Inflation: Understanding Its Impact And Economic Consequences

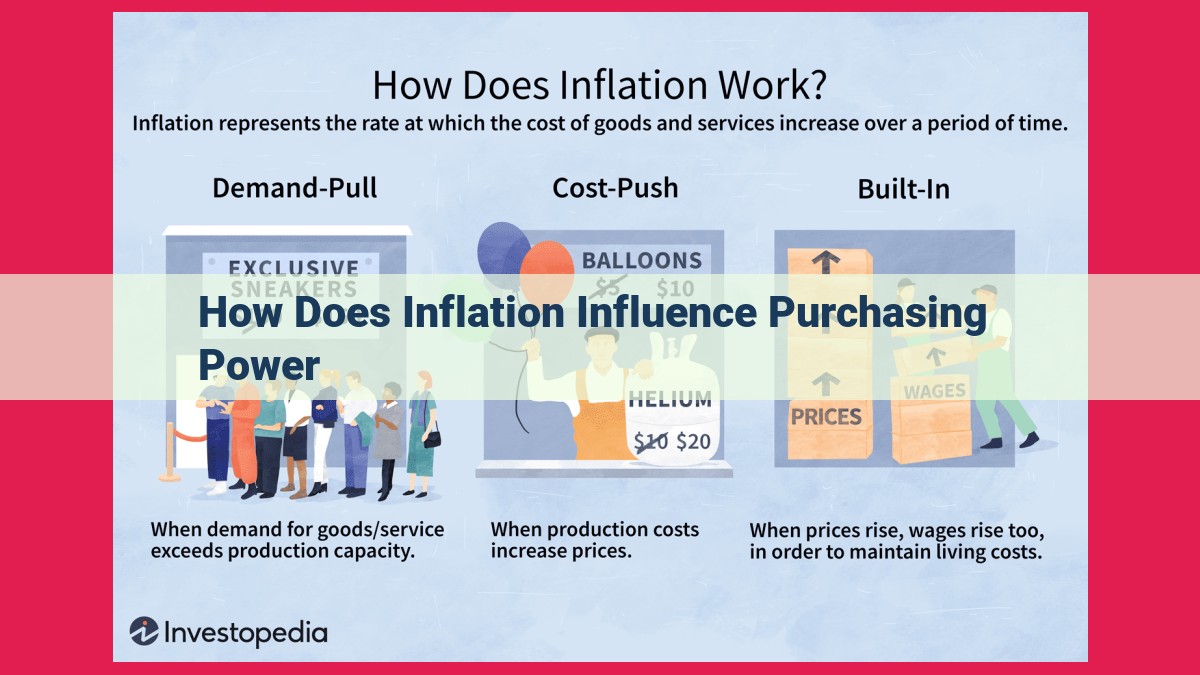

Inflation erodes purchasing power by increasing the cost of goods and services. As inflation rises, daily necessities and desired lifestyles become less affordable due to higher prices. Housing, food, and transportation living expenses increase, straining household budgets. Extreme inflation (hyperinflation) can collapse currency value, destabilize economies, and drastically reduce purchasing power. Stagflation occurs when inflation coexists with economic stagnation, leading to reduced spending and a weakened economy. Inflation can result from increased demand (demand-pull) or rising production costs (cost-push), both of which reduce purchasing power.

How Inflation Eats Away at Your Purchasing Power: A Tale of Lost Value

In the realm of economics, inflation looms like an ever-present specter, its insidious grip eroding the purchasing power of our hard-earned money. Purchasing power is simply the ability to buy goods and services with the currency we possess. But when inflation rears its ugly head, it subtly undermines this power, making it harder to afford the things we need and desire.

Imagine a world where a loaf of bread used to cost $1, and your monthly income was $100. You could easily afford 100 loaves of bread. But with inflation, the price of bread creeps up to $1.20. Suddenly, your income can only buy you 83 loaves. This seemingly small increase in bread price has shrunk your purchasing power by 17%.

The insidious nature of inflation lies in its widespread impact. It’s not just bread that gets more expensive; it’s groceries, housing, transportation, and everything else you spend your money on. As prices rise across the board, your cost of living inevitably increases. The same amount of money you used to live comfortably now leaves you stretching to make ends meet.

