Calculate Overhead Costs Effectively: A Comprehensive Guide To Direct Vs. Indirect Costs, Overhead Rates, And Activity-Based Costing

To calculate overhead applied, begin by understanding direct and indirect costs. Overhead cost, the indirect costs not easily assigned to specific units, is calculated as total overhead costs divided by a suitable activity base. Using a predetermined overhead rate, which considers burden rate and actual overhead, overhead allocation assigns overhead costs to cost objects based on their activity. Activity-based costing enhances accuracy by linking costs to specific activities, providing a more accurate picture of overhead application.

Demystifying Overhead Costs: A Comprehensive Guide to Direct and Indirect Expenses

Imagine you’re running a bakery. You’re baking delicious pastries and cakes that your customers love, but you’re also facing a nagging question: how much does it cost to produce each delectable treat? To answer that, you need to understand the world of overhead costs, which play a crucial role in determining the profitability of your bakery.

Direct Costs: The Obvious Expenses

Direct costs are those that can be easily traced to a specific unit of production. In our bakery, direct costs would include ingredients like flour, sugar, and butter. Each pastry or cake you make requires a specific amount of these ingredients, making them easily identifiable as direct costs.

Indirect Costs: The Hidden Expenses

In contrast to direct costs, indirect costs are not easily assignable to a specific unit of production. They’re the hidden expenses that support your production process, such as rent, utilities, and depreciation of equipment. While these costs are essential for running your bakery, it’s challenging to determine how much of each cost goes into making a single pastry or cake.

Examples of Direct and Indirect Costs

Here’s a table to illustrate the difference between direct and indirect costs in our bakery:

| Direct Costs | Indirect Costs |

|---|---|

| Flour | Rent |

| Sugar | Utilities |

| Butter | Depreciation of equipment |

| Labor (mixing, baking) | Insurance |

| Packaging | Administration |

As you can see, direct costs are directly related to the production of each pastry or cake, while indirect costs benefit the production process as a whole.

Understanding Overhead Cost: A Comprehensive Guide

Overhead cost, a crucial component of business operations, encompasses all indirect expenses that cannot be directly attributed to specific units of production. These costs, often hidden, are essential for the smooth functioning of any organization. However, understanding and calculating overhead costs can be a daunting task. To help you navigate this complex topic, here’s a comprehensive guide.

Definition and Calculation

Overhead cost is defined as all indirect expenses incurred in the course of business operations that cannot be easily assigned to specific units of production or cost objects. These costs are often classified as fixed, remaining relatively constant regardless of production output, or variable, fluctuating with changes in production volume.

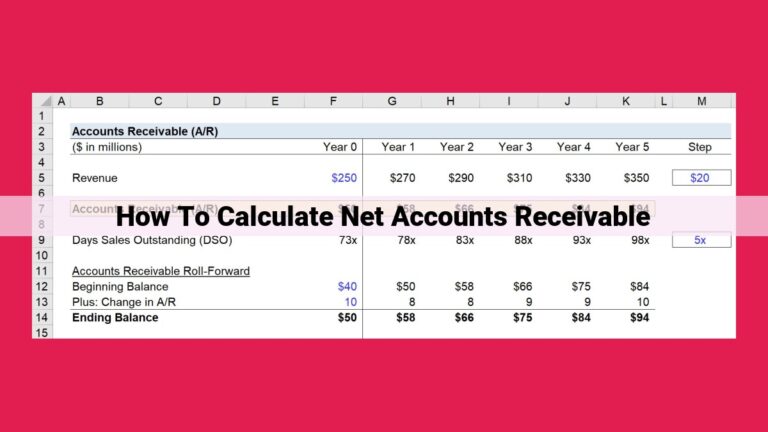

Calculating overhead costs involves identifying and summing all indirect expenses. This includes expenses such as rent, utilities, depreciation, salaries of administrative staff, insurance, and property taxes. Once calculated, the total overhead cost is allocated to cost objects, such as products, services, or departments, based on predetermined criteria.

Burden Rate: A Unit Cost Concept

Burden rate is a crucial concept in overhead cost calculation. It represents the rate at which overhead costs are applied to cost objects. The burden rate is calculated by dividing the total overhead cost by the total activity measure, which could be direct labor hours, machine hours, or units produced. The resulting burden rate is then used to allocate overhead costs to each unit of production.

