Inventory Shrinkage: Detection, Measurement, And Impact On Financial Statements

Inventory shrinkage is reported in financial statements by adjusting the inventory balance on the balance sheet to reflect estimated shrinkage and recognizing it as an expense on the income statement. The shrinkage adjustment reduces the value of inventory, while the expense recognition captures the cost of the loss in inventory. Additionally, disclosures in the notes to financial statements provide transparency about shrinkage policies, risks, and impacts.

Recognizing Inventory Shrinkage: The Cornerstone of Accurate Financial Reporting

Maintaining inventory accuracy is crucial for businesses to prevent costly shrinkage. Accurate inventory records ensure that businesses know what they have on hand, which helps them optimize stock levels, reduce waste, and prevent losses. Counting inventory regularly, implementing robust control measures, and managing inventory efficiently are essential steps in minimizing shrinkage.

Effective inventory management involves setting up systems and processes that reduce the risk of theft, damage, and obsolescence. This includes establishing clear inventory policies, training employees on handling and storage procedures, and conducting regular audits. By addressing potential causes of shrinkage head-on, businesses can proactively safeguard their inventory assets.

Estimating Inventory Shrinkage: A Path to Inventory Accuracy

Introduction:

Inventory shrinkage is an unavoidable reality in the world of business. It’s the unfortunate loss of inventory due to various factors, including theft, damage, evaporation, and administrative errors. Estimating inventory shrinkage accurately is crucial for businesses to maintain transparency in their financial statements and gain a clear understanding of their inventory health.

Physical Inventory:

The most common method of estimating inventory shrinkage is conducting a physical inventory. This involves counting the physical inventory on hand and comparing it to the inventory records. Physical inventories are typically conducted at regular intervals, such as monthly or quarterly, to ensure accuracy.

Observation:

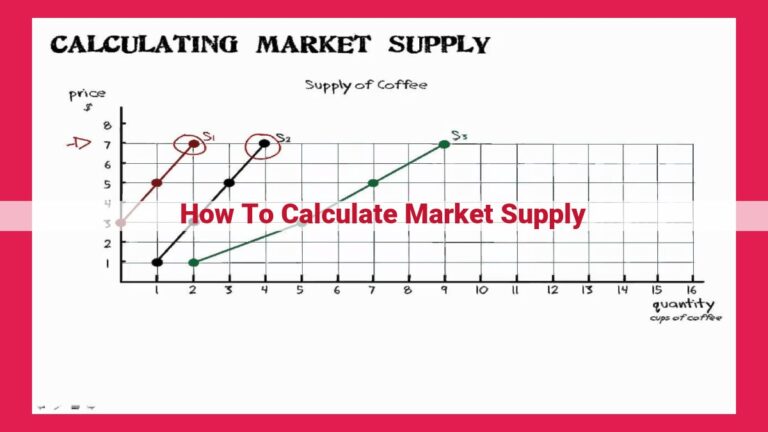

Observation involves closely monitoring inventory levels and observing any unusual activities that could indicate shrinkage. Discrepancies between the expected inventory levels and the actual inventory levels can be a sign of potential shrinkage.

Sampling:

Sampling is a statistical method used to estimate inventory shrinkage. It involves selecting a representative sample of the inventory and conducting a physical count. The results of the sample are then extrapolated to estimate the shrinkage for the entire inventory.

Statistical Analysis:

Statistical analysis techniques, such as regression analysis and time series analysis, can also be used to estimate inventory shrinkage. These methods analyze historical data to identify trends and patterns that can help predict future shrinkage levels.

By utilizing these methods, businesses can gain a better understanding of their inventory shrinkage and take proactive measures to minimize its impact.

Reporting Inventory Shrinkage on the Balance Sheet

In the realm of financial accounting, the hallowed halls of the balance sheet stand as the epicenter of a company’s financial well-being. Amidst its labyrinthine entries, inventory emerges as a cornerstone asset, reflecting the raw materials, work-in-progress, and finished goods that fuel the engine of commerce. However, as the tides of business ebb and flow, an insidious force known as inventory shrinkage lurks in the shadows, threatening to diminish the value of this precious asset.

