Optimize Bond Interest Expense Calculation For Seo:how To Calculate Bond Interest Expense Accurately

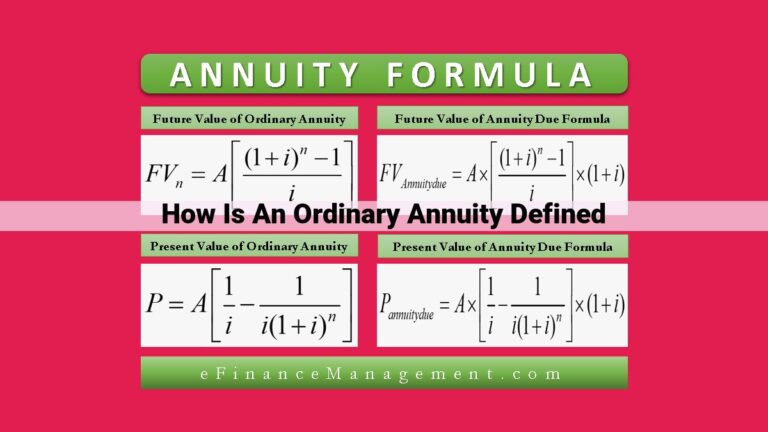

To calculate interest expense on bonds, determine the total interest payments over the bond’s life, which is the product of the face value and the coupon rate. The effective interest rate, the true annual interest rate, is used to calculate the periodic interest expense based on the carrying value of the bond. This amount is adjusted for the amortization of any discount or premium, which represents the difference between the purchase price and face value. The carrying value is then adjusted over time to reflect the interest expense and amortization.

Understanding Bond Concepts: The Building Blocks of Fixed-Income Investing

When venturing into the world of investing, bonds often serve as a reliable pillar, offering a stable source of income and diversifying your portfolio. To grasp the intricacies of these financial instruments, let’s embark on a journey into the core concepts that define them.

Principal Amount: The Foundation of Borrowing

Think of the principal amount as the backbone of a bond, representing the amount of money borrowed by the issuer. This face value is the benchmark against which all other bond calculations are made.

Interest Rate: The Cost of Borrowing

The interest rate is the annual percentage charged on the principal amount. It compensates investors for lending their money and serves as the cornerstone for determining the bond’s yield.

Yield: The Return on Investment

The yield, intricately linked to the interest rate, measures the return an investor can expect to receive from a bond. It represents the percentage of the bond’s current market value that is paid as annual interest.

Unveiling the Complexities of Bond Maturation and Payments

Bonds have a maturity date, the day when the issuer must repay the principal amount to bondholders, effectively redeeming the bond. Interest payments, known as coupon payments, are typically made semi-annually, providing investors with a steady stream of income.

The coupon rate indicates the annualized percentage of the coupon payment relative to the bond’s face value. It serves as a benchmark for comparing different bonds and assessing their relative attractiveness.

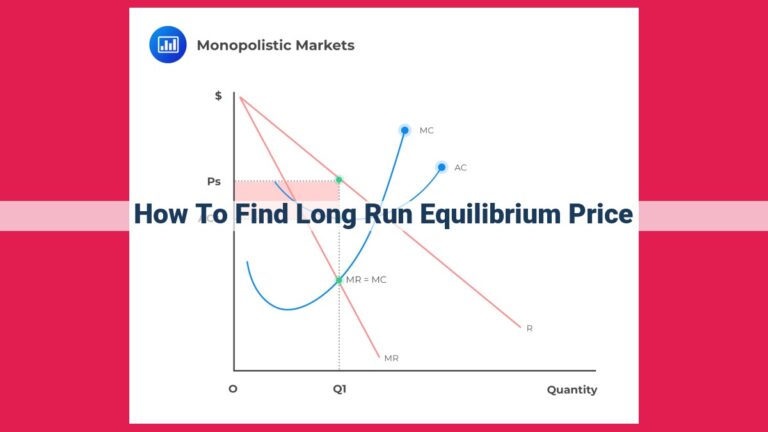

Exploring Bond Pricing: Discounts, Premiums, and Market Dynamics

Bonds are not always traded at their face value. When a bond’s market price falls below its face value, it is said to be trading at a discount. The discount rate quantifies this discount as an annualized percentage of the face value.

Conversely, when a bond’s market price exceeds its face value, it is said to be trading at a premium. The premium rate measures this premium similarly, as an annualized percentage of the face value.

Calculating Interest Expense: A Measure of Borrowing Costs

The total interest paid over the life of the bond is the sum of all coupon payments made until maturity. The effective interest rate, a more accurate reflection of the true cost of borrowing, incorporates the initial bond price and amortization of discounts or premiums over the bond’s life.

Amortization: Spreading the Cost Over Time

Discounts and premiums are not static over a bond’s life. They are gradually amortized through adjustments to interest expense and the bond’s book value. This process ensures that the bond’s carrying value reflects its true value over time.

By delving into these fundamental concepts, you’ve laid the groundwork for exploring the intricacies of bond investing. With a clear understanding of these building blocks, you can navigate the bond market with confidence, maximizing your potential for financial success.

Bond Maturation and Payments: A Detailed Explanation

In the realm of bonds, one crucial aspect to grasp is their maturity and payment schedule. These factors determine when investors will receive their principal investment and interest payments.

Maturity Date: The Day of Reckoning

Every bond has a designated maturity date, which marks the day when the issuer is obligated to repay the principal amount (the initial investment) to the bondholder. This is when the bond “matures” and ceases to exist.

