Decoding Income And Price: Their Impact On Demand

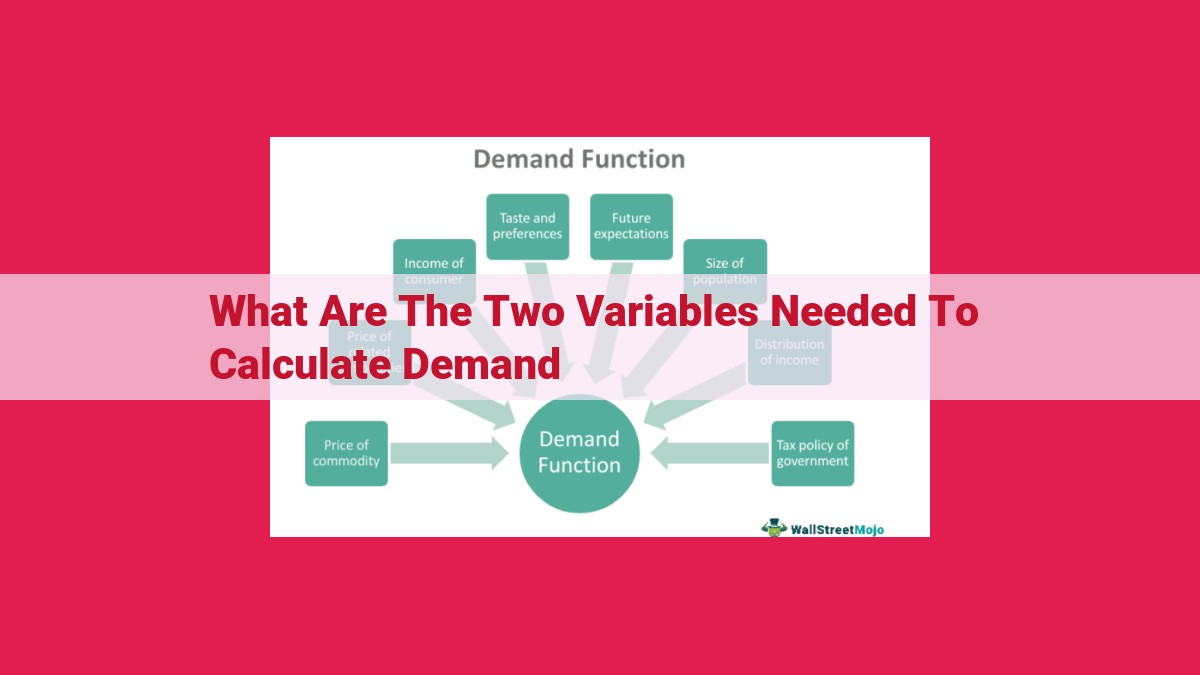

To calculate demand, two crucial variables are income and price. Income, including wages, salaries, and dividends, determines consumers’ purchasing power and ability to afford goods and services. Price, on the other hand, represents the cost of acquiring the desired products or services and influences consumer choices. Understanding the interplay of income and price is essential as they have an inverse relationship: higher income typically leads to increased demand, while higher prices lead to lower demand.

The Crucial Role of Income and Price in Shaping Demand: A Consumer’s Perspective

In the intricate tapestry of market dynamics, two fundamental threads stand out: income and price. These economic forces exert a profound influence on the demand for goods and services, shaping the very foundation of consumer behavior. Understanding their interplay is indispensable for businesses and consumers alike.

Income: The Fuel that Drives Demand

Income, the lifeblood of purchasing power, serves as the primary determinant of demand. It represents the financial resources available to consumers, enabling them to acquire goods and services that satisfy their wants and needs. As income levels rise, consumers can afford to purchase more, bolstering demand and driving economic growth.

Price: The Balancing Act of Value and Affordability

Price, on the other hand, acts as a balancing force in the demand equation. It reflects the cost of producing and distributing a good or service, as well as its perceived value to the consumer. When prices are low, demand tends to increase as products become more accessible. Conversely, high prices can discourage consumption, particularly for non-essential items.

Income: The Driving Force Behind Demand

The Significance of Income in Demand Calculation

Income plays a pivotal role in shaping consumer demand. It represents the financial resources available to individuals, dictating their purchasing power and ability to satisfy their wants and needs. A higher income generally translates into an increase in demand for goods and services, as consumers have more disposable income to allocate.

