The Comprehensive Guide To Full Cycle Accounting: A Step-By-Step Journey

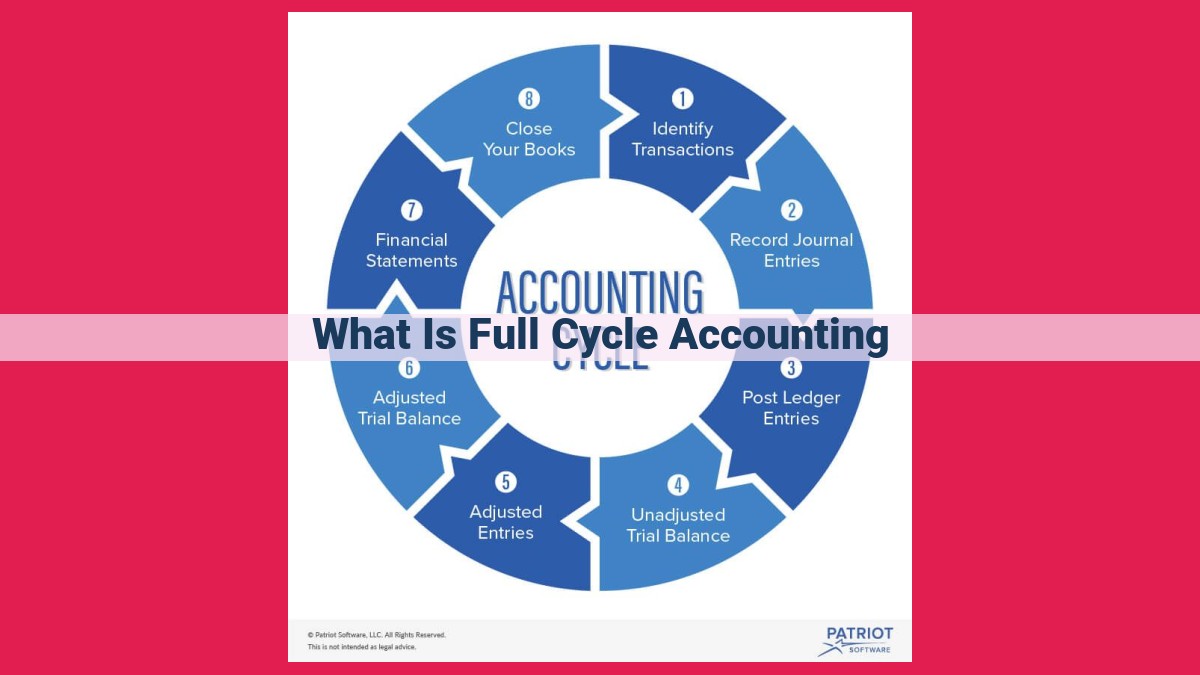

Full cycle accounting encompasses the entire process of recording, classifying, summarizing, analyzing, and interpreting financial transactions. It begins with capturing transactions into an accounting system and progresses through their classification into financial statement categories. Financial statements present a business’s financial health, while analysis provides insights into its performance and trends. The final step involves interpreting financial data to support decision-making and communicate information to stakeholders.

Understanding the Concept of Full Cycle Accounting

- Define full cycle accounting and its comprehensive nature.

Understanding the Comprehensive Nature of Full Cycle Accounting

In the intricate world of finance, the concept of full cycle accounting stands as a cornerstone, guiding businesses through the meticulous process of capturing, classifying, summarizing, analyzing, and interpreting financial transactions. It’s a comprehensive approach that offers a holistic view of a company’s financial health, enabling informed decision-making and accountability.

Embracing the Full Cycle Approach

Full cycle accounting involves a continuous loop, beginning with the recording of financial transactions, such as sales, purchases, and expenses. These transactions are then meticulously classified into distinct categories – income, expenses, assets, and liabilities – providing a structured framework for understanding a company’s financial position.

