Understanding Cost Of Goods Available For Sale: A Comprehensive Guide

To find cost of goods available for sale, start with beginning inventory, add purchases, and subtract ending inventory. Beginning inventory is the value of goods on hand at the start of the accounting period. Purchases include cost of goods acquired during the period, including freight-in, returns and allowances, and discounts. Ending inventory is the value of goods on hand at the end of the period, determined through physical count or inventory management techniques. The formula is: Beginning Inventory + Purchases – Ending Inventory = Cost of Goods Available for Sale. This calculation is crucial for inventory management, as it helps determine the cost of goods sold and gross profit.

Beginning Inventory: A Cornerstone for Inventory Management

In the realm of accounting, the concept of inventory plays a crucial role in understanding the financial health of a business. Beginning inventory serves as the foundation upon which the calculation of cost of goods available for sale is built. It represents the value of goods on hand at the commencement of an accounting period.

Defining Beginning Inventory: A Snapshot of Past Performance

Beginning inventory is akin to a photograph that captures the state of a company’s stock at a specific point in time. It provides a starting point for tracking the flow of goods throughout the accounting period. This information is derived from physical counts or inventory management systems that meticulously record the quantity and value of items on hand.

Importance of Beginning Inventory: A Strong Foundation for Future Calculations

The significance of beginning inventory lies in its role as the bedrock for calculating the cost of goods available for sale. This metric represents the total value of inventory available for sale during the accounting period. By combining beginning inventory with purchases made during the period and subtracting ending inventory, businesses can accurately determine the cost of goods available for sale. This calculation forms the backbone for other crucial financial metrics, such as the cost of goods sold and gross profit.

Purchases: The Acquisition of Inventory

In the world of business, inventory is king. It’s the lifeblood of any retail or manufacturing operation, and it’s crucial to track it accurately. One of the most important factors to consider when managing inventory is Purchases, which represent the cost of goods acquired during an accounting period.

The Basics of Purchases

Purchases are the expenses incurred when a company buys goods to sell or use in the production of other goods. These purchases include the cost of the goods themselves, as well as any related expenses, such as freight-in, returns and allowances, and discounts.

Related Concepts

1. Freight-in:

- This is the cost of transporting purchased goods from the supplier to the company’s warehouse.

2. Returns and Allowances:

- These are reductions in the purchase price due to returned or damaged items.

3. Discounts:

- Discounts are reductions in the purchase price offered for early payment or bulk purchases.

Calculating Purchases

Calculating Purchases is a straightforward process that involves adding up the cost of goods purchased during the accounting period. This includes the cost of the goods themselves, as well as any related expenses, such as freight-in, returns and allowances, and discounts.

The formula for calculating Purchases is as follows:

Purchases = Cost of Goods Purchased + Freight-in – Returns and Allowances – Discounts

By understanding the concept of purchases and how to calculate them, businesses can more effectively manage their inventory and ensure that they have the right amount of products on hand to meet customer demand.

Ending Inventory: Determining Your Current Stock

Understanding Ending Inventory

Ending inventory represents the value of products you have on hand at the close of an accounting period. It serves as a crucial element in determining the cost of goods available for sale and ultimately the cost of goods sold.

Methods to Determine Ending Inventory

There are two primary methods to ascertain your ending inventory:

-

Physical Count: Conducting a physical inventory involves counting the quantity of each item on hand. This method provides the most accurate count but can be time-consuming, especially for businesses with large inventory.

-

Inventory Management Techniques: Inventory management software or perpetual inventory systems continuously track inventory levels through automated processes. These techniques offer real-time visibility into your stock, reducing the need for frequent physical counts.

Importance of Accuracy

Maintaining an accurate ending inventory is essential for several reasons. It ensures:

-

Proper Valuation of Assets: Ending inventory represents a significant asset on your balance sheet. An accurate count ensures that your financial statements reflect the true value of your inventory.

-

Sound Inventory Management: Accurate ending inventory helps identify any discrepancies between the expected and actual inventory levels. This information aids in optimizing inventory levels, minimizing losses, and preventing shortages.

-

Reliable Financial Reporting: Ending inventory is a crucial component in calculating the cost of goods sold and gross profit. Accurate inventory data ensures the reliability of your financial reporting.

