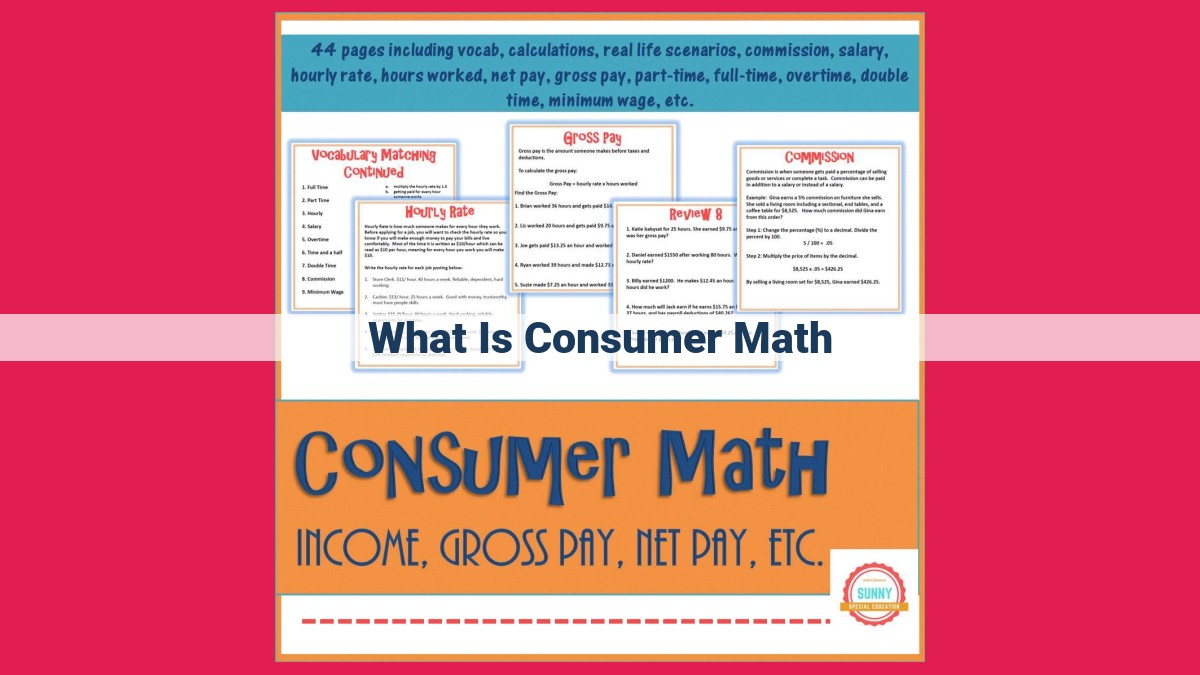

Essential Consumer Math For Financial Literacy And Personal Finance Management

Consumer math is a combination of financial literacy, numeracy, and problem-solving skills that empowers individuals to manage their finances effectively. It encompasses essential concepts such as budgeting, unit pricing, sales tax, discounts, interest, credit, consumer protection, comparison shopping, and personal finance planning. These skills are crucial for making informed decisions, maximizing savings, and securing financial stability over the long term.

Consumer Math: The Secret to Financial Success

Consumer Math is not just a cold and calculating set of skills. It’s the magical key to unlocking a world of financial empowerment. It’s the art of combining financial literacy, numeracy, and problem-solving to make wise decisions about your hard-earned cash.

Consumer Math is not some mysterious formula reserved for financial wizards. It’s a set of practical skills that anyone can master to take control of their finances. It’s about understanding the numbers that pop up in our daily lives, from budgeting to shopping and beyond.

Sub-Heading: The Power of a Budget

A budget is like a financial roadmap, guiding you towards your financial goals. It helps you track your expenses, maintain a positive cash flow, and save for those rainy days and future dreams. Budgeting is the cornerstone of Consumer Math, giving you a clear picture of where your money goes and where you can make smarter choices.

