Understanding Economic Equilibrium: The Balance Between Production And Consumption

The equilibrium level of output is the amount of goods and services that an economy produces when the aggregate supply (what producers are willing to supply) and aggregate demand (what consumers are willing to buy) are equal. This level of output is crucial as it represents the balance between production and consumption, ensuring economic stability. Shifts in aggregate supply or demand can disrupt this equilibrium, leading to imbalances in the market and potential economic fluctuations. Policymakers use fiscal and monetary policies to adjust aggregate demand or supply to maintain the equilibrium level of output and foster economic stability.

The Balancing Act: Understanding Equilibrium Level of Output

In the realm of economics, equilibrium strikes a delicate balance, where the forces of supply and demand intersect perfectly. This point of equilibrium determines the level of output that an economy can sustainably produce and absorb without creating imbalances.

Equilibrium level of output is the quantity of goods and services an economy produces when aggregate supply equals aggregate demand. Aggregate supply reflects the willingness of producers to offer goods and services, while aggregate demand represents the desire of consumers to purchase those offerings.

The equilibrium level of output is critical for economic stability. When output exceeds this level, inflationary pressures can arise, as demand outweighs supply. Conversely, if output falls below equilibrium, recessionary conditions can emerge, as supply exceeds demand.

Aggregate Supply: The Producers’ Perspective

- Definition of aggregate supply and factors that influence it.

- How shifts in aggregate supply affect the equilibrium level of output.

Aggregate Supply: The Producers’ Perspective

In the intricate dance of economics, the equilibrium level of output represents a harmonious balance between what producers can supply and consumers demand. To understand this delicate equilibrium, we must delve into the realm of aggregate supply, the total output that businesses and firms are willing and able to produce at a given price level.

Many factors orchestrate the symphony of aggregate supply. Input costs, such as the price of raw materials and labor, play a pivotal role. When input costs rise, producers may be less inclined to produce, resulting in a decline in supply. Technological advancements, on the other hand, can boost productivity and increase aggregate supply.

Government policies can also exert a significant influence on aggregate supply. Tax incentives designed to encourage business investment can incentivize producers to expand output, while price controls can disincentivize production, leading to a contraction in supply.

Shifts in Aggregate Supply

Like a pendulum swinging between extremes, shifts in aggregate supply can dramatically alter the economic landscape. An increase in aggregate supply represents a pivot towards expansion, where producers are eager to supply more goods and services. This can lead to a lower equilibrium price and higher output.

Conversely, a decrease in aggregate supply signals a contraction, with producers scaling back production. As a result, the equilibrium price may rise, and output may decline. Such a shift can occur due to rising input costs, declining productivity, or unfavorable government policies.

Understanding aggregate supply is crucial for economic policymakers who seek to stabilize the economy. By carefully manipulating fiscal and monetary policies, governments can influence the level of output and achieve desired outcomes for economic growth and inflation.

Aggregate Demand: The Consumers’ Influence

Every economy relies on its consumers to drive growth and prosperity. In macroeconomics, the total demand for goods and services in an economy is known as aggregate demand. It represents the collective spending of households, businesses, and the government.