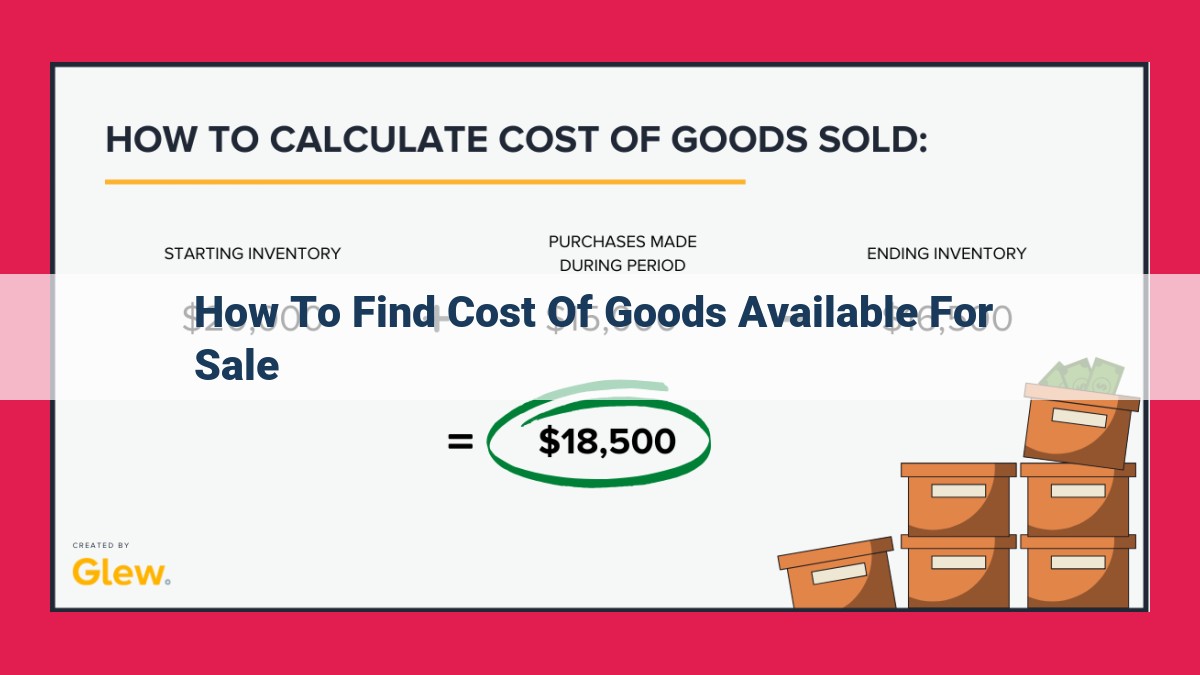

Calculating Cost of Goods Available for Sale: A Tale of Inventory and Purchases

Envision yourself as a business owner, embarking on a journey to determine the value of your unsold goods. This enigmatic concept known as Cost of Goods Available for Sale (COGAS) holds the key to unlocking your inventory’s financial story. Let’s follow a step-by-step approach to unravel its mystery:

Step 1: Beginning Inventory – Your Starting Point

Your adventure begins with Beginning Inventory, the value of goods sitting on your shelves at the start of your accounting period. It’s like a snapshot of your inventory’s past, the foundation upon which your COGAS calculation will rest.

Step 2: Purchases – Acquiring New Goods

Next, you embark on a shopping spree, acquiring new goods to replenish your inventory. These Purchases represent the cost of all the items you’ve brought into your business during the accounting period. Don’t forget to account for any freight-in costs incurred during transportation.

Step 3: Ending Inventory – The Current State of Affairs

As the accounting period draws to a close, it’s time to take stock of your current inventory. Ending Inventory is the value of goods still on your shelves. You can determine this through a physical count or employ sophisticated inventory management techniques.

Step 4: The Formula – Unlocking COGAS

Now, comes the grand finale: calculating Cost of Goods Available for Sale. It’s as simple as this:

COGAS = Beginning Inventory + Purchases - Ending Inventory

This formula weaves together the beginning and ending states of your inventory, along with your purchases during the period, to give you a comprehensive picture of the goods you had at your disposal for sale.

The Significance of COGAS

Why is COGAS so important? It’s the cornerstone of inventory management, providing valuable insights into your business’s performance. COGAS is instrumental in determining Cost of Goods Sold, a crucial metric for calculating your gross profit. By understanding your COGAS, you gain a deeper understanding of your inventory’s profitability and efficiency.

Significance of Cost of Goods Available for Sale

In the realm of inventory management, the calculation of Cost of Goods Available for Sale (COGAS) holds immense significance as it serves as the cornerstone for determining two crucial financial metrics: Cost of Goods Sold and Gross Profit.

COGAS reflects the totality of goods in your possession at any given point during the accounting period. It encapsulates the beginning inventory, the purchases made throughout the period, and the ending inventory remaining at its conclusion.

The Cost of Goods Sold, which represents the direct costs associated with the goods sold during the period, is calculated by subtracting the ending inventory from the COGAS. This value provides a transparent snapshot of the expenses directly incurred in generating sales revenue.

The Gross Profit, a measure of the profitability of your business operations, is derived by deducting the cost of goods sold from the total sales revenue. It gauges the margin between the costs of producing and selling goods and the revenue generated from their sale.

A precise understanding of COGAS is paramount for effective inventory management. It enables businesses to optimize their inventory levels, minimize wastage, and reduce storage costs. Additionally, it assists in forecasting future demand, thereby ensuring the availability of adequate stock without overstocking.

In conclusion, COGAS plays a critical role in inventory management and financial analysis. It empowers businesses to make informed decisions, enhance profitability, and optimize their operations for sustained growth.