Understanding Inflationary Expenditure Gaps: Causes, Impacts, And Solutions

An inflationary expenditure gap occurs when aggregate expenditure exceeds real output. This can be caused by factors such as increased consumer spending, investment, government spending, or net exports. As a result, excess demand is created, driving up prices and leading to inflation. This inflationary expenditure gap becomes persistent when the economy’s capacity to produce (real output) cannot keep up with the high demand. It can be rooted in both demand-pull inflation (excessive aggregate expenditure) and cost-push inflation (rising production costs).

Understanding Inflationary Expenditure Gaps

Defining the Gap:

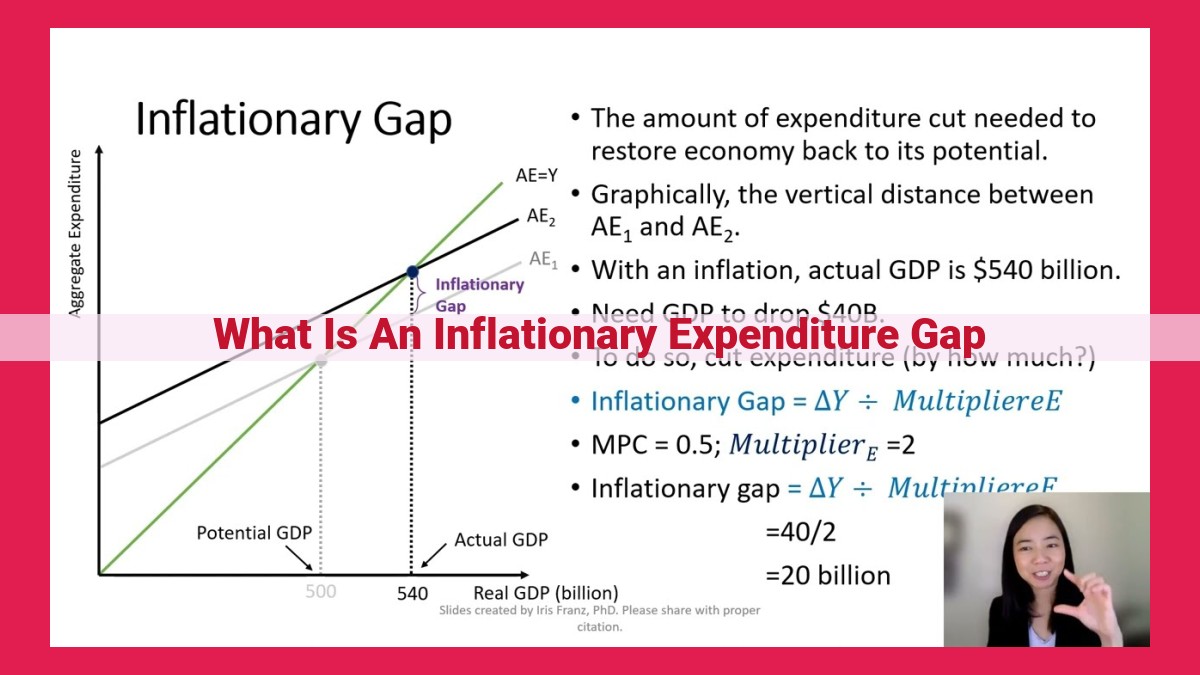

Inflationary expenditure gaps occur when aggregate expenditure, the total demand for goods and services in an economy, exceeds real output, the actual production of goods and services. In this scenario, demand outstrips supply, leading to an excess demand situation.

Related Concepts:

Aggregate expenditure is composed of four major components: consumption, investment, government spending, and net exports. Real output, on the other hand, represents the economy’s potential production level at full employment. Understanding the relationship between these concepts is crucial for grasping inflationary expenditure gaps.

Components of Aggregate Expenditure

Understanding the factors that influence aggregate expenditure is crucial for comprehending inflationary expenditure gaps. Aggregate expenditure encompasses everything spent in an economy, including consumption, investment, government spending, and net exports.

Consumption represents the spending by households on goods and services. It constitutes the most significant component of aggregate expenditure, driven by factors such as disposable income, consumer confidence, and expectations about future income.

