Calculating Direct Materials Used: A Comprehensive Guide For Accurate Cost Determination

To find the Cost of Direct Materials Used, begin by determining the Beginning Inventory value of raw materials. Add the cost of Purchases made during the accounting period. Then, subtract the value of the Ending Inventory on hand at the end of the period. This formula (Beginning Inventory + Purchases – Ending Inventory) calculates the cost of raw materials utilized in the production process.

Exploring the Essence of Direct Materials: The Foundation of Product Creation

Imagine yourself as a master builder, embarking on the creation of an extraordinary masterpiece. Just as your blueprint outlines the structure, the raw materials you gather serve as the essential building blocks. In the realm of accounting, these fundamental materials are known as direct materials.

Unveiling the Definition of Direct Materials

Think of direct materials as the physical ingredients that undergo a magical transformation during the creation of a product. They are the wood that shapes a sturdy chair, the fabric that weaves an elegant dress, or the metal that forges a gleaming sword. By becoming an integral part of the finished product, direct materials play a crucial role in determining its quality and value.

Beginning Inventory: A Snapshot of Your Raw Material Stockpile

As you begin your production journey, it’s essential to take stock of your raw materials. This is where the concept of beginning inventory comes into play. It represents the value of all the direct materials you have on hand at the start of your accounting period. Like a diligent inventory manager, you meticulously count and assess your resources, ensuring you have everything you need to embark on your creative endeavor.

Purchases: Fueling Your Production with New Materials

As production progresses, you’ll likely need to replenish your raw material stock. This is where purchases enter the picture. They represent the cost of all the direct materials you acquire during your accounting period. Think of it as adding more wood to your lumber yard or restocking your fabric bolts. By keeping track of your purchases, you can ensure you have a constant supply of the materials needed to bring your creations to life.

Ending Inventory: Capturing the Value of Your Remaining Materials

As your production line hums and your creations take shape, you’ll eventually reach the end of your accounting period. It’s time to take another inventory, this time assessing the direct materials you have left on hand. Ending inventory represents the value of these remaining materials. Just as a wise craftsman carefully stores unused materials for future projects, you’ll want to accurately account for your ending inventory to optimize your resource allocation.

Calculating Cost of Direct Materials Used: A Formula Unveiled

Now, let’s delve into the heart of the matter: determining the cost of direct materials used. This crucial calculation is the key to understanding how much your raw materials contribute to the final cost of your products. By following this simple formula, you can uncover this essential piece of information:

Beginning Inventory + Purchases – Ending Inventory = Cost of Direct Materials Used

It’s like putting together a puzzle where the individual pieces (beginning inventory, purchases, and ending inventory) come together to form the complete picture (cost of direct materials used). This formula provides a clear understanding of the value of the materials consumed in the production process.

