job Cost Sheet and Its Components

The job cost sheet is the centerpiece of JOC. It tracks three main cost categories:

- Direct materials: Materials that can be directly traced to a specific job, such as wood for a custom-built cabinet or fabric for a tailored suit.

- Direct labor: The wages of employees who work directly on the job, including time spent on assembly, fabrication, or finishing.

- Manufacturing overhead: The indirect costs of production that cannot be traced directly to a specific job, such as rent, utilities, and depreciation of equipment.

Tracking Direct Materials, Direct Labor, and Manufacturing Overhead

JOC meticulously tracks each cost category throughout the production process. Direct materials are charged to the job as they are used. Direct labor is recorded as employees work on the job. Manufacturing overhead costs are allocated to the job using various methods, such as direct labor hours or machine hours.

This detailed cost tracking allows businesses to accurately determine the total cost of each job. This information is essential for pricing products, evaluating profitability, and making informed decisions about production processes.

Application of Manufacturing Overhead

In Job Order Costing (JOC), accurate overhead cost allocation is crucial for determining the true cost of each job. Manufacturing overhead comprises indirect costs that cannot be directly traced to specific jobs but are essential for production.

Allocation Methods

- Direct Labor Hours: Overhead costs are allocated based on the number of direct labor hours worked on the job. This method is straightforward but may not reflect the actual resource consumption.

- Machine Hours: Similar to direct labor hours, overhead is allocated based on the machine hours used. This method is suitable for capital-intensive operations.

Importance of Overhead Cost Estimation

Accurate overhead cost estimation is critical because underestimating can lead to inflated job costs, while overestimating can result in unprofitable jobs. Managers must carefully consider historical data, industry benchmarks, and production volume to derive reasonable overhead rates.

By correctly allocating manufacturing overhead, JOC provides detailed insights into the cost structure of each job, enabling businesses to make informed decisions regarding pricing, product mix, and resource utilization.

Cost Flow in Job Order Costing

In the job order costing system, costs flow through two primary inventory accounts: work in process inventory and finished goods inventory. Comprehending these accounts is crucial for understanding how costs are accumulated and reported throughout the production process.

Work in Process Inventory

Work in process (WIP) inventory represents the costs associated with jobs that are still in production. It includes the costs of direct materials, direct labor, and manufacturing overhead that have been incurred to date. As materials are issued to production, labor is performed, and overhead costs are applied, the WIP inventory account increases.

The WIP inventory account is significant because it provides a snapshot of the current status of production costs. By analyzing WIP inventory, management can gain insights into:

- Production efficiency: High WIP balances may indicate production delays or bottlenecks.

- Cost control: Tracking WIP inventory helps identify areas where costs can be optimized.

- Scheduling: Accurate WIP inventory data supports effective production planning and scheduling.

Finished Goods Inventory

Once a job is completed, its total cost is transferred from WIP inventory to finished goods inventory. Finished goods inventory represents the costs of products that are ready for sale. When products are sold, the cost of goods sold is recognized, and the corresponding balance in finished goods inventory is reduced.

Maintaining an appropriate level of finished goods inventory is essential for meeting customer demand while minimizing storage and obsolescence costs. By monitoring finished goods inventory, companies can ensure:

- Customer satisfaction: Adequate finished goods inventory levels ensure that customers receive products on time.

- Revenue optimization: Having sufficient finished goods inventory minimizes lost sales due to stockouts.

- Inventory control: Careful inventory management helps prevent overstocking and minimize the risk of product deterioration.

Understanding the cost flow in job order costing, particularly the significance of WIP and finished goods inventory, is vital for effective cost management, inventory planning, and overall business success.

Unlock the Power of Job Order Costing: Advantages for Enhanced Cost Management

Accurate Cost Information for Individual Jobs

Job Order Costing (JOC) grants businesses the razor-sharp ability to pinpoint the exact costs associated with each unique job or project. By meticulously tracking direct materials, direct labor, and manufacturing overhead, JOC provides an unparalleled level of detail that enables companies to confidently price their products or services and make informed decisions based on real-time cost data.

Support for Decision-Making and Pricing

The granular cost information derived from JOC empowers decision-makers with invaluable insights. They can identify areas where costs can be optimized, allocate resources efficiently, and set competitive prices that reflect the true value of each job. This data-driven approach allows businesses to make strategic choices that drive profitability and outperform competitors.

Enhanced Inventory Management and Cost Control

JOC plays a pivotal role in inventory management and cost control. By tracking materials and labor used in each job, businesses gain real-time visibility into their inventory levels. This heightened awareness enables them to minimize waste, prevent overstocking, and optimize purchasing decisions. Additionally, the accurate cost information provided by JOC helps companies manage costs effectively, ensure profitability, and stay ahead of the competition in a dynamic market.

Disadvantages of Job Order Costing: The Price of Precision

While Job Order Costing (JOC) offers unparalleled visibility into individual job costs, it comes with certain drawbacks that cannot be ignored. One notable disadvantage lies in its complexity and time consumption. Compared to simpler costing methods, JOC requires a meticulous tracking of direct materials, direct labor, and manufacturing overhead for each job. This intricate process can be laborious and time-intensive, especially for organizations with high-volume job production.

Another challenge with JOC is the potential for cost tracking inaccuracies. The accuracy of JOC heavily relies on precise data collection and allocation. Even minor discrepancies in tracking or estimation can lead to distorted cost information, impacting decision-making and financial reporting. To mitigate this risk, organizations must implement robust data validation procedures and ensure accurate record-keeping throughout the job costing lifecycle.

Finally, JOC demands robust record-keeping and cost tracing. Maintaining accurate job cost sheets and supporting documentation is crucial for effective cost tracking. This can be a significant burden for organizations with complex or large-scale job operations. The requirement for detailed record-keeping not only increases administrative overhead but also poses a challenge in maintaining data integrity and ensuring timely access to cost information.