Defining Income

Income encompasses various forms of financial gains, including wages, salary, dividends, interest, and rent. It represents the compensation received for labor, investments, or the ownership of assets. These sources provide consumers with the means to purchase goods and services, influencing their spending patterns.

The Impact of Income on Demand

Income significantly impacts demand through the following mechanisms:

- Increased Income: As income rises, consumers have greater purchasing power, enabling them to buy more goods and services. This increased demand leads to an upward shift in the demand curve.

- Diminishing Marginal Utility: However, the law of diminishing marginal utility suggests that as consumers acquire more of a particular good, the additional satisfaction derived from each unit decreases. This phenomenon may limit the extent to which increased income translates into higher demand for specific products.

- Substitution and Income Effects: Income changes can also affect consumer preferences. Substitution effects occur when an increase in income leads to a shift in consumption towards more expensive and desirable goods. Conversely, income effects refer to changes in consumption due to the overall change in purchasing power, regardless of price changes.

By understanding the relationship between income and demand, businesses can better forecast consumer behavior and make informed decisions regarding product pricing, marketing strategies, and market expansion plans.

Price: The Decisive Factor in Demand Generation

In the intricate tapestry of consumer behavior, price holds immense sway over the ebb and flow of demand. It is not merely a numerical representation of a product’s worth but a potent force that shapes purchasing decisions.

Defining Price

Price can be defined as the monetary value assigned to a product or service in exchange for its ownership or use. It serves as a benchmark for comparing products, guiding consumers toward more desirable or affordable options. Price often reflects the inherent value of the product, encompassing its production costs, marketing expenses, and profit margin. However, it can also be influenced by external factors such as competition, market trends, and consumer perceptions.

Influence on Demand

The relationship between price and demand is inversely proportional. Generally speaking, higher prices lead to lower demand, while lower prices stimulate increased demand. This principle stems from the fundamental concept of affordability. When a product is priced beyond the means of potential customers, it becomes inaccessible, resulting in reduced demand. Conversely, lowering the price makes it more accessible, enticing more consumers to purchase the product.

Related Concepts

Several related concepts augment the multifaceted nature of price:

- Cost: The expenses incurred in producing and distributing the product.

- Value: The perceived worth or benefit the consumer derives from the product.

- Market Value: The price at which a product is typically sold in the marketplace.

Understanding these concepts enables businesses to strategically position their products in the market, balancing cost, value, and market value to optimize demand.

The Interplay of Income and Price: Determining Demand

As we delve into the intriguing world of economics, we uncover the profound relationship between income, price, and the ever-shifting tides of demand. These two economic forces intertwine like an intricate dance, shaping the trajectory of consumer behavior and the success of businesses.

Impact of Income on Demand

Income holds significant sway over consumer spending. Higher income fuels a surge in demand. With more disposable cash in their pockets, individuals feel emboldened to indulge in a broader range of goods and services, embracing luxuries they may have previously shied away from. Conversely, declining income often leads to contraction in demand, as consumers tighten their belts and prioritize essential purchases.

Influence of Price on Demand

Price, too, exerts a potent influence on consumer behavior. Higher prices tend to discourage demand, encouraging consumers to seek out more affordable alternatives or simply reduce their consumption. On the other hand, lower prices can stimulate demand, making products more attractive and prompting consumers to indulge more liberally.

The Interplay of Income and Price

The interplay of income and price creates a dynamic and nuanced landscape that shapes demand. When income rises, higher prices may have a less pronounced impact on demand, as consumers can afford to absorb the increased cost. However, when income falls, even modest price increases can decimate demand, as consumers are forced to make tough choices and prioritize their meager resources.

Implications for Businesses

Understanding the interplay of income and price is crucial for businesses seeking to optimize their pricing strategies. By considering both consumer income and product prices, companies can make informed decisions that maximize demand and boost sales. This delicate balancing act requires constant monitoring and adjustment, reflecting the ever-changing economic landscape.

In conclusion, income and price are inseparable forces that shape the intricate tapestry of demand. By understanding their dynamic relationship, businesses can navigate the complex waters of economics, maximizing their success and meeting the ever-evolving needs of consumers.