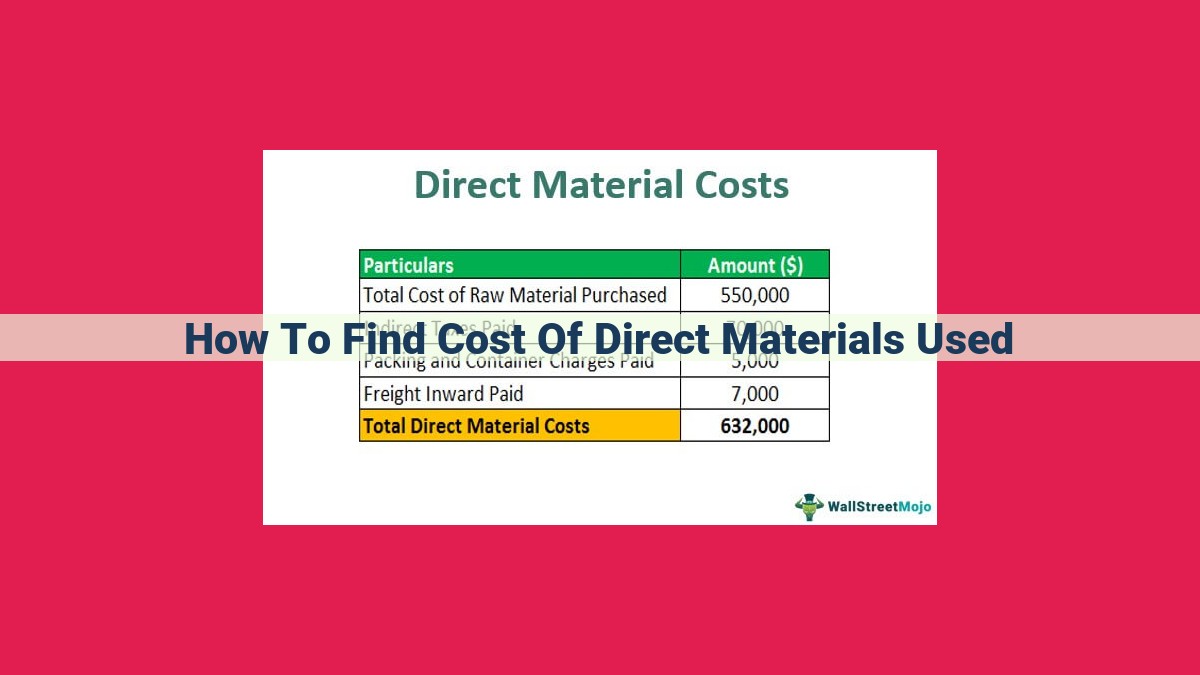

Example Calculation: Putting the Pieces Together

Let’s say you start the accounting period with a beginning inventory of $500 worth of materials. You then make purchases totaling $1,000. At the end of the period, you have $200 worth of materials remaining in your inventory. Plugging these values into our formula, we get:

$500 + $1,000 – $200 = $1,300

This means that the cost of direct materials used in the production of your products during the accounting period was $1,300.

Understanding direct materials is fundamental to managing your production costs effectively. By mastering these concepts, you’ll gain a deeper insight into the resources that fuel your creative endeavors and drive your business success.

Calculating Beginning Inventory

- Explanation of beginning inventory as the value of raw materials on hand at the start of the accounting period.

Calculating Beginning Inventory: A Crucial Step in Understanding Direct Materials

In the vibrant tapestry of accounting, direct materials play a pivotal role in capturing the essence of a company’s production process. Understanding the concept of beginning inventory is essential for unraveling the intricacies of this essential component.

Beginning Inventory: The Foundation of Production

Every accounting period commences with a snapshot of the raw materials that lie in waiting at the doorstep of production. This cache of materials forms the beginning inventory, a crucial determinant in the calculation of direct materials used. Without an accurate understanding of this initial stock, the accounting process becomes muddled and unreliable.

Determining the Value of Raw Materials

Calculating beginning inventory involves a meticulous assessment of the value of raw materials on hand. This may include materials purchased but not yet used, as well as materials inherited from a prior period. The value assigned to these materials typically reflects their acquisition cost, which encompasses the price paid, as well as any additional costs incurred in getting them to the factory floor.

A Balancing Act

As the accounting period progresses, beginning inventory provides a benchmark against which to measure purchases and ending inventory. By tracking these changes, accountants can gain insights into the ebb and flow of raw material usage, enabling them to make informed decisions regarding production planning and cost optimization.

Analyzing Purchases: The Importance of Raw Material Acquisition

In the realm of accounting, direct materials play a crucial role in determining the Cost of Goods Sold. Purchases, representing the acquisition of these raw materials, are an integral part of this equation. They encompass the cost of raw materials bought during a specific accounting period.

Understanding purchases is essential for accurate inventory and cost accounting. It involves meticulously recording and tracking the cost of each raw material purchased. This includes not only the actual price paid to suppliers but also any additional costs incurred in acquiring the materials, such as shipping and handling fees.

In the absence of accurate purchase records, determining the cost of direct materials used becomes a significant challenge. Purchases provide a clear and comprehensive representation of the raw materials that have been procured for production. They also form the basis for reconciling physical inventory with accounting records.