Once classified, these transactions are summarized into financial statements. These statements paint a detailed picture of a company’s performance, profitability, and assets. The income statement, balance sheet, and cash flow statement serve as essential tools for stakeholders to assess the company’s financial well-being.

Analyzing and Interpreting Financial Data

The full cycle accounting process doesn’t stop at mere data entry. Analysis is crucial for uncovering trends and patterns within the company’s financial performance. Financial ratios, such as profitability ratios, liquidity ratios, and efficiency ratios, provide valuable insights into a company’s strengths and weaknesses.

Finally, the interpretation of financial data is paramount for informed decision-making. The ability to translate financial numbers into meaningful information empowers businesses to optimize operations, allocate resources effectively, and communicate their financial performance to investors, creditors, and other stakeholders with clarity and accuracy.

Recording Financial Transactions: The Heartbeat of Full Cycle Accounting

Understand the Process

At the core of full cycle accounting lies the meticulous process of capturing and recording financial transactions into an accounting system. This system serves as a central repository for all financial activities, acting as the backbone of accurate and reliable accounting records.

Types of Transactions and Their Impact

Financial transactions encompass a vast array of events, including cash sales, purchases, loans, and investments. Each type of transaction has a distinct impact on the financial records:

- Assets increase when cash is received or inventory is purchased.

- Liabilities increase when money is borrowed or obligations are incurred.

- Equity increases when revenue is earned or investments are made.

Capturing Transactions Accurately

To ensure accuracy, transactions are recorded in a timely and organized manner. This involves:

- Identifying the transaction type and its relevant accounts.

- Determining the value and date of the transaction.

- Submitting the transaction into the accounting system for processing.

By meticulously recording all financial transactions, businesses can maintain a comprehensive and accurate portrayal of their financial position and performance. This information forms the foundation for various accounting activities, including financial statement preparation and financial analysis.

Classifying Transactions

- Describe the importance of classifying transactions into income, expenses, assets, and liabilities.

- Highlight the different categories and their significance in financial reporting.

Classifying Transactions: The Cornerstone of Financial Reporting

Understanding the nature of financial transactions is crucial for effective accounting and financial reporting. At the heart of this process lies the task of classifying transactions into income, expenses, assets, and liabilities. This categorization plays a pivotal role in accurately reflecting a business’s financial position and performance.

Income represents the revenue earned by a company during a specific period. It is classified as income when it is earned, regardless of whether the cash has been received. On the other hand, expenses are the costs incurred in generating income. They are classified as expenses when they are incurred, even if the cash has not yet been paid.

Assets are resources owned or controlled by a company that have economic value. These can include tangible assets (e.g., inventory, equipment) and intangible assets (e.g., patents, trademarks). Liabilities, on the other hand, are obligations or debts that a company owes to other entities.

The proper classification of transactions is essential for several reasons:

- Financial Statement Preparation: Financial statements (e.g., income statement, balance sheet) are prepared based on the classification of transactions. Income and expenses are included in the income statement, while assets and liabilities are reflected in the balance sheet.

- Trend Analysis: Classifying transactions consistently over time allows for the identification of trends and patterns in a company’s financial performance. This information can be invaluable for making informed business decisions.

- Comparative Analysis: By classifying transactions using industry-standard norms, companies can compare their financial performance to others in the same industry. This enables them to identify areas for improvement and make competitive decisions.

- Compliance and Reporting: Accurate classification of transactions ensures compliance with accounting standards and regulatory requirements. It also facilitates the timely and transparent disclosure of financial information to investors, creditors, and other stakeholders.

In summary, classifying transactions into income, expenses, assets, and liabilities is a fundamental aspect of full cycle accounting. By doing so, businesses can effectively capture, summarize, and interpret their financial transactions, ultimately providing a clear and comprehensive picture of their financial health and performance.

Summarizing Transactions through Financial Statements

In the realm of accounting, financial statements are the unveiled blueprints that depict a business’s financial heartbeat. These statements provide a panoramic view of a company’s financial position and performance, acting as crucial tools for decision-makers and stakeholders alike.