Bond issuers often establish maturity dates based on their financial needs and market conditions. Maturity dates can range from short-term (less than one year) to long-term (up to 30 years or more).

Date of Redemption: Cashing In the Bond

The date of redemption refers to the specific day when the bondholder actually receives the principal payment. This may not always coincide exactly with the maturity date due to settlement procedures.

Coupon Payments: Semi-Annual Interest Payouts

In addition to receiving the principal at maturity, bondholders also earn coupon payments, which are periodic interest payments made by the issuer. These payments are typically made semi-annually (every six months).

The coupon rate is the fixed annual interest rate paid on the bond. It is expressed as a percentage of the face value. For example, a bond with a face value of $1,000 and a coupon rate of 5% would pay an annual interest payment of $50 ($1,000 x 5%).

Bond Pricing: Understanding Discounts and Premiums

In the world of finance, bonds are like loans you make to companies or governments. And just like any loan, bonds come with a certain price tag that can fluctuate based on a variety of factors. Enter bond pricing, a crucial concept that helps you navigate the financial waters.

Bond Discounts: When Bonds Trade Below Face Value

Imagine you lend someone $1,000 and agree to get paid back $1050 in a year with interest payments along the way. However, what if you find out later that the person is willing to pay you back $950 instead? That’s where bond discounts come in.

A bond is considered discounted when it trades below its face value, which is the amount you originally agreed to lend. This happens when the market interest rates have risen since the bond was issued. As a result, investors are willing to pay less for the bond to earn a higher yield. The discount rate represents the annualized percentage below face value at which the bond trades.

Bond Premiums: When Bonds Trade Above Face Value

Now, let’s flip the scenario. What if that person offered to pay you back $1,050 instead of $950? This time, we’re dealing with bond premiums.

A bond is considered a premium when it trades above its face value. This occurs when market interest rates have fallen since the bond was issued. Investors are willing to pay more for the bond to lock in the higher interest payments. The premium rate represents the annualized percentage above face value at which the bond trades.

Calculating Interest Expense

- Explain the total interest paid over the life of the bond and how to calculate it.

- Introduce the effective interest rate as the true annual rate of interest and how to calculate it.

Calculating Interest Expense: The Key to Bond Valuation

Understanding the interest expense associated with bonds is crucial for investors seeking to make informed decisions. The total interest paid over the life of a bond is simply the sum of all the interest payments made to the bondholder. This can be calculated by multiplying the face value of the bond by the annual coupon rate and then by the number of years to maturity.

For example, a bond with a $1,000 face value, a 5% annual coupon rate, and a 10-year maturity would have a total interest payment of $1,000 * 0.05 * 10 = $500.

However, the true annual rate of interest, known as the effective interest rate, takes into account the bond’s price. This is because bonds are often issued at a discount or premium to their face value. A discount occurs when the bond is sold for less than its face value, while a premium occurs when the bond is sold for more than its face value.

The effective interest rate adjusts for these price fluctuations and provides a more accurate measure of the bond’s actual yield. It is calculated using a complex formula that takes into account the bond’s coupon rate, face value, sale price, and time to maturity.

Knowing the effective interest rate is essential for investors as it allows them to compare the yields of different bonds on an equal footing. This is a key consideration for any investor seeking to maximize returns on their bond investments.

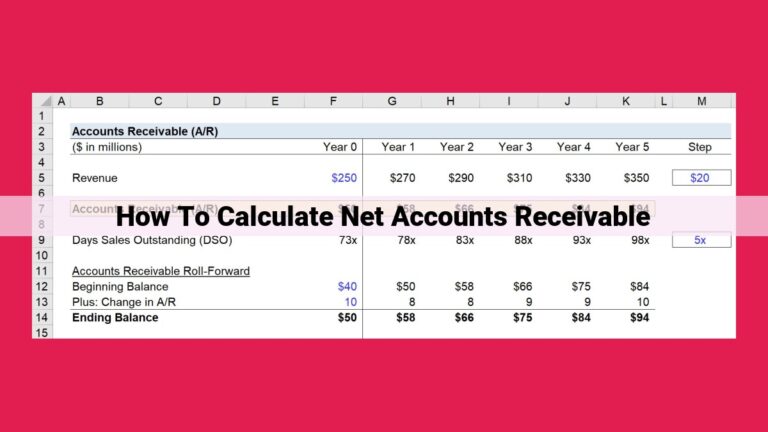

Amortization of Bond Discount/Premium

Understanding the Impact on Interest Expense

When a bond is issued at a discount (below face value) or a premium (above face value), the difference between the issue price and the face value must be amortized over the life of the bond. This amortization process affects the interest expense recorded each period.

Allocation of Discount/Premium

If a bond is issued at a discount, the discount is allocated to interest expense. This increases the effective interest rate charged by the issuer. Conversely, if a bond is issued at a premium, the premium is allocated to interest expense. This decreases the effective interest rate paid by the issuer.

Adjusting the Bond’s Book Value

The book value of the bond should be adjusted over time to reflect the amortization of discount or premium. For discount bonds, the book value is increased by the amount of discount amortized each period. For premium bonds, the book value is decreased by the amount of premium amortized each period.

Amortization Process Over Time

The amortization process continues until the maturity date of the bond, when the book value will equal the face value. This ensures that the issuer pays the correct amount of interest expense over the life of the bond and the bondholder receives the correct amount of interest payments and the face value at maturity.