Sub-Heading: Unit Pricing: Finding the Best Value

When you’re shopping, it’s easy to get lost in a sea of price tags. But with Consumer Math, you can become a savvy shopper by understanding unit pricing. Unit pricing tells you the cost per item, regardless of package size. It’s the only way to make sure you’re getting the best bang for your buck.

Consumer Math is not a boring subject. It’s an essential life skill that will empower you to make informed decisions about your finances. By embracing these principles, you can unlock financial freedom, achieve your goals, and live a life of financial well-being.

Budgeting: Managing Your Finances

In the realm of consumer math, budgeting stands as a cornerstone for financial well-being. It’s the process of meticulously tracking your expenses, ensuring a positive cash flow, and diligently setting aside funds for future aspirations. Budgeting empowers you to take control of your finances, giving you a clear roadmap to financial stability.

Visualize a typical household. Each month, a steady flow of income enters their bank account. Rent, utilities, and groceries siphon off significant portions, leaving a dwindling balance. Without a budget, it’s easy to lose track of where the money goes, leading to overspending and financial stress.

Enter the transformative power of budgeting. It paints a vivid picture of your financial situation, revealing exactly where your hard-earned money is going. By categorizing expenses, you gain insights into your spending habits. You pinpoint areas where you may be overspending and identify opportunities to save.

The benefits of budgeting extend beyond mere expense tracking. It fosters a mindful approach to spending, helping you make informed decisions about your purchases. No longer will you indulge in impulsive buys that derail your financial goals. Instead, you’ll prioritize essential expenses and consciously allocate funds for the things that truly matter to you.

Moreover, budgeting lays the foundation for long-term financial success. By consistently setting aside savings, you’re building a financial cushion for unexpected expenses, retirement, or future investments. It’s a proactive approach that ensures your financial well-being not just today but for years to come.

Embarking on your budgeting journey can seem daunting, but it’s a worthwhile endeavor that will reap countless rewards. Whether you prefer pen and paper, spreadsheets, or budgeting apps, find a method that works for you and stick to it. The insights gained from budgeting will empower you to take charge of your finances, achieve your financial goals, and live a life free from financial worries.

Unit Pricing: Unlocking the Secret to Savvy Shopping

Are you tired of feeling overwhelmed when comparing prices at the grocery store? Do you wonder if you’re truly getting the best bang for your buck? Fear not, fellow shopper, for unit pricing holds the key to unlocking the secrets of savvy shopping.

Unit pricing is simply the price of an item divided by its weight, volume, or count. It allows you to compare the cost of different brands and sizes of similar products, leveling the playing field to make informed decisions.

Calculating unit price is easy:

- Locate the unit price label on the product. It’s usually a small sticker or label that shows the price per ounce, pound, or other unit of measure.

- Divide the total price by the unit of measure. For example, if a 10-ounce bag of chips costs $2.50, the unit price is $2.50 ÷ 10 oz = $0.25 per ounce.

By using unit pricing, you can:

- Compare different brands and sizes. A smaller size may be cheaper per unit than a larger one.

- Avoid impulse purchases. By comparing unit prices, you can see which items offer the best value and avoid spending more than necessary.

- Save money on everyday purchases. Over time, the savings from unit pricing can add up to a significant amount.

So, the next time you’re at the store, don’t be fooled by catchy packaging or flashy promotions. Instead, arm yourself with unit pricing knowledge and make informed choices that will stretch your shopping dollars further.

Sales Tax: Uncovering the Hidden Costs

In the realm of consumer math, understanding sales tax is crucial to avoid financial surprises and make informed purchases. Sales tax is an indirect tax levied on the sale of goods and services, varying across states and localities. It’s what we pay at the checkout, and it can significantly impact the total cost of our purchases.

Types of Sales Tax

Various types of sales tax exist, each with its unique characteristics:

- State Sales Tax: Levied by the state government, this tax is typically a flat rate applied to most taxable goods and services.

