Factors Influencing Supply Curve Shifts: A Comprehensive Analysis

The supply curve depicts the positive relationship between price and quantity supplied. Factors that can cause movement along this curve include changes in input prices (raw materials, labor, energy), advancements in production technology, entry or exit of suppliers, government policies (subsidies, taxes, regulations), and anticipations about future prices and production decisions. These factors influence production costs and the willingness of suppliers to offer goods and services at varying prices, resulting in shifts along the supply curve.

Factors Influencing Movement Along the Supply Curve

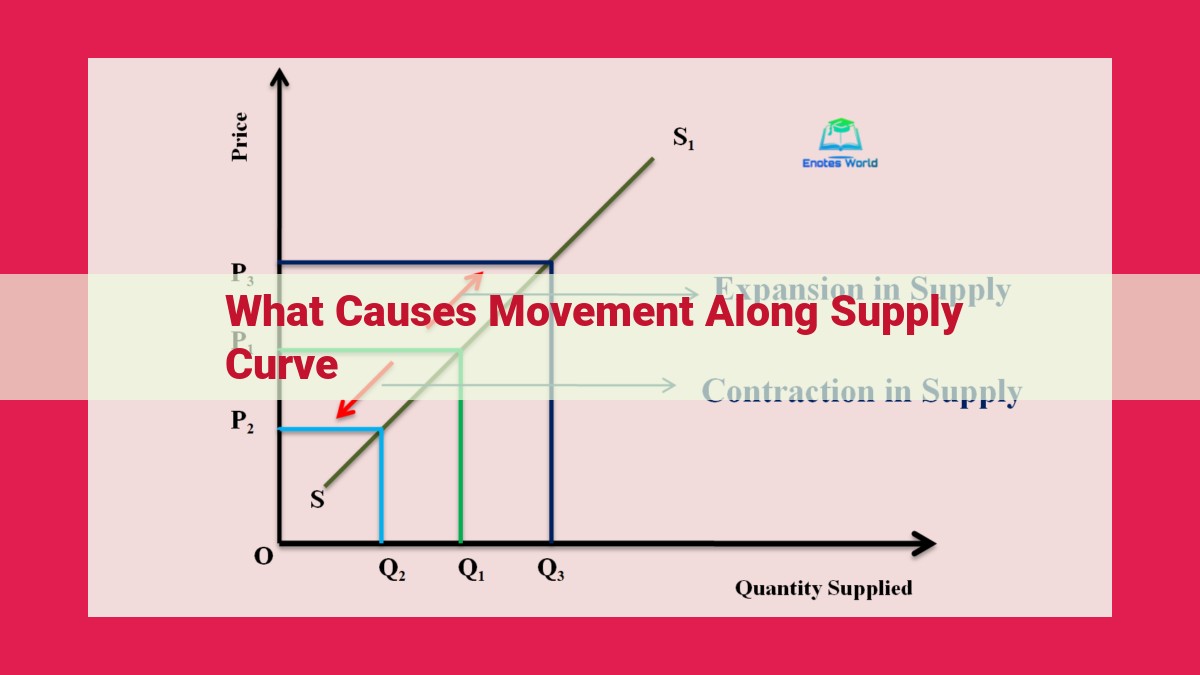

The supply curve is a graph that shows the relationship between the price of a good or service and the quantity supplied. It slopes upward, indicating that as the price increases, more of the good or service will be supplied. This is because at a higher price, it is more profitable for producers to supply more.

There are many factors that can influence movement along the supply curve. Some of the most important include:

1. Input Prices

The prices of the inputs used to produce a good or service can have a significant impact on the supply curve. If input prices increase, it will cost more to produce the good or service, and the supply curve will shift to the left. This is because producers will be less willing to supply the same quantity of the good or service at the same price.

2. Technology

Advancements in production technology can make it possible to produce more goods or services with the same inputs. This will shift the supply curve to the right, as producers will be able to supply more of the good or service at the same price.