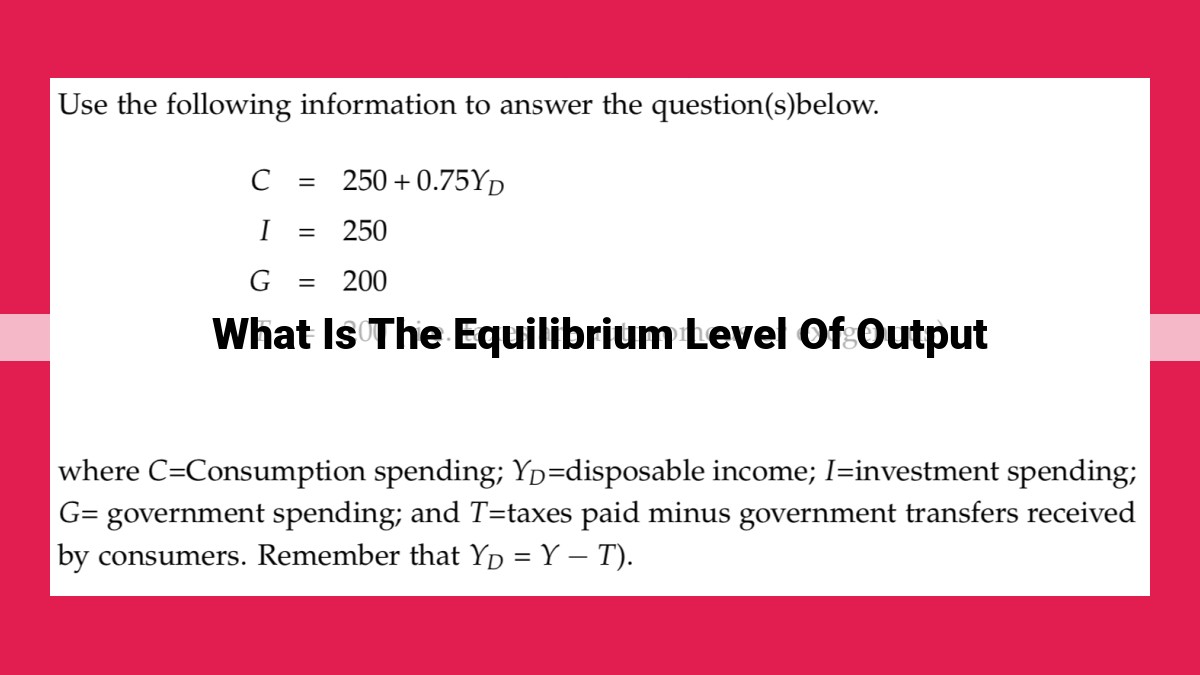

Numerous factors influence aggregate demand. Consumer spending is a major component, affected by disposable income, wealth, expectations about the future, and interest rates. When consumers feel confident about their financial situation and expect a positive economic outlook, they are more likely to spend, boosting aggregate demand.

Another factor is business investment. When businesses anticipate growth in demand, they may invest in new equipment, facilities, or research and development. This investment spending increases aggregate demand by adding to the supply of goods and services in the economy.

Government spending also plays a role in aggregate demand. When the government purchases goods and services, it injects money into the economy, which can stimulate spending by households and businesses.

Shifts in aggregate demand can have significant impacts on the equilibrium level of output. An increase in aggregate demand will lead to a higher level of output, while a decrease will result in a lower level of output. This is because businesses are motivated to produce more goods and services when there is higher demand, and vice versa.

Understanding aggregate demand is crucial for policymakers. By adjusting fiscal policy (government spending and taxation) or monetary policy (interest rates), governments can influence aggregate demand and stabilize the economy. In times of recession or low economic growth, policies that stimulate aggregate demand can help boost output and employment. Conversely, when the economy is overheating with high inflation, policies that reduce aggregate demand may be necessary to cool down the economy.

Reaching Equilibrium: The Dance of Supply and Demand

Imagine our economy as a vast marketplace, where producers and consumers engage in a continuous dialogue. Producers, like farmers and manufacturers, offer their goods and services, while consumers, like individuals and businesses, demand them. At the heart of this economic dance lies the equilibrium level of output, the point where the quantity of goods and services supplied by producers exactly matches the quantity demanded by consumers.

Establishing equilibrium is a delicate balancing act. Aggregate supply, representing the total output produced by firms at any given price level, plays a crucial role. Factors such as technological advancements, production costs, and government policies can influence aggregate supply. When aggregate supply rises, it shifts the supply curve to the right, leading to a lower equilibrium price level and a higher equilibrium quantity. Conversely, a decrease in aggregate supply shifts the curve to the left, resulting in a higher equilibrium price and a lower equilibrium quantity.

On the other side of the equation, we have aggregate demand, representing the total spending by consumers, businesses, and the government. Factors such as income levels, interest rates, and consumer confidence can affect aggregate demand. When aggregate demand rises, it shifts the demand curve to the right, leading to a higher equilibrium price and a higher equilibrium quantity. Conversely, a decrease in aggregate demand shifts the curve to the left, resulting in a lower equilibrium price and a lower equilibrium quantity.

The point at which aggregate supply and aggregate demand intersect, known as the equilibrium point, represents the ideal economic scenario. At this point, the quantity supplied by producers equals the quantity demanded by consumers, and the market is in balance. This equilibrium level of output ensures that resources are efficiently allocated, unemployment is minimized, and economic growth is sustainable.

Understanding the equilibrium level of output is critical for policymakers. By influencing aggregate demand through fiscal and monetary policies, governments can stabilize the economy, manage inflation, and promote economic recovery.

Policy Implications: Leveraging Equilibrium for Economic Stability

Maintaining economic stability is a delicate balancing act, and policymakers rely on two key tools to adjust aggregate demand and influence the equilibrium level of output: fiscal policy and monetary policy.

Fiscal Policy:

- Role: Fiscal policy involves government spending and taxation.

- Impact: By adjusting government spending or tax rates, policymakers can stimulate or contract aggregate demand.

- In times of economic downturn, increased government spending or tax cuts can boost aggregate demand, shifting the aggregate demand curve to the right and increasing the equilibrium level of output.

- Conversely, during periods of economic overheating, policymakers may reduce spending or raise taxes to curb aggregate demand, shifting the curve to the left and reducing the equilibrium level of output.

Monetary Policy:

- Role: Monetary policy is conducted by central banks, which control the supply of money and credit in the economy.

- Impact: Central banks can influence interest rates, which affect the cost of borrowing for businesses and consumers.

- Lower interest rates encourage borrowing and investment, stimulating aggregate demand and shifting the curve to the right.

- Higher interest rates discourage borrowing and spending, contracting aggregate demand and shifting the curve to the left.

By leveraging these policy tools, policymakers can adjust demand to maintain an equilibrium level of output that supports economic growth and stability. This ensures that the economy is producing goods and services at a level that meets consumer demand while avoiding excessive inflation or unemployment.