- Local Sales Tax: In addition to state sales tax, some cities or counties may impose an additional local tax, increasing the overall tax rate.

- Selective Sales Tax: This tax targets specific categories of goods, such as alcohol, tobacco, or luxury items, with a higher tax rate than general sales tax.

Calculating Sales Tax

To determine the total cost of a purchase, including sales tax, it’s simple:

- Multiply the price of the item by the sales tax rate.

- Add the result to the original price.

For instance, if an item costs $100 and the sales tax rate is 8%, the sales tax would be $100 x 0.08 = $8. The total cost of the item would be $100 + $8 = $108.

Avoid Tax Surprises

Be mindful of the following tips to avoid sales tax-related surprises:

- Check the Receipt: Always review your receipt to verify that the correct tax rate was applied.

- Consider Tax-Exempt Items: Some items may be exempt from sales tax, such as groceries or prescription medications, saving you money.

- Factor in Tax When Budgeting: Incorporate sales tax into your budget to avoid overspending and maintain financial control.

Understanding sales tax is an essential aspect of consumer math. By being aware of its different types, how to calculate it, and avoiding tax surprises, you can make informed purchases and budget effectively. Remember, knowledge is power, especially when it comes to managing your finances and making the most of your hard-earned money.

Discounts: Unlocking Savings for Savvy Consumers

In today’s competitive retail landscape, discounts are a powerful tool that can help consumers save significant amounts of money. From coupons and rebates to promo codes and loyalty discounts, a wide range of options exists to help you stretch your dollar further.

Coupons: A Time-Honored Savings Strategy

Coupons have been a staple of consumer wallets for decades, and for good reason. These small pieces of paper or digital codes offer instant deductions at the point of purchase. Whether you clip them from newspapers, find them online, or receive them in mailers, coupons provide a direct way to lower your bill.

Rebates: Cash Back on Your Purchases

Rebates work slightly differently than coupons. Instead of an instant discount, rebates offer a refund after you make a purchase. To claim your rebate, you typically need to mail in a proof of purchase and a completed form. While rebates can take longer to process, they can often be more substantial than coupons.

Promo Codes: Online Shopping’s Secret Weapon

With the rise of e-commerce, promo codes have become increasingly popular. These codes are entered at checkout to unlock exclusive discounts on a wide range of products and services. From free shipping to percentage off, promo codes are a great way to maximize your savings when shopping online.

Loyalty Discounts: Rewarding Repeat Customers

Many businesses offer loyalty discounts to customers who make repeat purchases. These discounts can come in various forms, such as points that accumulate towards future discounts or exclusive discounts for members-only. By joining loyalty programs, you can earn rewards for your patronage and save even more money in the long run.

Tips for Smart Discount Hunting

To make the most of discounts, it’s important to be a _savvy* shopper:

- Research available discounts: Before making a purchase, take some time to research coupons, rebates, and promo codes that may be available.

- Sign up for loyalty programs: Joining loyalty programs can give you access to exclusive discounts and other perks.

- Compare prices: Don’t assume that the first discount you find is the best. Compare prices from different retailers to ensure you’re getting the greatest value.

- Consider the long term: While discounts can be a great way to save money in the short term, it’s important to consider the overall value. Sometimes, a higher-priced item without a discount may be a better investment in the long run.

Interest: The Power of Time Value

When it comes to money, time isn’t on your side. It’s like a sneaky little thief, slowly draining your hard-earned cash without you even realizing it. That’s where interest comes in—the silent force that can make your money work for you or against you.

Simple interest is the boring Twin of Interest. It is calculated as a flat percentage of the principal amount borrowed or saved and is applied for a specific period of time. If you borrow $100 at a simple interest rate of 10% for two years, you’ll owe $100 + ($100 x 0.10 x 2) = $120.