In extreme cases, inflation can spiral out of control, leading to hyperinflation. This is when prices soar at an alarming rate, causing the value of currency to plummet. People lose faith in their money, and the economy suffers severe disruptions.

The consequences of inflation are far-reaching. It can lead to stagflation, a dreaded combination of inflation and economic stagnation. In this scenario, consumers spend less, businesses struggle to grow, and the economy takes a nosedive.

Understanding the types of inflation can help us better grasp its impact on purchasing power. Demand-pull inflation occurs when demand for goods and services exceeds supply, driving prices up. Cost-push inflation, on the other hand, results from rising production costs, which are passed on to consumers as higher prices.

Conversely, deflation is a decline in the general price level. While this may seem like a positive development, it can also be harmful to the economy as it reduces demand and investment.

Inflation is a complex economic phenomenon with far-reaching consequences. By understanding its impact on purchasing power, we can better appreciate the value of our hard-earned money and make informed decisions about how we spend it.

How Inflation Chills Your Purchasing Power

Inflation is the nightmare that transforms your hard-earned cash into a shrinking value; it’s like watching your money evaporate before your eyes.

As prices soar, the goods and services you once took for granted become elusive luxuries. Your dollar struggles to stretch as far as it used to, leaving you with a gnawing sense of unease. Daily necessities like groceries and housing become more burdensome, while maintaining the lifestyle you’ve grown accustomed to seems like an unattainable dream.

Take, for example, a loaf of bread that cost you $1 last year. With inflation, it might now cost you $1.50. This doesn’t just mean you have less bread for the same amount of money; it means that every dollar you have is worth less. Your purchasing power has been eroded.

The same grim reality extends to transportation costs. The price of gasoline or bus fares climbs steadily, eating away at your monthly budget. Suddenly, it becomes harder to get to work, run errands, or simply enjoy a leisurely drive.

The impact of inflation is a vicious cycle. As prices rise, wages struggle to keep pace. This means that your real income—what you earn adjusted for inflation—begins to dwindle. You may find yourself working harder for the same or even less, leaving you with a sense of frustration and despair.

Inflation’s Impact on the Rising Cost of Living

Inflation, a persistent increase in the general price level, has a profound impact on our daily lives. It erodes our purchasing power, making it increasingly difficult to afford essential goods and services. While inflation affects all aspects of life, it notably drives up the cost of living in several key areas.

Housing: A Growing Burden

Housing expenses represent a significant portion of household budgets. Inflationary pressures have pushed up both rent and mortgage payments. Landlords pass on increased costs of utilities, maintenance, and property taxes to tenants, leading to rising rents. Similarly, mortgage rates have climbed, making it more challenging for homeowners to keep up with their monthly payments.

Food: Feeding the Inflationary Cycle

Food is another essential expense that has felt the sting of inflation. Rising costs of transportation, labor, and raw materials have trickled down to grocery bills. Consumers face higher prices for fresh produce, meats, and dairy products. This has particularly impacted low-income households, who spend a larger proportion of their income on food.

Transportation: Fueling Inflationary Concerns

Transportation costs are heavily influenced by inflation, primarily due to fluctuations in fuel prices. Rising oil prices have led to increased gas and diesel prices at the pump. This, in turn, raises the cost of public transportation and goods transported by trucks. As a result, consumers are spending more to get around and receive the items they need.

Inflation’s effects on the cost of living are undeniable. Increased housing expenses, food prices, and transportation costs put a strain on household budgets, making it challenging to maintain a desired lifestyle. Understanding these impacts is crucial in making informed financial decisions and advocating for policies that mitigate inflation’s burden on consumers.

**Stagflation: A Tale of Inflation and Economic Woes**

Imagine a peculiar economic twilight zone, where the cost of living spirals out of control but the economy seems to grind to a halt. This perplexing phenomenon is known as stagflation, a cruel combination of inflation and economic stagnation.

