Understanding Gross Pay And Deductions For Financial Wellness

Hourly gross pay is calculated by multiplying the hourly rate by the hours worked, including overtime. Salaried gross pay is the annual salary divided by the number of pay periods. Overtime pay is earned when employees work extra hours beyond the standard work week and is calculated at a higher rate. Deductions, such as taxes, insurance, and retirement contributions, reduce gross pay to determine net pay. Understanding these calculations and deductions is crucial for employees to manage their finances effectively.

Hourly vs. Salaried: Understanding the Basics

When it comes to compensation, there are two main types: hourly and salaried. Hourly employees receive a fixed amount of money for each hour they work, while salaried employees receive a fixed amount of money each pay period, regardless of the number of hours worked.

How Hourly Pay Is Calculated

Hourly pay is calculated by multiplying the employee’s hourly rate by the number of hours worked. The hourly rate is typically negotiated in advance and can vary based on factors such as experience, skills, and industry. For example, an employee who earns $15 per hour and works 40 hours in a week would earn a gross pay of $600.

Overtime Pay

Hourly employees who work more than the standard 40-hour work week are entitled to overtime pay. Overtime pay is typically calculated at a rate of 1.5 times the employee’s regular hourly rate. For instance, if an employee earns $15 per hour and works 10 hours of overtime in a week, they would earn an additional $150 in overtime pay.

How Salaried Pay Is Calculated

Salaried employees receive a fixed annual salary that is divided into equal pay periods, such as monthly or bi-weekly. The annual salary is typically negotiated in advance and can vary based on factors such as experience, skills, and industry.

Unlike hourly employees, salaried employees are not entitled to overtime pay. However, they may receive other benefits such as paid time off, health insurance, and retirement contributions.

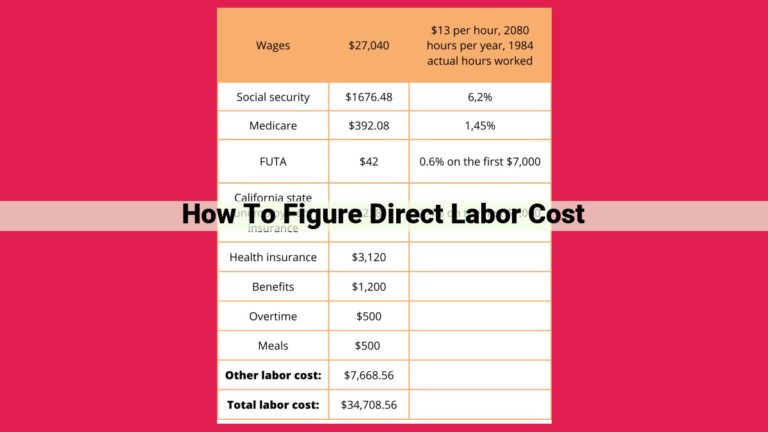

Deductions from Gross Pay

Once gross pay is calculated, deductions are taken out to cover various expenses such as:

- Taxes (federal income tax, social security tax, Medicare tax)

- Insurance (health insurance, dental insurance, vision insurance)

- Retirement contributions (401(k), IRA)

These deductions reduce an employee’s gross pay to their net pay, which is the amount of money they actually receive in their paycheck. It’s important to review your deduction statement to understand how deductions impact your take-home pay.

Calculating Hourly Gross Pay: Understanding the Basics

Hourly Gross Pay represents the total amount earned by an employee before any deductions or taxes are taken out. It’s calculated based on the employee’s hourly rate and the number of hours worked.

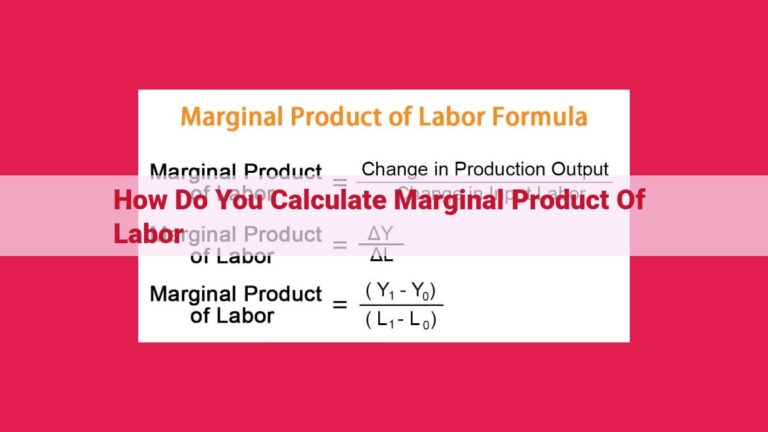

The formula for calculating hourly gross pay is:

Hourly Gross Pay = Hourly Rate x Hours Worked

Hourly Rate: This is the agreed-upon amount per hour that the employee is paid for their work. It’s often stated on their employment contract or pay stub.

Hours Worked: This refers to the total number of hours an employee has worked during a specific pay period. It includes regular hours, overtime hours, and any other compensable time.

Overtime Calculations: In some jurisdictions, employees may be entitled to overtime pay if they work beyond a certain number of hours per week. Overtime rate is typically 1.5 times the employee’s regular hourly rate. To calculate overtime pay, multiply the number of overtime hours by the overtime rate and add it to the regular gross pay.