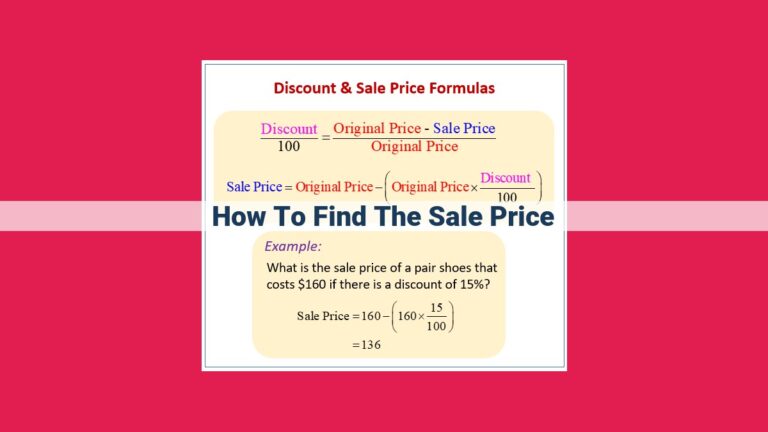

Applied vs. Actual Overhead: The Difference

Applied overhead refers to the overhead cost that is allocated to a cost object based on the predetermined burden rate. In contrast, actual overhead is the actual amount of overhead costs incurred during a given period. The difference between applied overhead and actual overhead can arise due to changes in production levels or inaccuracies in the burden rate.

Comprehending overhead costs is paramount for accurate costing, pricing, and profitability analysis. By understanding the concepts of applied overhead, burden rate, and actual overhead, you can effectively allocate indirect costs to your products or services. This will provide a more accurate picture of your costs and help you make informed decisions.

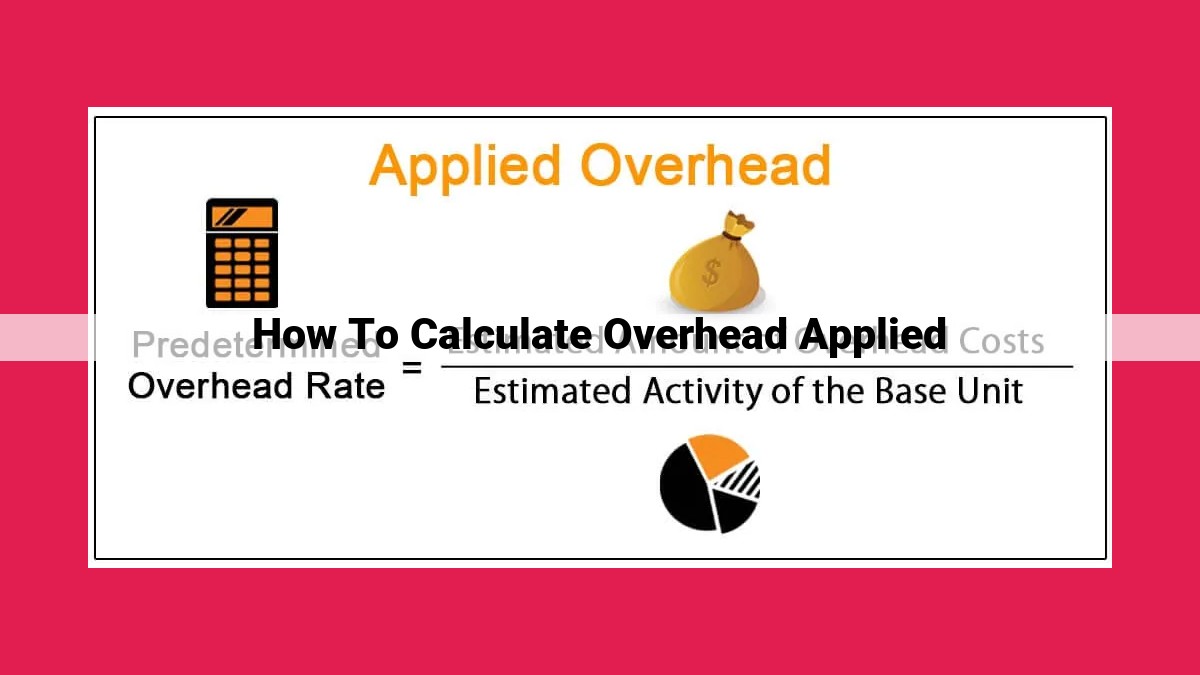

Predetermined Overhead Rate

The Overhead Application Rate: A Guiding Force

Just like a compass steers a ship in the right direction, the overhead application rate plays a crucial role in allocating overhead costs to specific products or services. This rate is a calculated value that represents the portion of overhead expenses to be assigned to each unit of production.