3. Number of Suppliers

The number of suppliers in a market can also affect the supply curve. If more suppliers enter the market, the supply curve will shift to the right. This is because there will be more competition among suppliers, and they will be more willing to lower their prices to attract customers.

Change in Input Prices: A Driving Force of Supply Fluctuation

In the intricate tapestry of economics, supply and demand dance in a delicate balance, their every movement influencing the price and availability of goods and services. A crucial factor that can swing this dance in unexpected directions is a change in input prices—the costs associated with producing a product or service.

Raw Materials: The Building Blocks of Production

Imagine a baker crafting a delectable loaf of bread. The flour, sugar, yeast, and other ingredients required are all raw materials that impact the cost of production. If the price of flour suddenly spikes due to a severe drought, the baker may face higher costs and a reduced profit margin. Consequently, the supply of bread in the market may decrease as the baker adjusts to the increased expenses.

Labor: The Human Fuel of Production

Beyond raw materials, labor is another critical input in the production process. Skilled workers, from assembly line technicians to software engineers, all contribute to the creation of goods and services. When labor costs rise, for instance, due to increased minimum wages or union negotiations, manufacturers may face higher production costs. To recoup these expenses, they may reduce their output, leading to a contraction in the supply of their products.

Energy: Powering the Production Engine

In today’s technologically advanced world, energy is indispensable for production. From powering manufacturing machinery to illuminating factories, energy costs significantly impact production expenses. A sudden surge in energy prices, such as during a geopolitical crisis, can force businesses to cut back on production or raise prices, ultimately affecting the supply of goods and services.

The Ripple Effect: From Input Prices to Market Equilibrium

The impact of input price changes on supply is not limited to the immediate industry but can reverberate through the entire economy. For example, rising labor costs in the construction industry may lead to higher housing prices, which in turn can affect the demand for other goods and services. This intricate web of interconnections highlights the profound influence that input price fluctuations can have on the delicate balance of supply and demand.

The Impact of Technology on the Supply Curve: A Story of Efficiency and Abundance

In the ever-evolving tapestry of economics, the supply curve tells a tale of the relationship between the price of a good or service and the quantity that producers are willing to offer. Along this curve, factors such as input costs, technological advancements, and government policies can nudge and shift the supply, affecting the delicate balance between demand and availability.

One of the most potent forces driving movement along the supply curve is the march of technology. As production methods evolve and machines become more intelligent, efficiency soars, and costs plummet. This technological prowess enables producers to churn out more goods and services at a lower cost, effectively increasing the supply at any given price.

Consider the smartphone industry: the advent of automated assembly lines, advanced chip design, and sophisticated software has slashed production expenses and boosted efficiency. This technological revolution has allowed manufacturers to offer feature-rich smartphones at prices that were unimaginable a decade ago, flooding the market with an abundance of these ubiquitous devices.

The impact of technology goes beyond reducing costs. Automation also frees up human labor, allowing it to be redirected to more specialized and value-added tasks. This shift in the labor force can enhance productivity and innovation, further driving down costs and increasing supply.

The story of technology and the supply curve is one of progress and plenty. As technology continues to advance, we can anticipate an ever-expanding supply of goods and services, empowering consumers with more choices and lower prices.

Influence of the Number of Suppliers on Market Supply

The Dance of Supply and Demand

In the realm of economics, supply and demand are two sides of the same coin, influencing the availability and pricing of goods and services. The supply curve, a graphical representation of this dance, illustrates the relationship between price and the quantity supplied. As prices rise, suppliers are incentivized to produce more, while lower prices may lead to decreased production.

The Supplier’s Entrance and Exit

The number of suppliers in a market can drastically impact supply dynamics. When new suppliers enter the market, competition intensifies, and the overall supply increases. This influx of newcomers may force existing suppliers to reduce prices or improve the quality of their offerings to stay competitive.