By carefully analyzing purchases, companies can gain valuable insights into their supply chain management. They can identify areas where costs can be reduced, such as negotiating better terms with suppliers or exploring alternative sourcing options. Additionally, purchase analysis can help companies identify potential inventory discrepancies, ensuring the accuracy and integrity of their financial statements.

Determining Ending Inventory: A Crucial Component of Cost Accounting

In the realm of cost accounting, ending inventory holds immense significance as it reflects the value of raw materials still on hand at the conclusion of an accounting period. Understanding this concept is essential for businesses to accurately determine the cost of their goods sold and gauge their financial performance.

Ending inventory represents the remaining value of materials that have not yet been used in the production of finished goods. It serves as a snapshot of the raw materials available for future use, enabling businesses to plan their production activities and optimize their inventory management.

Calculating ending inventory involves conducting a physical count of the materials on hand or utilizing perpetual inventory systems that provide real-time updates on stock levels. By subtracting the value of the ending inventory from the sum of beginning inventory and purchases, businesses can determine the cost of direct materials used in production.

Calculating Cost of Direct Materials Used: A Simplified Guide

In the realm of manufacturing and production, understanding the cost of direct materials is crucial for accurate inventory management and financial performance analysis. Direct materials refer to the raw materials that undergo physical transformation or consumption during the production process. To determine the cost of these essential inputs, businesses rely on a simple yet effective formula:

Beginning Inventory + Purchases – Ending Inventory = Cost of Direct Materials Used

This formula acts as a powerful tool, providing valuable insights into the cost associated with the materials directly involved in product creation. By calculating the cost of direct materials used, businesses can gain a clear understanding of their material consumption patterns and make informed decisions regarding inventory management and production costs.

Importance of Direct Materials Cost Calculation

Accurately calculating the cost of direct materials used is not merely an accounting exercise but a strategic imperative for businesses. This calculation provides a solid foundation for:

-

Cost Control: Understanding the cost of direct materials allows businesses to identify areas for cost optimization and minimize material waste, leading to improved profitability.

-

Inventory Management: A precise understanding of direct materials consumption enables businesses to maintain optimal inventory levels, reducing the risk of overstocking or stockouts.

-

Financial Reporting: Accurate calculation of direct materials cost contributes to reliable financial statements, ensuring transparency and stakeholder confidence.

By incorporating this formula into their inventory management practices, businesses gain a valuable tool for optimizing material utilization, managing costs, and enhancing their overall financial performance.

Example Calculation

- Presentation of sample data with beginning inventory, purchases, and ending inventory values.

- Demonstration of the formula to calculate the Cost of Direct Materials Used.

Understanding Direct Materials and Calculating Their Costs

In the world of manufacturing, understanding the concept of direct materials is crucial for managing inventory costs effectively. Direct materials are the raw materials that are physically transformed or directly used in the creation of a product.

To begin, it’s important to determine the beginning inventory, which represents the value of raw materials on hand at the start of the accounting period. Next, we consider purchases, which refer to the cost of raw materials acquired during the accounting period.

Equally important is ending inventory, which represents the value of raw materials remaining on hand at the end of the accounting period. By understanding these three factors, we can calculate the Cost of Direct Materials Used (CDM), an essential element for cost accounting.

Calculating the CDM

To determine the CDM, we employ a simple formula:

CDM = Beginning Inventory + Purchases - Ending Inventory

Let’s illustrate this concept with an example. Suppose a manufacturing company had a beginning inventory of $5,000 worth of raw materials, purchased $10,000 of additional materials during the period, and had $3,000 worth of materials remaining at the end.

Using the formula, we calculate the CDM as follows:

CDM = $5,000 + $10,000 - $3,000

CDM = $12,000

This result tells us that the company used $12,000 worth of raw materials in its production process during the accounting period. This information is vital for determining the total production costs, pricing products, and managing inventory levels effectively.