In stagflation, prices soar like a runaway train while businesses languish, unemployment rises, and consumer spending plummets. It’s like a cruel joke played by the economy, leaving individuals and businesses alike feeling lost and bewildered.

The root of stagflation often lies in a mismatch between supply and demand. When demand for goods and services outpaces supply, prices surge. However, if the economy is not growing fast enough to create new jobs and income, people can’t afford the higher prices.

Furthermore, supply-side shocks, such as rising oil prices or labor shortages, can drive up production costs, which are passed on to consumers as higher prices. This cost-push inflation further exacerbates the stagflation problem.

The consequences of stagflation can be dire. Reduced consumer spending weakens the economy, leading to job losses and business closures. Governments find themselves in a quandary, attempting to tame inflation without stifling growth further.

Stagflation is a potent reminder that the economy is a complex beast, and sometimes it can throw us some real curveballs. Understanding its causes and consequences is crucial for navigating these economic storms and ensuring a more stable and prosperous future.

Hyperinflation: The Crippling Grip of Extreme Inflation

Imagine a world where the currency you hold in your hand loses its value so rapidly that you can barely keep up. Prices soar to astronomical heights, making it impossible to afford even the most basic necessities. This is the terrifying reality of hyperinflation, an extreme form of inflation that can cripple economies and shatter lives.

Collapse of Currency Value:

Hyperinflation occurs when the supply of money grows at an alarming rate, outpacing the production of goods and services. This imbalance creates a situation where money becomes worthless, losing its purchasing power as prices spiral out of control. Hyperinflation can devalue currency to the point where it becomes useless overnight.

Economic Destabilization:

As currency loses its value, so does confidence in the economy. Businesses become reluctant to invest and hire, while consumers hoard cash in a desperate attempt to preserve their wealth. This stalls economic growth and can lead to widespread unemployment. Hyperinflation also erodes the value of savings and pensions, wiping out the future security of countless individuals.

Loss of Purchasing Power:

The most devastating impact of hyperinflation is its effect on purchasing power. As prices skyrocket, people’s ability to afford essential goods and services plummets. Food, shelter, and transportation become unattainable, forcing many into poverty. Hyperinflation destroys the value of wages and salaries, making it difficult for families to make ends meet.

Historical Examples:

Throughout history, countries have endured the horrors of hyperinflation. One of the most infamous examples is post-World War I Germany, where the German mark lost its value so rapidly that people used it to wallpaper their homes and burn it for heat. Other examples include Zimbabwe, Venezuela, and Argentina, all of which have experienced periods of extreme inflation that have devastated their economies and left countless citizens destitute.

Hyperinflation is a catastrophic event that can bring entire economies to their knees. It destroys the value of currency, stalls economic growth, and shatters the lives of individuals. The consequences of hyperinflation can be long-lasting and debilitating, leaving countries scarred for years to come. It is a reminder of the perils of reckless monetary policy and the importance of maintaining sound economic fundamentals.

Demand-Pull Inflation: When Demand Soars and Purchasing Power Suffers

Inflation, a word that sends shivers down the spines of consumers, businesses, and economies alike. It’s the silent thief, eroding our purchasing power and making it harder for us to afford the things we need and desire. In the realm of inflation, there are two main culprits: cost-push and demand-pull. Today, we delve into the world of demand-pull inflation, where an insatiable desire for goods and services leads to a rise in prices.

The Nature of Demand-Pull Inflation:

Demand-pull inflation occurs when the aggregate demand for goods and services outstrips the supply. Aggregate demand represents the total amount of spending in an economy, including consumer spending, business investment, and government spending. When demand exceeds supply, businesses are able to charge higher prices for their products and services, leading to a general increase in the price level.

Consequences for Purchasing Power:

As prices rise, our hard-earned money loses its value. We can buy less with the same amount of cash, making it more difficult to maintain our desired standard of living. Everyday necessities, such as food, housing, and transportation, become more expensive, putting a strain on our budgets.

Economic Effects:

Demand-pull inflation can have ripple effects throughout the economy. Initially, it may lead to increased production and employment as businesses ramp up their output to meet the surge in demand. However, if inflation becomes persistent, businesses may face increased costs of production, forcing them to raise prices further. This can lead to a vicious cycle, eroding purchasing power and destabilizing the economy.