Now, let’s meet compound interest, the slyer Twin. This one is like a snowball; it starts small but keeps growing, adding to the interest you’ve already earned. If you invest $100 at a compound interest rate of 10% for two years, you’ll earn $100 + ($100 x 0.10 x 1) + ($100 x 0.10 x 0.10) = $121.

The difference is subtle, but it’s significant. Even a small difference in interest rate can add up to big savings or losses over time.

Time is your ally in investments. The longer you invest, the more interest you earn. But it’s your enemy in credit. The longer you carry a balance, the more interest you pay.

Don’t let interest rob you blind. Take control of your money by understanding its power. You can use it to grow your wealth and crush your debts.

It’s not about being a math wizard. Consumer math is about making smart money decisions, and understanding interest is the key. Invest wisely, borrow responsibly, and let interest be your friend, not your foe.

Credit: Using It Wisely

In the realm of consumer math, credit plays a significant role in our financial journeys. It can be a powerful tool for accessing goods and services we need, but it’s crucial to understand its terms, risks, and costs to make informed decisions.

Types of Credit Facilities

Credit comes in various forms, each with its own unique characteristics:

- Credit Cards: Plastic cards that allow you to borrow money for purchases or cash advances. They typically have higher interest rates than other forms of credit but offer convenience and rewards programs.

- Personal Loans: Unsecured loans you can use for various purposes, such as debt consolidation or home improvements. They usually have fixed interest rates and repayment terms.

- Home Equity Loans: Loans secured by your home’s equity. They offer lower interest rates than unsecured loans but come with the risk of losing your home if you default.

- Lines of Credit: Revolving loans that allow you to borrow up to a certain amount on an as-needed basis. They often have variable interest rates, so payments can fluctuate.

Risks and Costs of Credit

While credit can be beneficial, there are potential risks and costs associated with it:

- High Interest Rates: Credit cards and other unsecured loans typically have high interest rates that can make repaying debt expensive.

- Debt Trap: Using credit to cover everyday expenses can lead to a cycle of debt, where you are continuously borrowing to pay off existing balances.

- Impact on Credit Score: Missed or late payments can damage your credit score, which can make it harder to obtain credit in the future and lead to higher interest rates.

- Bankruptcy: In severe cases, excessive debt can lead to bankruptcy, which has long-lasting financial consequences.

Making Informed Decisions with Credit

To use credit wisely, it’s essential to understand your financial situation and weigh the pros and cons carefully:

- Determine Your Credit Needs: Clearly define why you need credit and how much you will borrow.

- Compare Loan Options: Research different types of credit facilities and compare their interest rates, fees, and repayment terms.

- Create a Budget: Outline a realistic budget that includes your credit payments and ensures you can afford them comfortably.

- Pay on Time: Establish a payment system to avoid missed or late payments that can hurt your credit score.

- Monitor Your Credit: Regularly review your credit report to track your progress and identify any errors or potential fraud.

Consumer Protection: Safeguarding Your Rights

Every consumer has certain fundamental rights and protections that are in place to shield them from unfair or deceptive practices. By understanding these rights and the laws that enforce them, you can empower yourself as a savvy shopper, making informed choices and safeguarding your interests.

Consumer Rights

Your consumer rights encompass a range of protections, including:

- The right to safety: Products should be free from defects or hazards that could cause injury or harm.

- The right to information: You’re entitled to accurate and transparent information about products and services.

- The right to choose: You have the freedom to make informed choices about the goods and services you purchase.

- The right to fair competition: Businesses should compete fairly without engaging in deceptive or monopolistic practices.

- The right to redress: If you experience consumer issues, you have the right to seek remedies, such as refunds, replacements, or compensation.

Consumer Laws

Various laws exist to uphold consumer rights and promote fair marketplace practices, including:

- Truth-in-Advertising Laws: Prohibit misleading or deceptive advertising.

- Consumer Protection Acts: Define unfair or deceptive trade practices and provide remedies for violations.

- Product Safety Laws: Establish standards for the safety of consumer products and regulate product recalls.