Determining the Rate: An Art and a Science

Determining the overhead application rate requires a careful assessment of past overhead expenses, estimated future expenses, and the expected level of activity. Accountants use a variety of methods, including the following:

- Provisional Rate: A preliminary estimate based on historical data.

- Anticipated Rate: An estimate based on forecasted activity levels.

- Estimated Rate: A rate adjusted periodically to reflect actual overhead expenses.

Provisional vs. Estimated: A Matter of Time

Provisional rates are used at the beginning of a period, while estimated rates are calculated throughout the period. The former is less accurate but provides a starting point for overhead allocation. The latter is more precise but requires constant monitoring and adjustment.

Anticipated Rates: Looking Ahead

Anticipated rates are projections based on expected activity levels. They are useful when there are significant changes in production volume or overhead expenses. By factoring in these expectations, businesses can improve the accuracy of their overhead allocation.

Predetermined overhead rates serve as invaluable tools for assigning overhead costs to cost objects. By choosing the appropriate rate and carefully considering the factors that influence it, businesses can ensure that their costing systems accurately reflect the true cost of their products and services. This knowledge is essential for sound decision-making and maintaining profitability.

Overhead Application: Allocating Costs to Cost Objects

In the realm of cost accounting, overhead costs pose a unique challenge. These indirect expenses, not directly attributable to specific units, require a careful allocation process to ensure accurate pricing and profit analysis. Enter overhead application, a methodical approach to assigning these costs to cost objects.

Overhead allocation entails three key steps:

1. Absorption

Absorption evenly distributes overhead costs over all products or services produced during a specific period. This process involves calculating an overhead application rate, which represents the fixed amount of overhead costs applied to each unit produced.

2. Distribution

Distribution assigns overhead costs to cost objects based on a predetermined overhead rate. This rate is typically calculated by dividing the total estimated overhead costs by the estimated number of units to be produced. By applying this rate, overhead costs are spread across all cost objects, ensuring that each unit bears a portion of the indirect expenses.

3. Overhead Allocation

Overhead allocation encompasses both absorption and distribution. It ensures that all overhead costs are accounted for and assigned to the appropriate cost objects. This process involves identifying cost drivers, which are factors that generate overhead costs, such as machine hours or labor costs. Once identified, cost drivers are used to determine the allocation of overhead costs to specific units, departments, or products.

By meticulously applying overhead costs, businesses gain a clearer understanding of the true cost of their products or services. This information is crucial for informed decision-making, accurate pricing, and maximizing profitability.

Activity-Based Costing: A Game-Changer for Overhead Allocation

Imagine you’re a small business owner struggling to understand why your pricing isn’t bringing in the expected profits. You’ve been simply dividing your total overhead costs by the number of units produced, but you can’t shake the feeling that something’s amiss.

Enter activity-based costing (ABC), a revolutionary approach that can help you uncover the true costs associated with each step of your production process.

Cost Drivers, Activity Cost Pools, and Cost Objects

The core of ABC lies in understanding the cost drivers, the specific activities that consume resources in your business. These activities can range from production setup to customer service.

Next, you’ll group these activities into activity cost pools, which represent similar activities that share a common cost driver. For example, you might create an activity cost pool for “material handling.”

Finally, you’ll identify cost objects, the units or products that receive the benefits of these activities. In our example, the cost objects would be the finished goods.

How ABC Improves Overhead Allocation

Traditional overhead allocation methods, like the one you were using, can lead to inaccurate pricing because they simply spread costs evenly across all units. However, ABC recognizes that different activities incur different costs, and allocates overhead accordingly.

By assigning costs to specific activities and then to the cost objects that benefit from those activities, ABC provides a much more precise picture of your overhead costs. This enables you to:

- Price your products or services more accurately

- Identify areas for cost reduction

- Improve your profitability analysis

Activity-based costing is an indispensable tool for businesses looking to optimize their overhead allocation and gain a deeper understanding of their costs. By embracing ABC, you can transform your pricing strategy and achieve greater profitability. Remember, understanding overhead costs is the key to successful pricing and informed business decisions.