Examples in the Real World:

History is replete with examples of demand-pull inflation. During the post-World War II era, the United States experienced a period of high demand for goods and services due to strong consumer spending and pent-up wartime demand. This led to a significant increase in prices, reducing the purchasing power of Americans. Similarly, in the 1970s, oil shortages led to a surge in demand for fuel, resulting in rampant inflation and an overall decline in living standards.

Demand-pull inflation is a formidable force that can erode our purchasing power and hinder economic growth. Understanding its nature and consequences is crucial for policymakers and consumers alike. By carefully managing aggregate demand and ensuring a balance between supply and demand, we can mitigate the adverse effects of inflation and preserve the value of our hard-earned dollars.

Cost-Push Inflation: When Rising Costs Fuel Inflation’s Fire

Imagine you’re the owner of a small business that produces handmade crafts. One day, you discover that the price of your favorite raw materials, like fabric and paint, has suddenly skyrocketed. Now, you face a dilemma: do you absorb the cost of these increases or pass them on to your customers?

In most cases, businesses like yours will have little choice but to raise their prices to cover the increased cost of materials. This phenomenon is known as cost-push inflation. It occurs when rising production costs—whether due to higher raw material prices, wages, or other expenses—force businesses to increase the prices of their goods or services.

The story doesn’t end there. As businesses pass on their increased costs, the ripple effect continues. Consumers now have to spend more on everyday necessities, reducing their purchasing power and potentially dampening economic growth. In some cases, businesses may struggle to maintain their profit margins, leading to reduced investment and job losses.

Cost-push inflation can be particularly harmful during periods of already high inflation. When combined with other factors like increased demand or supply disruptions, it can create an upward spiral of rising prices that is difficult to control. To mitigate the impacts of cost-push inflation, governments may consider measures such as subsidizing essential goods, controlling wage growth, or implementing price controls. However, these interventions can also have unintended consequences, so balancing the need to address inflation with the potential risks is crucial.

Remember, cost-push inflation is not just a dry economic concept but a force that can have real consequences for businesses and consumers alike. By understanding its causes and impacts, we can better prepare ourselves to navigate its challenges and work towards a more stable economic environment.

Deflation: The Perils of Falling Prices

In the realm of economics, inflation often dominates the headlines. But its lesser-known counterpart, deflation, can pose equally sinister threats to our financial wellbeing. Simply put, deflation occurs when the overall price level in an economy decreases. This may seem like a boon at first—who wouldn’t want cheaper goods? However, the consequences of sustained deflation can be far-reaching and detrimental.

Reduced Demand and Purchasing Power

Deflation erodes our purchasing power over time. As prices fall, the value of our money increases, allowing us to buy more with the same amount. However, this can lead to a paradox: reduced demand. Consumers delay spending in anticipation of even lower prices, slowing economic growth. Businesses face declining revenues and may be forced to lay off workers.

Debt Trap

Deflation poses a specific threat to those carrying debt. As prices fall, the real value of the debt increases. This makes it harder for borrowers to repay their loans, which can lead to defaults and bankruptcies. In extreme cases, a deflationary spiral can ensue, where falling prices and reduced demand worsen each other.

Economic Stagnation

Sustained deflation can lead to economic stagnation. Businesses may be reluctant to invest in new projects or hire staff if they expect prices to continue falling. This can lead to a vicious cycle of falling demand, declining output, and rising unemployment.

Deflation: A Vicious Cycle

Deflation, once it takes hold, can be difficult to reverse. Governments and central banks may struggle to stimulate demand and increase prices. This is because deflationary expectations can become ingrained in consumer and business psychology. As a result, deflation can linger for extended periods, causing widespread economic damage.

Key Takeaways

Deflation is a serious economic threat that can erode purchasing power, trap borrowers in debt, and lead to economic stagnation. It is a reminder that rising prices are not always the enemy, and that falling prices can have their own insidious consequences. Understanding the nature of deflation is crucial for policymakers and individuals alike to mitigate its potential risks and ensure a healthy and stable economy.