- Warranties and Guarantees: Govern the terms and conditions under which manufacturers or retailers promise to repair or replace defective products.

- Lemon Laws: Protect consumers who purchase vehicles with persistent defects.

Product Safety Regulations

Government agencies, such as the Consumer Product Safety Commission (CPSC), enforce product safety regulations to protect consumers from dangerous or defective products. These regulations cover a range of consumer goods, including toys, appliances, and electronics. By adhering to these regulations, manufacturers and retailers help ensure that products meet safety standards and minimize the risk of harm to consumers.

By understanding your consumer rights, being aware of consumer laws, and following product safety regulations, you can navigate the marketplace with confidence and safeguard your interests as a consumer. Remember, knowledge is power, and by being informed, you can protect yourself from unfair practices and make well-informed choices that benefit you and your family.

Comparison Shopping: The Informed Consumer’s Guide

In the vast consumer landscape of today, comparison shopping has emerged as an indispensable tool for the savvy shopper. Embarking on a purchase without thorough research is like setting sail without a compass, destined to wander aimlessly amidst a sea of options.

Market Research: Your Navigator in the Shopping Maze

Before you set foot in a store or click on a website, allocate some time to explore the market. Identify your needs and compare product specifications, features, and prices. Utilize online review platforms, consult consumer forums, and connect with friends and family for genuine insights.

Product Reviews: Lifting the Veil of Deception

Product reviews are the unsung heroes of comparison shopping. They offer unfiltered accounts from previous buyers, disclosing strengths, weaknesses, and overall satisfaction levels. This invaluable information sifts through the marketing hype, unveiling the true nature of products.

Empowered Purchases: Making Informed Decisions

Armed with market research and product reviews, you are now at the helm of your purchase decision. Carefully consider the price-to-value ratio and ensure that the product aligns with your specific needs. Comparison shopping eliminates impulsive buys and guarantees that your hard-earned money is spent wisely.

Embrace the Journey of Comparison Shopping

Remember, comparison shopping is a rewarding journey that empowers you as a consumer. By diligently navigating the market, you gain confidence in your choices and unlock the full potential of your purchasing power. So, before you make your next purchase, don’t hesitate to engage in comparison shopping and become an informed consumer.

Personal Finance: Planning for the Future

- Describe how consumer math extends to long-term personal finance considerations, including investing, retirement planning, and tax planning.

Personal Finance: Your Roadmap to a Secure Future

As we navigate the complex world of consumerism, it’s crucial to master the skills of consumer math. This handy toolbox equips you with the knowledge and abilities to manage your finances effectively, making informed decisions, and securing a financially secure future.

One vital aspect of consumer math is its role in personal finance planning. This involves thinking beyond immediate needs and considering long-term financial goals. Smart financial planning includes:

Investment

- Investing is the cornerstone of building wealth over time. It involves putting your money into assets that grow in value, such as stocks, bonds, or mutual funds. By wisely allocating your investments, you can reap the benefits of compound interest and secure a comfortable retirement.

Retirement Planning

- Retirement planning may seem distant, but it’s never too early to start. Consumer math empowers you to calculate how much you need to save and invest to sustain your desired lifestyle in your golden years. Consider factors like inflation, life expectancy, and tax implications.

Tax Planning

- Taxes can significantly impact your financial well-being. Tax planning involves optimizing your tax deductions and credits to minimize your tax liability. Understanding consumer math helps you make informed decisions about tax-advantaged accounts, such as 401(k)s and IRAs, which offer tax-deferred growth.

By mastering consumer math and extending it to personal finance planning, you gain the confidence to navigate the financial landscape with ease. It empowers you to:

- Invest wisely for long-term growth

- Plan for a financially secure retirement

- Minimize taxes and maximize your savings

Remember, the goal of consumer math is to empower you to make informed financial decisions that support your goals and aspirations. By understanding these concepts, you can take control of your present and secure a future where financial freedom thrives.