Investment refers to businesses spending on new capital goods, such as machinery, equipment, and factories. It is influenced by factors like interest rates, profitability expectations, and technological advancements.

Government spending includes expenditures by federal, state, and local governments on goods and services, transfer payments, and infrastructure projects. It can stimulate aggregate expenditure and economic growth in certain circumstances.

Net exports represent the difference between a country’s exports and imports. If exports exceed imports, it results in a positive net export, adding to aggregate expenditure. Conversely, if imports exceed exports, it would have a dampening effect.

Interplay of Components

The overall level of aggregate expenditure is a result of the combined impact of these components. Changes in any component can have significant consequences for the economy. For example, increased consumer confidence can boost consumption, leading to higher aggregate expenditure and potential inflationary pressures. Similarly, reduced investment due to uncertain economic conditions can decrease aggregate expenditure, potentially slowing economic growth.

Understanding the components of aggregate expenditure provides economists and policymakers with valuable insights for managing inflation and promoting economic stability.

Real Output vs. Potential Output: The Economy’s Production Capacity

Real output, the actual production level in the economy, tells the story of what’s being produced right now, this very moment. It’s a snapshot of our industriousness, a measure of our collective efforts.

On the other hand, potential output is like a distant star, shining bright with the promise of what our economy is capable of achieving. It represents the production level we could reach if every willing and able worker had a job and businesses were operating at their peak efficiency.

The relationship between real output and potential output is crucial for understanding inflation. When real output falls below potential output, we have slack in the economy. Factories are idle, workers are unemployed, and resources are underutilized. This gap creates room for growth without triggering inflation.

However, when real output exceeds potential output, the story changes. This is where our economy is working overtime, pushing beyond its sustainable limits. This imbalance creates an inflationary expenditure gap, where demand outstrips supply, leading to higher prices and the dreaded specter of inflation.

Excess Demand and Inflationary Pressures: A Threat to Economic Stability

In the realm of economics, excess demand emerges when the aggregate expenditure, the total spending in an economy, outstrips the potential output, the full employment production level. This imbalance unleashes a chain reaction that can ignite an inflationary expenditure gap.

Imagine a scenario where consumers, businesses, and the government are all spending exuberantly. This surge in aggregate expenditure would create a positive gap between spending and output. As the economy operates beyond its limits, it inevitably faces supply constraints. Producers struggle to meet the insatiable demand, driving up prices and inflation.

This persistent phenomenon of inflationary expenditure gaps is a major concern for policymakers. It can lead to a vicious cycle of rising prices, eroding purchasing power, and diminished economic growth.

To combat excess demand, central banks typically resort to monetary policy tools, such as raising interest rates. Higher interest rates make borrowing more expensive, which cools down spending and brings aggregate expenditure closer to potential output. However, this strategy often comes with the trade-off of slower economic growth.

Cost-Push Inflation: When Rising Costs Fuel Price Increases

Understanding Inflation

Imagine a scenario where the prices of everyday items you buy, such as groceries, gas, and clothing, keep rising steadily. This phenomenon is called inflation. When inflation becomes persistent and significant, it can erode the value of our money, making it harder to afford necessities.

Cost-Push Inflation: A Tale of Rising Costs

One type of inflation, known as cost-push inflation, occurs when the cost of producing goods and services increases. Think of it like this: when businesses spend more to make their products, they may pass on these increased costs to consumers by raising prices.

Factors Driving Cost-Push Inflation

Several factors can contribute to cost-push inflation. Rising wages is one major driver. When workers demand higher pay, businesses may have to raise product prices to cover the increased labor costs. Similarly, increasing raw materials prices can also lead to cost-push inflation. For example, if the cost of cotton or steel rises, companies that use these materials in their products may have to increase prices to maintain profitability.

Energy costs are another significant factor in cost-push inflation. When energy prices rise, businesses may have to pay more for electricity, transportation, and other energy-intensive operations. This can trickle down to the prices of goods and services we buy.