There are three pillars of financial statements:

-

Income Statement: This statement showcases a company’s earnings and expenses, painting a vivid picture of its financial performance over a specific period.

-

Balance Sheet: The balance sheet captures a snapshot of a company’s financial health at a given point in time, showcasing its assets, liabilities, and equity.

-

Cash Flow Statement: This statement tracks the movement of cash within a company, providing insights into its liquidity and operational prowess.

Each financial statement holds vital importance for understanding a company’s financial trajectory. Investors use these statements to assess risk, creditors rely on them for creditworthiness evaluation, and management leverages them for strategic planning. By studying financial statements, one can decipher a company’s financial well-being and future prospects.

Analyzing Financial Transactions

Understanding the Power of Financial Analysis

Financial statement analysis is like a microscope for businesses, allowing us to examine their financial health in intricate detail. It’s a critical tool for investors, creditors, and managers to make informed decisions about their financial investments and business operations.

Techniques for Unraveling Financial Statements

There are various techniques used in financial statement analysis, including:

- Horizontal Analysis: Compares financial statements over time to identify trends and changes.

- Vertical Analysis: Evaluates the relationship between different line items within a single financial statement.

- Ratio Analysis: Calculates financial ratios using data from financial statements to assess efficiency, liquidity, and profitability.

Common Financial Ratios

Financial ratios provide valuable insights into a company’s financial performance. Some of the most common ratios include:

- Profit Margin: Measures the profitability of a company’s sales.

- Debt-to-Equity Ratio: Assesses a company’s level of financial leverage.

- Return on Investment (ROI): Evaluates the return generated from investments.

- Current Ratio: Indicates a company’s ability to meet short-term obligations.

Identifying Trends and Patterns

Financial statement analysis helps identify trends and patterns in a company’s financial performance. By comparing ratios and analyzing changes over time, analysts can spot potential risks and opportunities. This information is crucial for making informed investment decisions and adjusting business strategies.

Empowering Informed Decisions

The insights gained from financial statement analysis empower investors and creditors to make better investment decisions. It helps them assess the financial strength and stability of companies they’re considering investing in. For managers, financial statement analysis provides valuable feedback on the effectiveness of their operations and assists in setting realistic goals and making sound financial decisions.

Interpreting Financial Transactions: The Key to Informed Decision-Making

The final step in the full cycle accounting process is interpreting financial transactions. This crucial step involves deciphering the underlying meaning and significance of the recorded and summarized financial data. By interpreting financial transactions effectively, businesses can extract valuable insights that guide decision-making and foster organizational success.

Decision-Making

Financial data is the lifeblood of any business. It provides a comprehensive overview of financial performance, profitability, and overall health. Interpreting financial transactions allows business leaders to:

- Identify strengths and weaknesses: By analyzing financial statements and financial ratios, organizations can pinpoint areas of excellence and areas that require improvement.

- Forecast future performance: Financial data can be used to create projections and forecasts, enabling businesses to anticipate future financial scenarios and make informed decisions.

- Set financial goals: Interpreted financial data serves as a solid foundation for establishing realistic and attainable financial goals and objectives.

Communicating Financial Information

Financial data is not only useful for internal decision-making but also for external communication. Businesses need to effectively communicate financial information to:

- Investors: Accurate and transparent financial data instills confidence and trust among investors, attracting capital and promoting financial stability.

- Creditors: Financial data is crucial for securing loans and maintaining good relationships with creditors. It demonstrates the business’s ability to repay debt and mitigate financial risks.

Importance of Clear Communication

To ensure effective communication of financial information, businesses must strive for:

- Clarity: Financial data should be presented in a clear and concise manner, using understandable language and visual aids.

- Accuracy: Financial information must be accurate and reliable, providing a true and fair representation of the business’s financial position.

- Timeliness: Information should be communicated promptly to ensure that stakeholders have access to up-to-date financial data.

By interpreting financial transactions effectively and communicating financial information clearly, businesses empower themselves to make informed decisions, attract investors, secure financing, and foster a strong foundation for sustainable growth.