For example, if an employee has an hourly rate of $20 and works 40 regular hours and 5 overtime hours in a week, their hourly gross pay would be calculated as follows:

Hourly Gross Pay = (20 x 40) + (20 x 1.5 x 5)

Hourly Gross Pay = $800 + $150

Hourly Gross Pay = $950

Understanding how to calculate hourly gross pay is crucial for employees to ensure they’re being paid accurately. By following the formula and considering any applicable overtime calculations, employees can confidently determine their total earnings before deductions.

Calculating Salaried Gross Pay: Understanding the Basics

When it comes to salaried employees, the concept of gross pay is crucial. Unlike hourly workers who get paid for every hour they work, salaried employees receive a fixed amount regardless of the number of hours worked. This amount is known as the annual salary.

The annual salary is typically divided into equal pay periods, usually bi-weekly, semi-monthly, or monthly. To calculate the gross pay for each pay period, we simply divide the annual salary by the number of pay periods in a year.

For example, if an employee earns an annual salary of $50,000 and gets paid bi-weekly, their bi-weekly gross pay would be $50,000 ÷ 26 = $1,923.08.

Factors that Impact Salaried Gross Pay

However, it’s important to note that salaried gross pay is not always a static figure. There may be certain deductions or adjustments that can impact the final amount. These deductions may include:

- Taxes: Federal, state, and local taxes are deducted from gross pay based on your income and personal circumstances.

- Insurance premiums: Health, dental, and vision insurance premiums may be deducted from gross pay, depending on your plan choices and employer contributions.

- Retirement contributions: Contributions to retirement accounts, such as 401(k)s or IRAs, are typically deducted from gross pay on a pre-tax basis.

Understanding Your Deduction Statement

It’s essential to understand how deductions impact your gross and net pay. Your employer will typically provide you with a deduction statement that outlines the amount deducted for each category. This statement will help you track your deductions and ensure that they are being applied correctly.

Calculating salaried gross pay involves understanding the concept of an annual salary and how it is divided into pay periods. It also requires consideration of any applicable deductions or adjustments that may impact the final gross pay amount. By being aware of these factors, you can better manage your finances and plan for the future.

Understanding Overtime Pay

Imagine working hard all week, putting in extra hours to complete a project or support a colleague. It’s only fair that you’re compensated for the additional time you’ve dedicated, right? That’s where overtime pay comes in.

Defining Overtime

Overtime is any work performed beyond the standard work week, which is typically 40 hours in many countries. This means that anything you work over 40 hours in a week is considered overtime.

Calculating the Overtime Rate

The overtime rate is usually calculated by taking your regular hourly rate and multiplying it by 1.5. This means that for every hour you work overtime, you earn 50% more than your regular pay.

Legal Regulations and Limitations

It’s important to note that overtime pay regulations can vary depending on the industry and jurisdiction. In many places, there are limitations on how much overtime you can work in a week or month. These regulations are in place to protect workers from excessive workloads that could lead to burnout or safety issues.

Understanding Your Rights

If you’re eligible for overtime pay, it’s crucial to be aware of your rights and responsibilities. Discuss with your employer the following:

- What constitutes overtime work in your role?

- How overtime pay is calculated and paid?

- Any restrictions or limitations on overtime hours?

Overtime pay is an essential safeguard for workers who dedicate extra hours to their responsibilities. Understanding the basics of overtime pay, including the standard work week, overtime rate calculation, and legal regulations, empowers you to advocate for fair compensation and ensure your well-being in the workplace.

Deductions: What’s Withheld from Gross Pay

- List common deductions such as taxes, insurance, and retirement contributions.

- Explain how deductions impact gross and net pay.

- Highlight the importance of understanding your deduction statement.

Deductions: What’s Withheld from Gross Pay

When you receive your paycheck, you may wonder why the amount is less than you expected. That’s because there are often a number of deductions that are taken out of your gross pay before you receive your net pay. These deductions can include taxes, insurance, and retirement contributions.

Common Deductions

- Taxes: The most significant deduction from your gross pay is usually taxes. These include federal income tax, state income tax, and Social Security tax. The amount of taxes you owe depends on your income and filing status.

- Insurance: If you have health insurance, dental insurance, or vision insurance, these premiums will be deducted from your paycheck. The amount of the deduction will vary depending on the type of coverage and your plan.

- Retirement contributions: If you participate in a retirement plan, such as a 401(k) or 403(b), your contributions will be deducted from your paycheck before you receive your net pay. These contributions are typically made on a pre-tax basis, which means they reduce your taxable income.

Impact on Gross and Net Pay

Gross pay is the total amount of money you earn before any deductions are taken out. Net pay is the amount of money you actually receive after all deductions have been made. The more deductions you have, the lower your net pay will be.

It’s important to understand how deductions impact your gross and net pay so that you can budget accordingly. If you have any questions about your deductions, be sure to contact your employer or your payroll department.

Understanding Your Deduction Statement

Your deduction statement will show you the amount of each deduction that is being taken out of your paycheck. It’s important to review your deduction statement regularly to make sure that the deductions are accurate. If you notice any errors, be sure to contact your employer or your payroll department immediately.

Understanding your deductions can help you make informed decisions about your finances. By adjusting your deductions, you can increase your net pay and reach your financial goals sooner.