Impact of Cost-Push Inflation

Cost-push inflation can have several negative consequences for consumers and the economy:

- Reduced Purchasing Power: When prices rise, your money buys less. This means you can afford fewer goods and services, affecting your overall standard of living.

- Lower Investment: When businesses face increased costs, they may be less likely to invest in new equipment, hiring, and expansion. This can slow down economic growth.

- Eroded Savings: If inflation outpaces your savings rate, the value of your savings can decline over time. This can make it harder to achieve financial goals.

Demand-Pull Inflation: Unraveling the Excessive Demand Enigma

Inflation, the persistent rise in the general price level, can be triggered by various factors. One such factor is demand-pull inflation, which occurs when aggregate expenditure, the total spending in an economy, exceeds the economy’s capacity to produce goods and services. In this article, we’ll delve into the concept of demand-pull inflation, its causes, and its consequences.

Understanding Demand-Pull Inflation

Demand-pull inflation arises when aggregate expenditure surpasses the economy’s potential output, the maximum level of production achievable with full employment. This excessive demand creates a situation where businesses can raise prices without losing customers, as consumers are eager to purchase the available goods and services.

Causes of Demand-Pull Inflation

Multiple factors can contribute to demand-pull inflation. Strong consumer spending is a major driver, as increased household income and confidence boost consumer purchasing power. Similarly, high investment can fuel demand as businesses expand and purchase new equipment and facilities.

Government spending also plays a role when it increases beyond the economy’s ability to produce, creating an imbalance between demand and supply. Additionally, net exports can contribute to demand-pull inflation if exports rise faster than imports, leading to increased demand for domestic goods and services.

Consequences of Demand-Pull Inflation

Demand-pull inflation has several consequences for the economy. Rising prices can erode the purchasing power of consumers, making it more difficult for them to afford basic necessities. It can also lead to higher interest rates as central banks attempt to curb inflation, which can slow down economic growth.

Moreover, demand-pull inflation can create a wage-price spiral. As businesses raise prices to cover their increased costs, workers demand higher wages to compensate for the higher cost of living. This can lead to a vicious cycle where rising wages and prices mutually reinforce each other.

Demand-pull inflation is a complex economic phenomenon that can have significant consequences for consumers, businesses, and the overall economy. Understanding its causes and mechanisms is crucial for policymakers and individuals alike to make informed decisions and mitigate its potential negative effects.

Economic Growth and Inflation

The Interplay of Progress and Price Stability

Economic growth is the foundation of any thriving society, promising increased prosperity and improved living standards. However, this pursuit of progress can come at a cost when growth outpaces an economy’s capacity to produce. This imbalance creates an inflationary expenditure gap, where aggregate expenditure (total spending in the economy) exceeds potential output (the economy’s optimal production level at full employment).

Demand-Driven Inflation

When growth exceeds the economy’s capacity, demand for goods and services outstrips supply. This excessive spending, known as demand-pull inflation, drives up prices as businesses struggle to meet demand. Strong consumer spending, robust investment, aggressive government spending, and positive net exports can all contribute to this inflationary pressure.

The Phillips Curve Trade-Off

Economists have long grappled with the Phillips curve, a theoretical relationship between inflation and unemployment. Historically, periods of high economic growth have often coincided with low unemployment rates. However, this relationship is not without its limits. As growth accelerates, the economy may reach a point where further growth cannot be sustained without pushing up prices. This trade-off presents policymakers with a delicate balancing act, seeking to maximize growth while minimizing inflation.

Managing Economic Growth and Inflation

Navigating the relationship between economic growth and inflation requires a carefully calibrated approach. Central banks play a crucial role in controlling inflation by adjusting interest rates. Higher interest rates can dampen aggregate expenditure, reducing demand and easing inflationary pressures. Fiscal policy, managed by governments, can also be used to influence economic growth and inflation. Prudent spending and tax policies can help stabilize demand and avoid overheating the economy.

Economic growth and inflation are intertwined forces, each with its own benefits and challenges. Understanding their interplay is essential for policymakers seeking to foster sustainable economic progress while maintaining price stability. By striking the right balance, economies can reap the rewards of growth without sacrificing price stability, ensuring both prosperity and financial well-being for all.