To effectively combat this elusive adversary, a firm understanding of inventory classification is paramount. Current assets are the lifeblood of a company’s day-to-day operations, and inventory falls squarely within this category. As a vital component of current assets, inventory directly impacts the calculation of a company’s working capital, a crucial metric that measures its ability to meet its short-term obligations.

In order to maintain the integrity of the balance sheet, adjustments must be made to account for the inevitable shrinkage of inventory. These adjustments come in the form of inventory valuation adjustments and allowance for shrinkage. Let us delve into each of these concepts in greater detail:

-

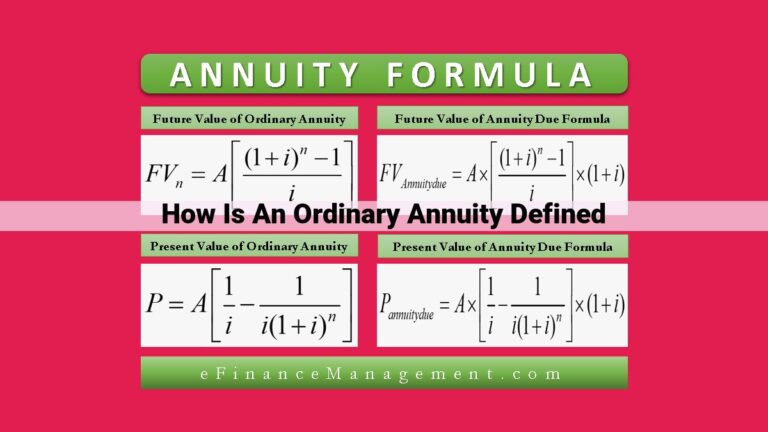

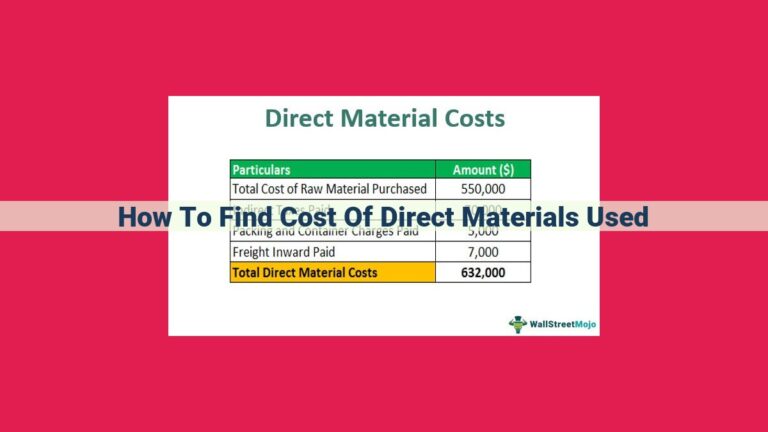

Inventory Valuation Adjustments: Shrinkage, the bane of inventory managers, can stem from a multitude of factors, including theft, damage, and obsolescence. To accurately report the value of inventory on the balance sheet, companies employ techniques such as physical inventory counts, observation, and statistical analysis to estimate the extent of shrinkage. The resulting estimate is subsequently deducted from the gross inventory value, providing a more realistic representation of the inventory’s worth.

-

Allowance for Shrinkage: To further safeguard the balance sheet from the vagaries of inventory shrinkage, companies may establish an allowance for shrinkage. This account functions as a reserve, absorbing the financial impact of shrinkage without distorting the value of inventory itself. The allowance is typically set up as a contra-asset account, offsetting the inventory balance on the balance sheet.

By meticulously adhering to these accounting principles, companies can ensure the accuracy and transparency of their financial statements. This precision not only enhances the reliability of the information presented to stakeholders but also bolsters investor confidence and facilitates informed decision-making.

Expense Recognition of Inventory Shrinkage

When it comes to financial reporting, accurately accounting for inventory shrinkage is crucial for maintaining the integrity of your balance sheet and income statement. Inventory shrinkage, the loss of inventory due to theft, damage, or other reasons, can have a significant impact on a company’s financial performance.