Conversely, when suppliers exit the market, the supply dwindles. Reasons for this can range from financial difficulties to strategic shifts. When the number of suppliers diminishes, remaining players may have more market power, allowing them to raise prices or reduce production without facing significant competition.

The Role of Market Structure

The number of suppliers in a market can also influence its competitive structure. Markets with few large suppliers—known as oligopolies or monopolies—have concentrated supply, giving these giants more control over pricing and output. In contrast, markets with numerous smaller suppliers—known as perfect competition—have dispersed supply, resulting in less market power for individual suppliers.

Implications for Consumers

The number of suppliers in a market can have significant implications for consumers. If the market is dominated by a few large suppliers, consumers may have fewer choices and higher prices. On the other hand, a market with many smaller suppliers generally offers greater variety and potentially lower prices due to increased competition.

The number of suppliers in a market is a crucial factor that shapes supply dynamics and influences market outcomes. New entrants and exits can alter the supply curve, leading to changes in prices, competition, and consumer welfare. By understanding these dynamics, decision-makers and consumers can make informed choices in the marketplace.

Government Policies: Shaping the Supply Landscape

Governments wield considerable influence over the supply of goods and services through their policies. These policies can directly or indirectly impact production costs, incentivizing or disincentivizing businesses to produce and supply the market.

Subsidies: Boosting Supply

Government subsidies, financial assistance provided to businesses, can significantly reduce production costs. This encourages businesses to increase output, leading to a higher supply of goods or services at the same price. For instance, subsidies to renewable energy companies lower their production expenses, enticing them to supply more clean energy.

Taxes: Dampening Supply

Conversely, taxes imposed on businesses increase their production costs. As a result, businesses may choose to reduce supply or pass on the higher costs to consumers in the form of higher prices. Taxes on non-renewable energy sources, such as coal and oil, discourage their production and promote a shift towards alternative energy.

Regulations: Shaping Production

Government regulations, such as environmental standards or labor laws, can both increase or decrease supply. Strict environmental regulations, for example, may require businesses to invest in costly pollution control measures, driving up production costs and potentially reducing supply. On the other hand, labor regulations that protect workers’ rights can improve employee productivity, leading to a higher supply at the same cost.

Implications for Consumers

Government policies can have significant implications for consumers. Subsidies on essential goods, such as food or healthcare, can make them more affordable and accessible. Conversely, taxes on luxury items may curb consumption, redirecting resources towards other sectors of the economy.

Balancing Interests

Government policymakers face the challenge of balancing the interests of producers, consumers, and society as a whole. They must carefully consider the impact of their policies on supply and strive to create a business environment that fosters innovation, economic growth, and social well-being.

Implications of Expectations on Supply Curve Movement

Just like how our expectations shape our personal decisions, they also play a pivotal role in determining the movement of the supply curve. Anticipations about future prices and production decisions can significantly impact current supply levels in the market.

Future Price Expectations:

Suppliers are forward-thinking beings. When they anticipate higher prices in the future, they may increase their current production to take advantage of the profitable opportunity. This leads to a rightward shift in the supply curve, resulting in a higher supply at a given price. Conversely, if they expect lower future prices, they may reduce production, causing the supply curve to shift leftward.

Production Decision Expectations:

Expectations can also influence suppliers’ production decisions. For instance, if they anticipate increased demand in the future, they may invest in new equipment or expand their production capacity. This improves their ability to meet the expected demand and leads to a higher supply at the same price.

Role of Market Signals:

Market signals, such as fluctuations in spot prices or futures contracts, can provide suppliers with valuable insights into future price trends. By interpreting and responding to these signals, suppliers can adjust their production decisions accordingly, influencing the overall supply in the market.

In conclusion, expectations are a subtle yet powerful force that can shape the movement of the supply curve. They prompt suppliers to make production decisions based not only on current conditions but also on their forecasts of future market dynamics. By understanding the implications of expectations, businesses and policymakers can better anticipate and respond to changes in supply, ensuring a smooth functioning of the economy.