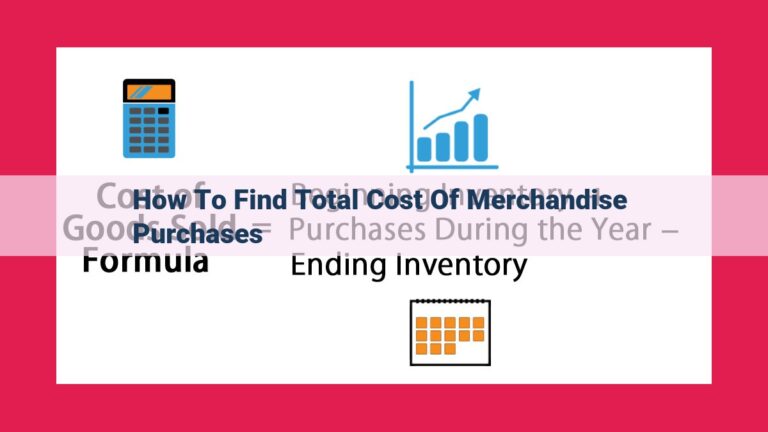

There are two primary options for recognizing inventory shrinkage as an expense: cost of goods sold (COGS) or operating expenses. The choice between these options depends on the nature of the shrinkage and the company’s accounting policies.

If shrinkage is considered an ordinary and necessary cost of doing business, it is typically expensed as COGS. This is because shrinkage is an inherent part of inventory management and is not related to specific operating activities. By including shrinkage in COGS, the company’s gross profit is reduced, reflecting the true cost of goods sold.

Alternatively, if shrinkage is considered an abnormal or unusual loss, it may be expensed as an operating expense. This is appropriate when the shrinkage is due to a specific event, such as a theft or a natural disaster. By expensing shrinkage as an operating expense, the company’s operating income is reduced, highlighting the impact of the loss.

Regardless of the chosen expense recognition method, it is essential to consistently apply it from period to period to ensure comparability and accuracy in financial reporting. Additionally, companies should disclose their inventory shrinkage policies and expense recognition methods in the notes to financial statements. This transparency provides users with a clear understanding of how the company accounts for inventory shrinkage and its impact on financial performance.

Disclosure of Inventory Shrinkage for Enhanced Transparency

Inventory shrinkage, an unfortunate but unavoidable reality in business, has significant implications for financial statements. To ensure accuracy and transparency, disclosures play a pivotal role in informing stakeholders about the company’s approach to managing and reporting shrinkage.

Notes to Financial Statements

The notes to financial statements provide a detailed account of shrinkage policies and their impact on the company’s financials. Here, management can disclose the methodologies used to estimate shrinkage, the rationale behind shrinkage allowance, and any assumptions made in the process. By providing such information, stakeholders gain a deeper understanding of the company’s control and management practices related to inventory.

Supplementary Information

In addition to the notes to financial statements, companies may choose to provide supplementary information that further elaborates on shrinkage. This information could include historical trends in shrinkage rates, analysis of the causes and consequences of shrinkage, and the effectiveness of different shrinkage mitigation strategies. By disclosing such details, companies demonstrate their commitment to transparency and proactive risk management.

Management’s Discussion and Analysis (MD&A)

The MD&A section of the annual report serves as a platform for management to discuss significant risks and uncertainties facing the company. Inventory shrinkage can be a material risk, especially in industries with high-value or perishable goods. In the MD&A, management can highlight the potential impact of shrinkage on the company’s operations, financial performance, and reputation. By acknowledging these risks and disclosing the company’s strategies to mitigate them, stakeholders gain valuable insights into the company’s risk management capabilities.

Transparency through disclosure is essential for stakeholders to fully understand a company’s inventory management practices and the impact of inventory shrinkage on its financial statements. By providing detailed information in the notes to financial statements, supplementary information, and MD&A, companies can enhance their credibility and demonstrate their commitment to accurate and transparent reporting. Such disclosures foster trust among stakeholders and support sound investment decisions.